Examining the Safety of Commercial Shipping and Implications for Supply Chains

The tragic collapse of Baltimore’s Francis Scott Key Bridge in the US after it was hit by a container ship, the Dali, has made headlines around the world. In this Q&A, Allianz Commercial Global Head of Marine Risk Consulting, Captain Rahul Khanna, who sailed on oil tankers and bulk carriers for 14 years, explains that while such incidents are thankfully rare, the fact that ships are getting bigger can make a number of different events more complicated when they do occur.

How often do events such as ships hitting bridges and other port infrastructure occur?

First and foremost, this event is obviously a human tragedy, and our sympathies are with those who lost their lives or have been impacted by it. Thankfully, such incidents of this magnitude are rare. One study shows that between 1960 and 2015, there were just 35 major bridge collapses worldwide involving incidents with ships or barges with a total loss of life of 342 people. It is important to note that the majority of accidents involving vessels and bridges cause damage that varies from minor to significant but does not necessarily result in collapse of the structure or loss of life.

Our annual Safety & Shipping Review, which highlights the latest trends impacting maritime safety, shows there were close to 2,000 reported incidents of vessels hitting port infrastructure (also including harbor walls, piers, quays, locks etc.) over the past decade around the world (1,980 between 2013 and 2022[1]), making it the fourth most frequent cause of more than 27,000 shipping incidents reported during this period (but accounting for just 7% of all incidents). Only around 200 of these (203) involved container ships.

After this tragedy, how safe would you say commercial shipping is?

The shipping industry has made significant improvements when it comes to maritime safety over the past decade. Thirty years ago, the global fleet was losing 200+ vessels a year. At the end of 2022 fewer than 40 losses were reported. Annual shipping losses have declined by 65% over the past decade, reflecting the positive effect of an increased focus on safety measures over time.

Total losses of vessels following collision incidents with other vessels and contact with port infrastructure are thankfully rare. Over the past decade (across all vessel types) there have been just 30 total losses from collision incidents (with other vessels) and just four from contact incidents (with port infrastructure). Collectively these account for just 4% of the total number of vessels lost overall (807 reported between 2013 and end of 2022).

Nevertheless, while total losses have declined, the number of shipping incidents reported around the world overall every year has remained consistent. There were 3,032 during 2022 compared to 3,000 a year earlier.

Successful Partnerships

As the insurance landscape constantly changes, at Infiniti Insurance we remain committed to supporting you to adapt to the changes and meet the insurance needs of our mutual clients.

We are here to help you succeed.

Company registration number: 2005/029823/06

An Insurer licensed to conduct Non-life insurance

business and an Authorised Financial Services Provider

FSP Number 35914

Container ships in particular have grown significantly in recent decades as owners have looked to reduce costs, lower emissions, and maximize capacity. What impact is this having on safety?

