Hayden Reinders, Convenor: Hedge Fund Standing Committee, (ASISA)

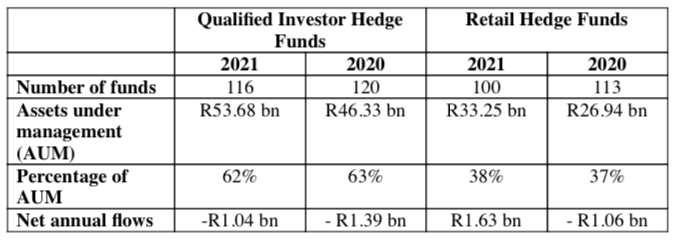

The South African hedge fund industry ended 2021 with assets under management of R86.93 billion. This represents a healthy growth in assets of R13.66 billion over the 12-month period.

The annual hedge fund statistics released today by the Association for Savings and Investment South Africa (ASISA) show that the nearly 19% growth in assets was achieved in spite of further consolidation and closure of funds, which reduced the number of hedge funds from 233 at the end of 2020 to 216 at the end of 2021. Hayden Reinders, convenor of the ASISA Hedge Fund Standing Committee, explains that the reduction in hedge funds continues to be driven by fund managers consolidating their product offerings into either Qualified Investor Hedge Fund structures or Retail Hedge Fund structures. South Africa became the first country in the world to put in place comprehensive regulations for hedge fund products in April 2015. The regulations provide for two categories of hedge funds, namely Qualified Investor Hedge Funds and Retail Hedge Funds.

Qualified Investor Hedge Funds require a minimum investment of R1 million and are open to investors with a solid understanding of the investment strategies deployed by hedge funds and the associated risks. Retail Hedge Funds, on the other hand, are more strictly regulated in terms of the investments and the risks that they are allowed to take and are open to all investors who can afford the average minimum lump sum investment amount of R50 000.

Muted net inflows despite good performance

Reinders reports that while hedge funds have delivered good returns on average, they attracted muted net inflows of R0.59 billion for the 12 months ended December 2021. He adds that following the net outflows of R2.45 billion experienced by the industry in 2020, the return to net inflows was a positive and welcome change.

He points out, however, that the net inflows in 2021 were driven exclusively by Retail Hedge Funds, which attracted net inflows of R1.63 billion. Qualified Investor Hedge Funds on the other hand recorded net outflows of R1.04 billion. Reinders explains that hedge funds continue to be hamstrung by Board Notice 90, which prevents long-only unit trust portfolios from investing in hedge funds even though they are also regulated as collective investment schemes.

“ASISA has been engaging with the Financial Sector Conduct Authority on this and we expect the regulator to release a draft standard for public comment soon. We also expect the amendments to Regulation 28 of the Pension Funds Act to be finalised shortly, which will hopefully provide the hedge fund industry with its own percentage allocation in pension fuSalient Numbersnd portfolios, rather than sharing in a broader allocation to alternative assets.”Reinders says that once these regulatory changes have been implemented, hedge funds will be able to operate on a more level playing field, which should result in healthy inflows.

Salient numbers

Popular hedge fund strategies

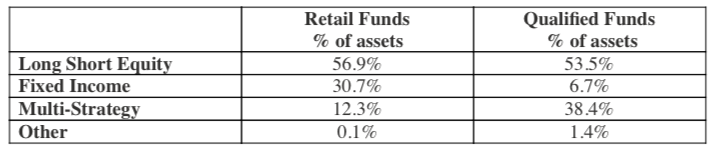

Hedge funds are designed to mitigate the impact of market volatility on capital by applying specialist strategies within the different asset classes. Hedge funds in South Africa are therefore classified according to their investment strategies:

- Long Short Equity Hedge Funds are portfolios that predominantly generate their returns from positions in the equity market regardless of the specific strategy employed such as “long bias” and “market neutral”.

- Fixed Income Hedge Funds are portfolios that invest in instruments and derivatives that are sensitive to movements in the interest rate market.

- Multi-Strategy Hedge Funds are portfolios that over time do not rely on a single asset class to generate investment opportunities but rather blend a variety of different strategies and asset classes with no single asset class dominating over time.

- Other Hedge Funds are portfolios that apply strategies that do not fit into any of the other classification groupings.

The most popular hedge fund strategy in South Africa is “equity long/short”. At the end of 2021, 56.9% of retail money was invested in Long Short Equity Hedge Funds and 53.5% of qualified investor money.