Dawn Julyan CFP®; Compliance Director, Simply Comply

Too often we hear business owners say, “My business is my retirement plan.” Yet, how many of those plans actually materialise?

As a financial services intermediary, you are likely pouring your time, energy, and expertise into building your practice. But while you’re focused on compliance, client servicing, and securing the next mandate, it’s easy to overlook the fact that your business may be your most valuable asset—an asset that is at risk of being undervalued, or worse, lost entirely, if you fail to plan your exit strategically.

Retirement is also not the only reason to consider an exit. Circumstances and ambitions change. You may eventually want to pursue a new venture, enter a different sector, or simply take a well-earned break. If your business isn’t structured to operate without you, you may find yourself trapped by your own creation, unable to leave and leverage the value you’ve spent years building.

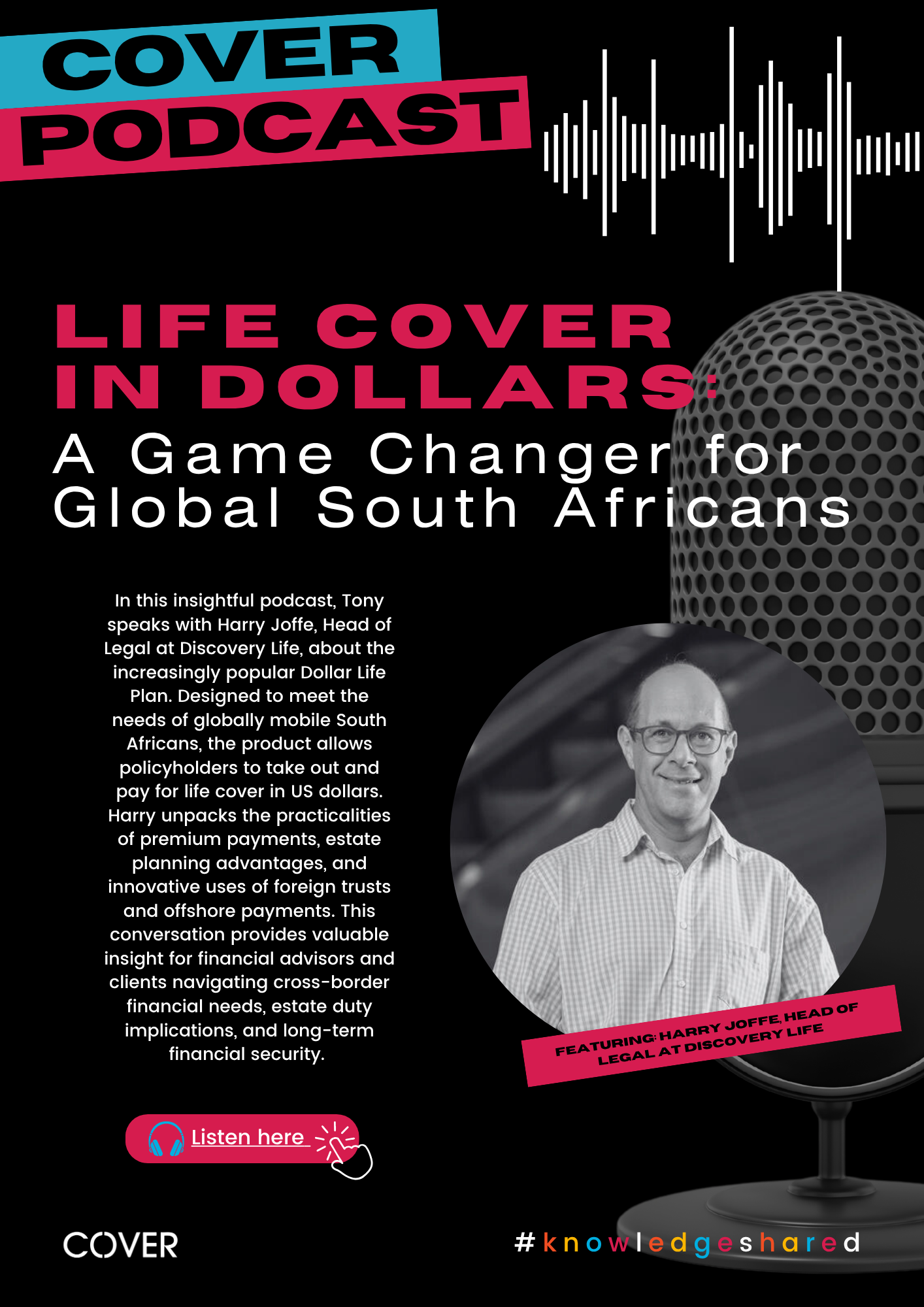

LIFE COVER IN DOLLARS

A Game Changer for Global South Africans

In this insightful podcast, Tony speaks with Harry Joffe, Head of Legal at Discovery Life, about the increasingly popular Dollar Life

Plan. Designed to meet the needs of globally mobile South Africans, the product allows policyholders to take out and pay for life cover in US dollars.

Harry unpacks the practicalities of premium payments, estate planning advantages, and innovative uses of foreign trusts

and offshore payments. This conversation provides valuable insight for financial advisors and clients navigating cross-border financial needs, estate duty implications, and long-term financial security.

Then there’s the unexpected such as an unsolicited offer from someone who sees the value in your book. A structured, operationally sound business—where policies, procedures, and controls guide day-to-day activities—is vastly more attractive to a buyer than one that is overly reliant on the founder. If your presence is central to your business’ continued performance, the chances of extracting maximum value on exit are slim, and you may be asked to stay on longer than you’d like.

A further consideration is the “what ifs.” What if you become ill or incapacitated? Insurance may cover certain financial losses, but what becomes of your business? Without a plan, you risk walking away with nothing, despite decades of hard work and value creation.

A forward-thinking exit strategy offers a contingency plan and a retirement plan and builds resilience. It ensures your internal operations are not only compliant but efficient, standardised, and replicable. It reduces dependency on you, making the business scalable and easier to transfer.

Too many business owners are so busy putting out fires or closing deals that they forget to stop and sharpen the axe. Strategic oversight—defining your vision, reviewing your structure and building future-proof systems is exactly what separates businesses that thrive long-term from those that disappear when the founder steps away.

Whether your departure is five years away or fifteen, planning your exit is a non-negotiable component of sustainable business leadership. The earlier you start, the more control you’ll have over your options and the more value you’re likely to realise when the time comes.

At the end of the day, an exit strategy isn’t about leaving—it’s about building a business that’s truly worth something when you do.