The South African hedge fund industry attracted record net inflows of R6.24 billion in 2023 and grew its assets under management to R137.9 billion (excluding fund of funds). These assets are invested in 213 hedge funds, which are managed by 11 hedge fund management companies.

The annual hedge fund statistics, released by the Association for Savings and Investment South Africa (ASISA), show that the industry recorded healthy net inflows for the second consecutive year. Net inflows in 2022 amounted to R4.54 billion.

Hayden Reinders, convenor of the ASISA Hedge Funds Standing Committee, welcomes the stronger uptake of hedge funds, especially by retail investors.

“This hopefully indicates that hedge funds in South Africa are increasingly being accepted as an important investment tool in mitigating market volatility,” comments Reinders.

Driving the flows in 2023

In 2015, South Africa became the first country in the world to implement comprehensive regulation for hedge fund products. The regulations provide for two categories of hedge funds, namely Retail Hedge Funds* and Qualified Investor Hedge Funds**. Hedge funds fall under the Collective Investment Schemes Control Act (CISCA) and are deemed regulated collective investment schemes, just like unit trust portfolios.

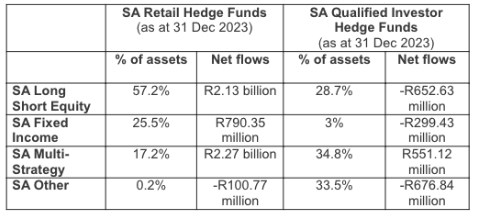

According to Reinder, 32% of assets under management were held by Retail Hedge Funds at the end of December 2023, while Qualified Investor Hedge Funds held 68% of assets.

Yet, the net inflows in 2023 were driven predominantly by South African Retail Hedge Funds, which attracted net inflows of R5.1 billion. South African Qualified Investor Hedge Funds, on the other hand, recorded net outflows of R1.1 billion.

Reinders explains that there is a growing awareness among retail investors that hedge funds are not high-risk alternatives to unit trust funds. “Hedge funds are one of the building blocks of a well-diversified investment portfolio to reduce market volatility.”

THINK BACK.THINK AHEAD.

Now Rethink Insurance.

For all insurance solutions related to the commercial, agricultural, engineering and sectional title sector contact your broker or call Western:

Western Cape +27 21 914 0290, Gauteng +27 12 523 0900 or visit www.westnat.com

Western National Insurance Company Ltd, affiliates of PSG Financial Services Ltd, a licensed controlling company, are authorised financial services providers. (FAIS: Juristic Reps under FSP 9465)

According to Reinders, Retail Hedge Funds have also become more accessible to retail investors in recent years as investment platforms are increasingly willing to offer retail hedge funds. In addition to increased marketing initiatives by some of the bigger hedge fund managers, solid performance has also resulted in greater interest from retail investors.

Most popular with investors

Hedge funds in South Africa are classified according to their investment strategies: Long Short Equity, Multi-Strategy, Fixed Income, and Other.

Reinders says judging from the net inflows, SA Multi-Strategy hedge funds were most popular with retail and qualified investors in 2023. Multi-Strategy hedge funds are portfolios that do not rely on a single asset class to generate investment opportunities but instead blend various strategies and asset classes with no single asset class dominating over time.

He comments that this is the first time in at least five years that SA Retail Multi-Strategy hedge funds outdid SA Retail Long Short Equity hedge funds in popularity. SA Retail Multi-Strategy funds attracted R2.27 billion in net inflows in 2023, while SA Retail Long Short Equity funds recorded R2.13 billion. Long Short Equity funds are portfolios that predominantly generate their returns by pairing long positions on equities with short-selling to benefit from both rises and drops in market prices.

Reinders notes that in the qualified investor space, only SA Multi-Strategy hedge funds attracted net inflows (R551.12 million). All other categories reported net outflows for the year.

SA Retail Fixed Income hedge funds attracted net inflows of R790.35 million. These portfolios invest in instruments and derivatives sensitive to movements in the interest rate market. Hedge funds in the “SA Other” category reported net outflows of R100.77 million. These portfolios apply strategies that do not fit into the other classification groupings.