Momentum Investements

Tax-free investment products have been around for a while. Although this relatively new investment vehicle should be welcomed and some clients are using these as part of their financial plan, many are using them but not making the most of it, and many are not using them at all.

Financial advisers know that investing tax-free can offer material benefits over the long term. In fact, the true benefit of tax-free investments is really unlocked if they are considered as part of a long-term investment strategy.

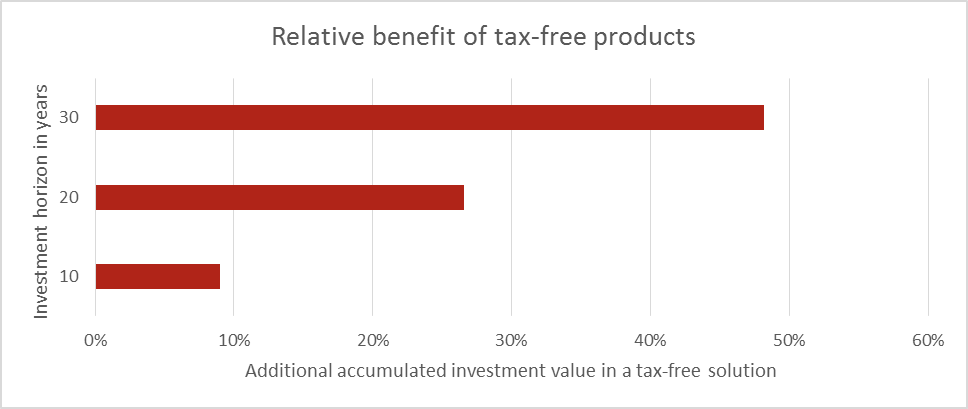

If we compare the proceeds from a tax-free investment to an equivalent taxed investment vehicle over different investment horizons, we can see the benefit. As an example, over 10 years a tax-free product can offer almost 10% higher accumulated value if compared to a taxed investment vehicle, assuming a marginal tax rate of 30%. And this can increase to almost 50% higher accumulated value over a 30-year period.

Source: Momentum Investments, March 2021

Tax-free investment products also offer additional flexibility. Unlike retirement fund solutions, a tax-free investment solution is not restricted to Regulation 28 requirements. You can therefore use this solution to tweak the overall asset class allocation of your client’s investment portfolio, especially if there is a need for higher allocation to appropriate growth asset classes.

The tax-free feature of this investment will be most beneficial when a client starts early in life and keeps it until retirement or beyond.

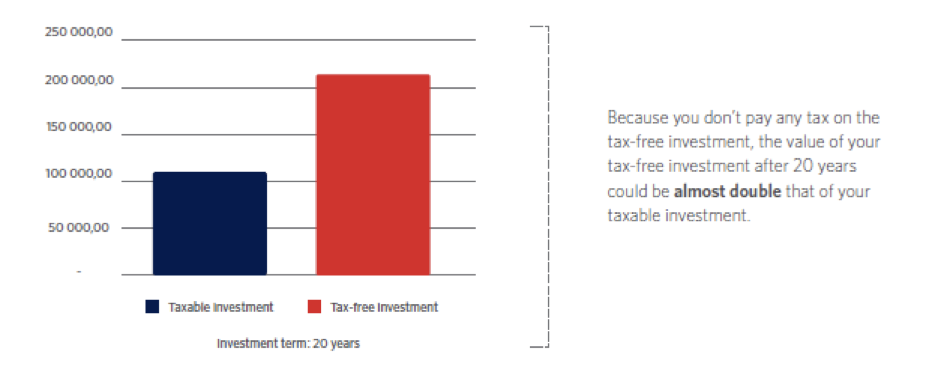

Another example can illustrate the power of investing tax-free.

Let’s say you invest R36 000 as a lump sum amount in a typical tax-free investment and also R36 000 in a typical taxable investment. We assume that you leave the money to grow for 20 years and get growth of 10% a year from the investment fund you chose for the two investments*.

Source: Momentum, April 2021

Clients will get the most out of the investment by:

- investing as much as they can, within the limits (R36 000 per year; R500 000 lifetime);

- investing as much of the allowable yearly amount as early in the tax year as possible;

- investing in growth asset classes; and

- leaving their money invested for as long as possible.

Clients will override the advantages by:

- using the investment as an emergency fund or for other short-term needs;

- withdrawing any amount before retirement

- investing in conservative underlying asset classes, such as fixed interest; or

- investing more than the allowable yearly amount.

With us, investing is personal and our Flexible Tax-free Option from Momentum Wealth gives clients the following added benefits to help them achieve their financial goals:

- The widest choice of underlying investment components to suit each client’s personal investment needs and goals.

- Our outcome-based solutions fund range targets specific growth outcomes, making the choice of investment funds easier.

- We offer cost efficiency, even more on our Target range of funds where we use passive-style investing with an active twist.

- We make sure clients don’t exceed limits with us, to avoid tax penalties.

We believe that financial advice plays a critical role to understand clients’ personal circumstances and develop an investment strategy that addresses your clients’ personal investment goals. If clients have the discipline to invest tax-free, and stay invested, they will reap the benefits over the long term.

*To calculate the impact of tax on the taxable investment, we assume:

- that your income is R600 000 a year;

- that you use the full interest exemption and capital gains tax exclusion every year on other investments; and

- that you take your money out of this investment after 20 years.

- We also assume that you use the same investment fund for both investments. We have excluded the impact of fees for this illustration.