A devastating earthquake in Turkey and Syria, severe convective storms (SCS) and large-scale urban floods were the main events driving insured natural catastrophe losses to USD 108 billion in 2023, reaffirming the 5–7% annual growth trend in global insured natural catastrophe losses since 1994. Swiss Re Institute estimates that insured losses could double within the next ten years as temperatures rise and extreme weather events become more frequent and intense. Therefore, mitigation and adaptation measures are key to reduce natural catastrophe risk.

Global insured losses from natural catastrophes outpaced global economic growth over the past 30 years: From 1994 to 2023, inflation-adjusted insured losses from natural catastrophes averaged 5.9% per year, while global GDP grew by 2.7%. In other words, over the last 30 years, the relative loss burden compared to GDP has doubled.

Jérôme Jean Haegeli, Swiss Re’s Group Chief Economist, says: “Even without a historic storm on the scale of Hurricane Ian, which hit Florida the year before, global natural catastrophe losses in 2023 were severe. This reconfirms the 30-year loss trend that’s been driven by the accumulation of assets in regions vulnerable to natural catastrophes. In the future, however, we must consider something more: climate-related hazard intensification. Fiercer storms and bigger floods fuelled by a warming planet are due to contribute more to losses. This demonstrates how urgent the need for action is, especially when taking into account structurally higher inflation that has caused post-disaster costs to soar.”

Moses Ojeisekhoba, Swiss Re’s CEO Global Clients & Solutions, says: “As weather hazards intensify due to climate change, risk assessment and insurance premiums need to keep up with the fast-evolving risk landscape. Looking ahead, we must focus on reducing the loss potential. 2023 was the hottest year on record, and the start to 2024 is following suit. Keeping property insurance sustainable and affordable requires a concerted effort by the private industry, the public sector and broader society – not just to mitigate climate risks, but to adapt to a world of more intense weather.”

Earthquake costliest disaster, SCS main loss driver in 2023

The most destructive natural catastrophe of the year was the earthquake in Turkey and Syria in February with estimated insured losses of USD 6.2 billion.

2023 was also marked by a high frequency of events as 142 insured natural catastrophes set a new record. Most were of medium severity, resulting in losses of USD 1–5 billion. There were at least 30 such events in 2023, many more than the previous ten-year average (17). Of those events, 21 were SCS, a new high. The number of these medium-severity events has grown by 7.5% since 1994, almost double the 3.9% increase in catastrophes generally.

After tropical cyclones, severe thunderstorms have become established as the second-largest loss-making peril due to exposures caused by urbanisation and economic and population growth. Hailstorms are by far the main contributor to insured losses from SCS, responsible for 50–80% of all SCS-driven insured losses. SCS is the umbrella term for a range of hazards including tornadic and straight-line winds, and large hailstones. SCS are frequently observed weather events that develop when warm humid air rises from the surface of the earth into upper layers of the troposphere, leading to the formation of towering clouds, lightning, and thunder. Meanwhile parcels of cool air rush to the earth’s surface, bringing powerful wind gusts, rain, or even hail. Global insured losses from SCS accumulated to a new record of USD 64 billion globally in 2023, 85% originating in the US. SCS-related insured losses were fastest-growing in Europe, exceeding USD 5 billion in each of the last three years. Hail risk in particular is increasing, mainly in Germany, Italy and France.

