David Case, Magwitch Offshore

One often hears that the investment industry is a man’s world, a perception possibly spurred on by the prevalence of male CEOs and male portfolio managers amongst the world’s large investment banks. However, in the rapidly expanding ETF industry nothing could be further from the truth.

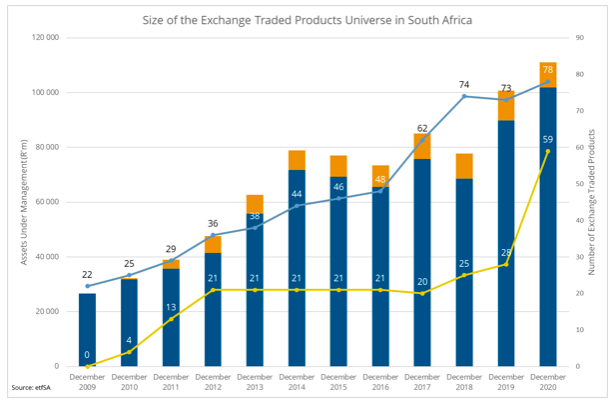

In South Africa, our ETF industry has been headlined by a triumvirate of females for the last while. Shareholder activist and Sygnia founder, Magda Wierzycka is well known for her hard-hitting commentary, especially during the period of the “Gupta Leaks”. Outgoing Satrix CEO Helena Conradie has overseen tremendous growth in South Africa’s initial ETF offering and Nerina Visser is the dominant personality of etfSA, South Africa’s biggest ETF research company. These women have driven the fledgling South African ETF industry to where it is now with several local and offshore ETF listings available on the JSE these days. At the end of the last calendar year there were 137 listed products with total market capitalisation of R111bn.

Looking offshore, this prevalence of women in prominent roles is just as common. ETFGI is one of the world’s leading independent ETF and ETP research and consultancy firms providing data to a diverse set of clients, including exchanges and asset managers. This large research house was founded by Deborah Fuhr in 2014 and has grown to become the only company that can provide a monthly report on the ETF industry of every region in the world. Deborah is also the founder and board member of Women in ETFs, the first women’s group for the ETF industry. They host an annual global conference with more than 2 400 delegates registered for their 2021 virtual edition.

One cannot chat about women in ETFs without mentioning Cathie Wood. Cathie is the rockstar portfolio manager and brains within ARK Investment Management. She founded ARK Investment Management in January 2014. Nine months later, she launched ARK’s first actively managed ETFs.

At the time, many active managers were put off by the transparency of ETFs. Unlike mutual funds, most ETFs must disclose their holdings every day — a repellent for active stock pickers who jealously guard their trading secrets. By opening their books, portfolio managers ran the risk that competitors could piggyback on their best ideas.

Instead of fleeing from transparency, Cathie embraced it. ARK’s investment research was published publicly. She published white papers, hosted podcasts, and became a regular commentator on financial markets. She sent out regular emails about her trades and publicised her stock selections on Twitter.

ARK’s first three years were a struggle. In 2015, ARK’s ETFs took in a paltry $17 million combined. Her fortunes began to turn in 2017 when two of her ETFs were among the top performers for the year. Since then, the firm’s flagship fund ARK Innovation ETF (“ARKK”) has continued to beat the market. The June 2021 factsheet for ARKK indicates that they have delivered a 48.36%pa return over the last 5 years. Returns like these may have helped the boom in active ETFs as other portfolio managers have seen how successful one can be by embracing the benefits within the ETF structures.

They say that women are more rational than men and maybe this logical way of thinking applies itself best within the ETF industry. Magwitch Offshore acknowledges all the women that have contributed to the incredible growth within this space.

Magwitch Offshore is a leading provider of Global Balanced ETF portfolios with products in all major currencies. Magwitch utilises an advisor distribution model and their portfolios are available through offshore endowment structures provided by some of the larger Insurers.