Wayne Dennehy, Institutional Distribution: Momentum Investments

Proper diversification is to ‘not put all your eggs in one basket. Smart Beta funds allow financial advisers, fund managers, and individual investors to be more diversified in the South African equity fund space.

In 2020 the difference in returns between the best performing SA equity fund and the worst was 43% – a stark reminder of the need to be well diversified.

To better understand what Smart Beta funds are in the context of SA equity funds, let’s start with what an index fund is. An index fund is the classic ‘buy the market’. Buying a Top 40 Index fund allows investors to buy the top 40 shares, with the holding in each share reflecting the size of the company in the market. A Capped SWIX Index fund is buying all SA shares, where no share may be more than 10% of the fund (the cap).

Smart beta equity funds use a rule-based approach to assess what shares to hold in the fund. Different smart beta funds will use different approaches to try and exploit market inefficiencies and capture styles of value, momentum, quality, and volatility.

Research shows that the average active equity fund does not always manage to out-perform the market over rolling 12-month periods. Therefore, the first lever we use to get better diversification in is by using more than one fund. The second consideration is to make sure that we have exposure to the key drivers of returns in the SA market, namely value, momentum, and quality. Exposure to all of these three styles further achieves better diversification.

Smart beta funds give us a third lever and provide an opportunity to diversify away from active managers, while still targeting market-beating returns. These funds allow financial advisers to consider funds that achieve a particular level of diversification for their clients but delivered through a more passive and systematic process.

The Momentum Trending Equity Fund, our momentum style smart beta fund, beat the market by 7.3% per year (after fees) since its launch in April 2017 to the end of December 2020. This is very ‘active’ looking returns but with a smart beta fund under the bonnet.

There has been a lot of research over the years on whether you can add value by trying to time your entry and exit from various equity styles. I have yet to see any evidence of a process or philosophy that consistently adds value to clients through trying to time equity styles in the market. A better long-term strategy is to make sure that you have exposure to the primary styles of value, momentum, and quality, and hold them through different market cycles.

THE STRATEGY FOR SA EQUITY IS SIMPLE:

- If you only have one style, the journey for clients can be volatile

- Blending in different equity styles gives a smoother journey

- Don’t try and time entry and exit from different styles

- Combine active, index, and smart beta funds for better diversification

Another compelling argument in favor of Smart beta funds is price. These funds are typically far cheaper than actively managed funds without compromising on the benefits that they can bring to the robustness of client portfolios when blended with other funds.

Every financial planner and client is unique and investing is personal, therefore financial advisers can either access individual smart beta funds if they are clear on what styles they would like to add to client portfolios or buy pre-packaged solutions.

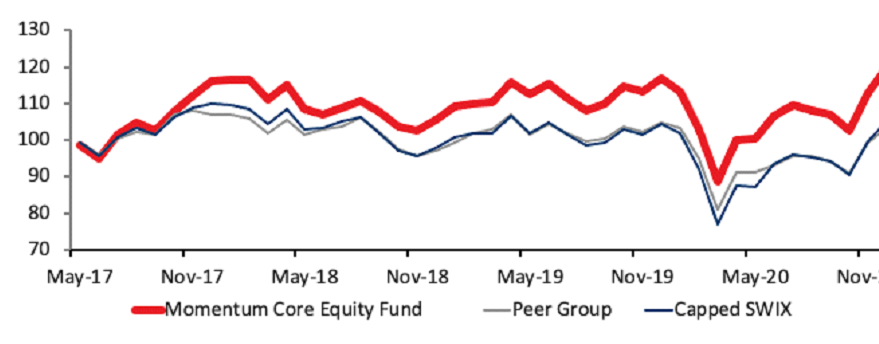

The Momentum Core Equity Fund is such an example, a blend of the capped Swix index fund and the three momentum smart beta funds (value, momentum, and quality). These funds offer competitive pricing and have a commendable track record since their launch in April 2017.

Momentum Core Equity Fund – Returns since inception

Source: Morningstar, Iress and Momentum Investments Momentum Collective Investments (RF) (Pty) Ltd (the “Manager”), registration number 1987/004287/07, is authorised in terms of the Collective Investment Schemes Control Act, No 45 of 2002 (CISCA) to administer Collective Investment Schemes (CIS) in Securities.

All the expertise, products and service to help you to keep your clients focused on the destination.

Momentum Investments is part of Momentum Metropolitan Life Limited, an authorised financial services (FSP6406) and registered credit (NCRCP173) provider.