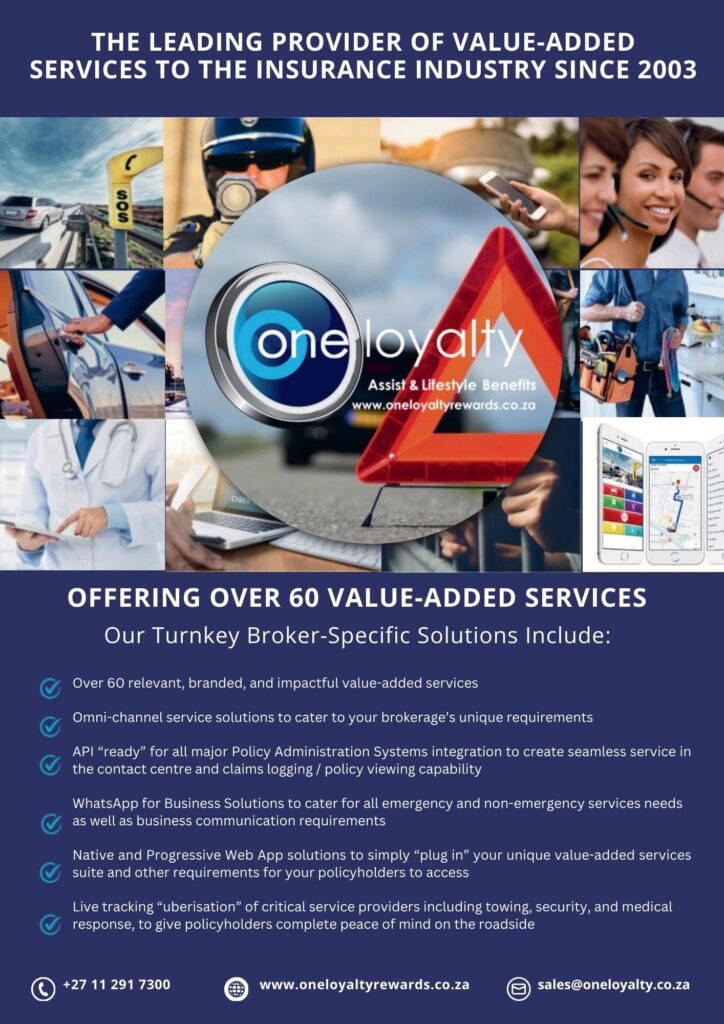

OFFERING OVER 60 VALUE-ADDED SERVICES

Our Turnkey Broker-Specific Solutions Include:

- Over 60 relevant, branded, and impactful value-added services

- Omni-channel service solutions to cater to your brokerage’s unique requirements

- API “ready” for all major Policy Administration Systems integration to create seamless service in the contact centre and claims logging / policy viewing capability

- WhatsApp for Business Solutions to cater for all emergency and non-emergency services needs as well as business communication requirements

- Native and Progressive Web App solutions to simply “plug in” your unique value-added services suite and other requirements for your policyholders to access

- Live tracking “uberisation” of critical service providers including towing, security, and medical response, to give policyholders complete peace of mind on the roadside

Setting premiums as incentives for adaptation measures

Increased exposures due to economic and population growth, urbanisation and wealth accumulation remain the main force behind rising SCS-related losses, and climate change-effects are likely to exacerbate the trend. Another factor is changes in exposure vulnerabilities, such as a rapid growth of solar power system installations on roof tops.

The first step to cutting losses is to reduce the loss potential through adaptation measures like enforcing building codes, building flood protection barriers, and discouraging settlement in areas prone to natural perils. Additionally, a collaboration with primary insurers, insurance associations and the public sector enables a data exchange which is key for shared risk mitigation.

Download the sigma study and join the Swiss Re Media Dialogue

We will discuss the key findings of the report and how collaboration is required to maintain insurability in a press event on 26 March, 11:00 to 12:00 CET. Please join us in person in Zurich or online and register via this link: Swiss Re Media Dialogue. The English version of the sigma 1/2024, “Natural catastrophes in 2023: gearing up for today’s and tomorrow’s weather risks”, is available in electronic format. You can download it here.

Total economic and insured losses in 2023 and 2022

| USD billion in 2023 prices | 2023 | 2022 | Previous 10-y average |

| Economic losses (total) | 291 | 295 | 235 |

| Natural catastrophes | 280 | 286 | 223 |

| Man-made catastrophes | 11 | 9 | 12 |

| Insured losses (total) | 117 | 141 | 99 |

| Natural catastrophes | 108 | 133 | 89 |

| Man-made catastrophes | 9 | 8 | 10 |

Note: Due to rounding, some totals may not correspond with the sum of the separate figures.

Source: Swiss Re Institute

Disclaimer

Although all the information discussed herein was taken from reliable sources, Swiss Re does not accept any responsibility for the accuracy or comprehensiveness of the information given or forward-looking statements made. The information provided and forward-looking statements made are for informational purposes only and in no way constitute or should be taken to reflect Swiss Re’s position, in particular in relation to any ongoing or future dispute. In no event shall Swiss Re be liable for any financial or consequential loss or damage arising in connection with the use of this information and readers are cautioned not to place undue reliance on forward-looking statements. Swiss Re undertakes no obligation to publicly revise or update any forward-looking statements, whether as a result of new information, future events or otherwise.