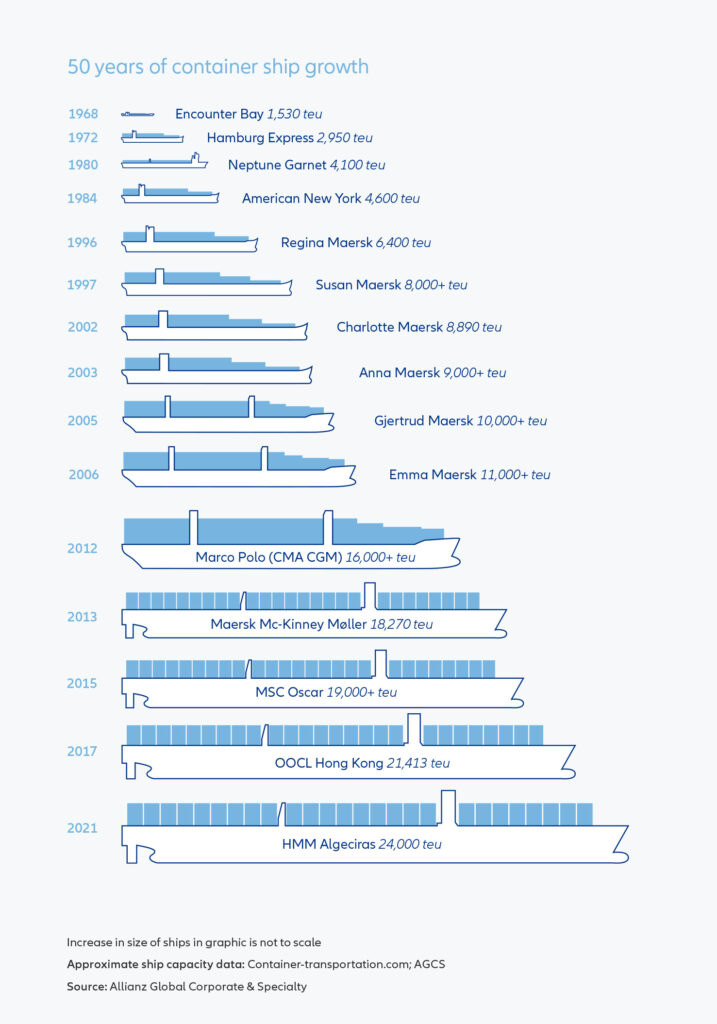

Container ship capacity has grown in size by around 1,500% in the last 50 years (see infographic) but it is important to note that the Dali isn’t anywhere near as large as the biggest vessels now hauling goods around the world. For example, the Ever Given, which blocked the Suez Canal for a week in March 2021, can carry more than 20,000 containers if full. The Dali can carry around 10,000 (although it was carrying less than half this amount when it hit the bridge). Nevertheless, it is still almost 1,000 feet long, the length of three football fields. Ships of the Dali’s size require careful consideration when navigating in restricted waters, especially when it comes to stopping distance. Back in the 1970s when the Francis Scott Key Bridge was built, container ships would have been less than half its size, probably even a lot less.

Ultimately, larger ships are not resulting in a higher frequency of accidents but when something does go wrong, the scale of the damage is likely to be much more severe because of their size and the fact that surrounding civil infrastructure did not anticipate such behemoths.

What are some of the typical risks associated with larger vessels?

While the number of serious shipping accidents worldwide has declined over the long-term, incidents involving large vessels – namely container ships and roll-on roll-off (Ro-ro) car carriers – are resulting in disproportionately high losses from events such as fires, container and carrier losses, hazardous cargo, more complex salvage operations and expensive repair costs, and issues with ports of refuge.

Recent events include fires on board the car carriers Fremantle Highway, Felicity Ace, and container ship X-Press Pearl. In 2022, the large container ship Ever Forward ran aground in Chesapeake Bay on the US Eastern Seaboard, and was stuck for over a month, almost a year to the day after its sister vessel the Ever Given ran aground and blocked the Suez Canal. Across the industry, there are ongoing discussions about whether infrastructure and regulation have kept pace with increasing vessel sizes.

What are some of the potential implications of this incident for supply chains and the insurance industry?

At this stage it is still too early to tell with any certainty. The collapse of the bridge led to the suspension of vessel traffic at the Port of Baltimore, which is one of the largest US ports but is smaller than the nation’s largest container terminals. However, it is a major component of the supply chain for vehicles, serving as the key discharge port for cars and trucks arriving from factories in Europe and Asia. It is also a significant embarkation point for exports of American coal. Many of those goods could be delayed in reaching their ultimate destinations, forcing shippers to make alternative plans, and limiting inventory.

More broadly, the bridge collapse highlights the growing challenges for businesses involved in global supply chains and their interconnectivity. Many are already contending with the loss of access to the Suez Canal in the Red Sea due to the Houthi attacks on merchant shipping that have followed the war in Gaza, and longer waiting times at the Panama Canal as a result of a prolonged drought that have impeded operations. About 90% of international trade is transported across oceans, so in an age of interconnection problems in one spot can quickly be felt more widely.

Assessing the impact and final cost of such a complex loss event in its immediate aftermath would just be speculation. Outside of the implications from any tragic loss of life, however, insured losses could include a wide range of claims such as property damage, business interruption from the port closure, debris removal, cargo loss and clean-up, and damage to the vessel. Initially, it is expected that most claims will be directed towards the marine insurance market, particularly Protection & Indemnity (P&I) insurance, which covers third-party property damage and liability, as well as hull insurance for physical damage to the vessel, and cargo insurance claims.

[1] Reported incidents involving vessels over 100 gross tonnage only (GT)