Tony Van Niekerk, COVER

In the ever-evolving landscape of insurance and claims management, efficiency, cost-saving, and streamlined processes have become paramount.

Recently, I had the opportunity to speak with Cameron Clark, Business Executive at INSRAP, and Alan Kinloch, General Manager, about the origins of their company and how their approach has evolved over the years.

INSRAP was founded in 2016 as an spawned out of Admin Plus, a company specialising in mobile device insurance. Recognizing an opportunity to create a supply entity that aggregates pricing, integrates multiple suppliers, and streamlines the claims process, INSRAP quickly grew into a fully independent entity – INSRAP is a company that by design has a purpose to reduce the cost of a claim (Its owned and built by “insurance people”) as opposed to a cellular wholesaler/retailer supplier will by design, seek to inscrease sales and margins. A very subtle yet distinctive difference. According to Cameron, what started as a basic idea for an online e-commerce replacement business has expanded into something much more comprehensive. Today, INSRAP provides replacements for electronic devices, white goods, brown goods, and repair services, making it a key replacement partner in the industry.

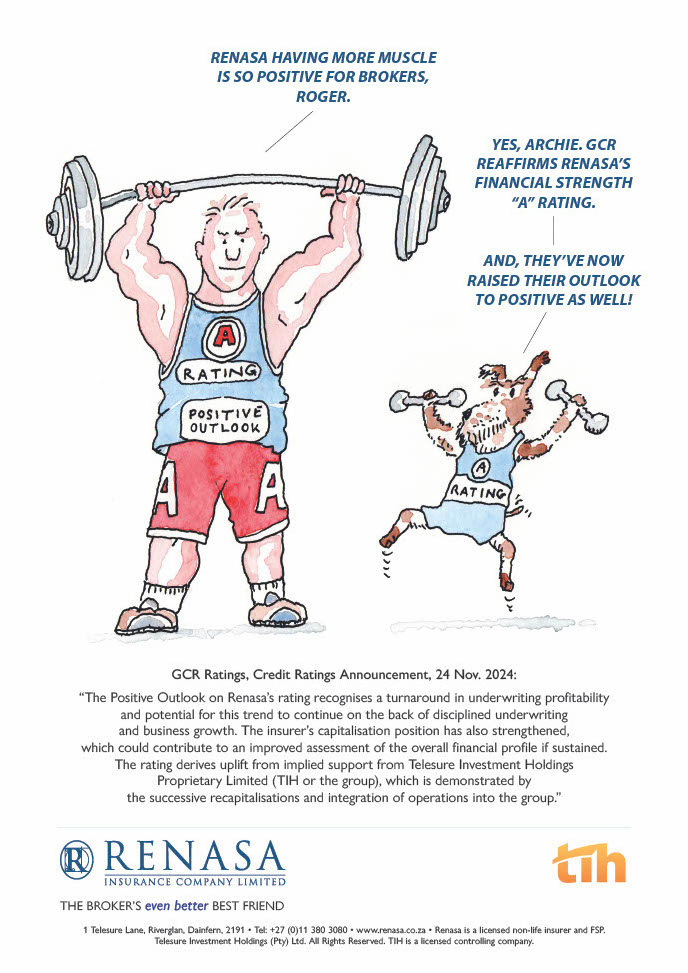

Renasa has always been the broker’s best friend.

Our entire business focus is exclusively on helping our intermediaries outcompete their competitors.

Now, as part of TIH, South Africa’s powerful insurance group,

we commit to do even more for our brokers.

GCR Ratings, Credit Ratings Announcement:

“The Positive Outlook on Renasa’s rating recognises a turnaround in underwriting profitability and potential for this trend to continue on the back of disciplined underwriting and business growth. The insurer’s capitalisation position has also strengthened,

which could contribute to an improved assessment of the overall financial profile if sustained. The rating derives uplift from implied support from Telesure Investment Holdings Proprietary Limited (TIH or the group), which is demonstrated by the successive recapitalisations and integration of operations into the group.”

Renasa is a licensed non-life insurer and FSP. Telesure Investment Holdings (Pty) Ltd. All Rights Reserved. TIH is a licensed controlling company.

The Drive for Speed and Efficiency – Speed and efficiency are at the core of INSRAP’s operations. Cameron emphasised the importance of keeping customers updated throughout the process, as delays in replacement can significantly impact customer satisfaction – In the cellular space specifically speed and human touch are so important. INSRAP ensures that orders placed before 2:00 PM are fulfilled 93% of the time within a 24-hour period in main metropolitan areas, Various courier services are utilised to maintain timely delivery, yet cost of claim reduction remains paramount

From a broker and insurer perspective, this level of efficiency is critical. The ability to provide swift replacements means that brokers can uphold service levels and maintain trust with their clients. In an industry where expectations are high, INSRAP ensures that customers receive their replacements promptly and with minimal hassle.

The Value Proposition for Brokers – INSRAP’s partnership with insurers and thier brokers is built on reliability, transparency, and efficiency. Brokers (Specifically with binders) play a crucial role in claims management, and having a trusted supply chain partner can make all the difference. Cameron highlighted several key benefits that brokers experience when working with INSRAP – However constant lower cost of claim is the main driver

- Personalised Service: Brokers have direct access to INSRAP’s team, ensuring smooth communication and seamless claims processing. All of this can be done online

- No Additional Fees: Unlike other supply partners in the market, INSRAP does not charge fees for their services, providing cost savings without compromising on quality.

- Vetted Suppliers and Strong Contracts: By ensuring strict service level agreements (SLAs) with suppliers, INSRAP guarantees a legitimate and reliable supply chain, offering peace of mind to brokers and their clients.

- Expert Technical Assistance: Many brokers may not have in-depth knowledge of device specifications. INSRAP’s team assists brokers in determining suitable replacements, verifying device specifications, and ensuring fair value replacements.

To become an INSRAP partner, brokers can easily connect through INSRAP’s website and undergo a simple onboarding process. Training sessions are conducted to familiarise claims handlers with the system, and each consultant receives personalised logins for easy access. The goal is to integrate smoothly into the broker’s existing workflow, minimising disruption while maximising efficiency.

INSRAP also offers an online chat function and direct communication channels, allowing brokers to get real-time assistance when needed. Whether it’s identifying a suitable replacement device or handling customer queries, the support system ensures a frictionless experience.

A National Footprint and Competitive Edge – One of the standout aspects of INSRAP is its national coverage. Whether servicing brokers in major cities or remote towns, INSRAP ensures consistent service delivery. This extensive footprint enables brokers to serve their clients efficiently, regardless of location.

Cameron also emphasised that cost savings are a significant advantage. By keeping claims costs low, brokers can help maintain favourable loss ratios, reducing the risk of premium increases for their clients. This strategic approach benefits both brokers and insurers, making INSRAP a valuable partner in the insurance ecosystem.

As the insurance industry continues to evolve, technology-driven solutions like INSRAP are setting new standards in service excellence. By integrating technology yet maintaining personalised service, INSRAP provides brokers with the tools they need to remain competitive while ensuring policyholders receive fast, reliable replacements.

As we move into 2025, it’s clear that INSRAP is well-positioned to continue its growth and deliver exceptional value to the insurance sector. For claims teams looking to optimise their claims processes and enhance their service offerings, INSRAP presents a compelling solution from your desktop.

Cameron, Alan, and the INSRAP team are paving the way for a more efficient, cost-effective, and customer-centric approach to claims replacement. With a strong commitment to innovation and service, they have positioned themselves as an essential partner in the insurance industry.