By Jonathan Kaiser & Miguel Malaj , SHA

South Africa is a dangerous place. This is not news to anyone, however, what may come as a surprise is the size of our private security force that has ballooned to 2,7m registered guards. To place that into perspective, South Africa only has 150,000 police officers and 71,000 active military personnel. The state of crime is such that security services are deemed a necessity and not a luxury. With over 300,000 cases of theft and burglary reported each quarter in South Africa, business owners and private individuals have little choice but to rely on the R50 billion private security industry. Concerningly 300 – 600 guards die in the line of duty each year. These facts are an unfortunate indictment on society.

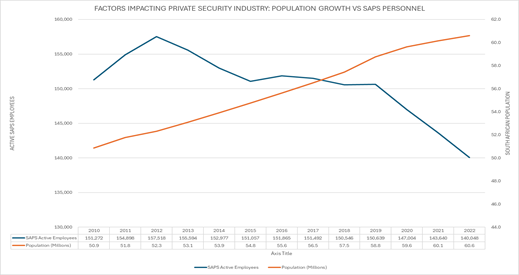

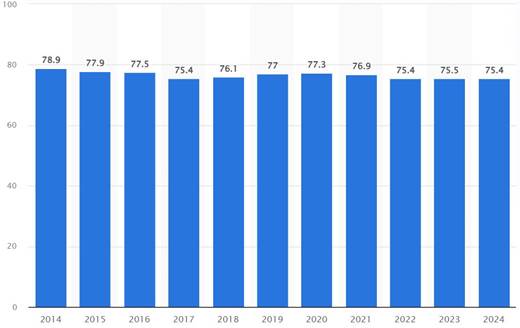

Alarmingly, from the first graph below, it is evident that, at least from 2010, we have deployed less police per person per year, notwithstanding the continual growth in population. Evident from the second graph depicting the Crime index, crime rates have not dropped and have remained uncomfortably stable and high. It is therefore no feat of great imagination to predict that our reliance on private security services will only increase in future.

FIGURE 01

FIGURE 02

When security services fail to protect property or life, the consequences can be severe (literally life or death), and clients are quick to hold security firms accountable, as recent case law demonstrates. What then are the key drivers behind claims in this space and what are the primary risks facing this industry?

Achilles Heel

With the exclusion of petty or chance theft, industry experts agree with us that, for the most part, criminal syndicates are responsible for organising most crime within this country. It is operated like a business and is exceptionally efficient. Claim investigations reveal that in most large-scale operations, one or more security officials have been bribed and in the few cases where bribes were refused, those guards are often kidnapped (or their lives threatened) and replaced with doppelgangers. Once the ‘replacement’ guard was let onto site, all the failsafe security systems and processes come to nought. In another case, the syndicate bribed two different security firms (onsite and offsite monitoring) and furthermore had inside knowledge on the building layout to locate and avoid the infrared beams.

The ‘Achilles heel’ then to the security industry is the apparent ease with which guards can be swayed to betray their employers, and furthermore, the lack of controls around ensuring that guards identities are properly authenticated prior to entry onto any site, irrespective if the person ‘looks’ like one of the regular guards. Much like cyber security, the weakest link is usually the human element.

Who watches the watchmen?

There is a lack of continuous oversight over the guards themselves. The philosopher Plato is credited with the quote ‘Quis custodiet ipsos custodes’: “Who watches the watchmen”. Independent checking and site supervision is key to keeping everyone honest. Based on our claims data, had there been independent oversight, perhaps in the form of a control room, it would forestall most if not all large-scale theft.

Without proper oversight, the trust placed in security officials is merely blind faith, and the risk of corruption is high. This risk is perhaps one born from socio-economic circumstances and with remuneration for security services being on the low end and consumers in South Africa being unwilling or unable to pay for absolute loyalty, these issues will persist.

To demonstrate effective risk mitigation, security service providers must implement measures to have ongoing oversight – to watch its watchmen.

TAKE THE ‘ADMIN’ OUT OF ADMINISTRATION.

Whatever your present challenges and future goals, C360 provides the best possible platform for building powerful, business-enabling solutions that future-proof your business while providing operational efficiency and regulatory peace of mind.

Self-defence or trigger happy?

Another factor plaguing the reputation of the industry as well as being a leading cause for claims is the lack of restraint being exercised by security officials. The law calls for a proportional response when acting in self-defence or out of necessity. One would, for example, be hard pressed to convince a court that it was necessary to shoot a suspect in the back when they failed to surrender and were fleeing. Only the police can issue orders that are by law required to be complied with. Notwithstanding such orders, the police would not, per se, be entitled to shoot any suspect in the back for disobeying their orders to surrender.

Recently an unarmed man was shot by a security official because he refused to move away from an ATM that the guard wanted to refill. The use of force in this incident was on the face of it unnecessary and extreme.

In another matter, a security official, in attempting to prevent robbers from fleeing the scene, accidentally shot an innocent bystander.

Self-defence or necessity typically requires that force be proportional and used only as a last resort. These incidents highlight the risks and legal complexities surrounding the discharge of firearms. The lesson here is clear: the use of a firearm must be strictly proportional to the threat and employed only when absolutely necessary. Numerous claims have arisen from the disproportionate use of force, underscoring the need for robust internal training and clear policies on the use of firearms. The primary objective of the security guard is to protect, not arrest.

Managing and maintaining a private security industry insurance portfolio in the South African context.

The South African private security industry is regarded as one of the most sophisticated in the world. Still, like any other industry, the industry is influenced by various elements which include, complying with the law, adhering to industry regulations and standards, maintaining commercial relationships, competition, meeting financial targets, managing reputational risk, investing and utilisation of technology, whilst simultaneously navigating the unique challenges that arise from other elements inherent to South Africa such as social inequality, poor economic performance, high levels of unemployment, lack of law enforcement, violence, and poverty ultimately contributing to a high crime rate.

When considering the unique challenges, the private security industry faces, as a portfolio manager (insurance broker and insurer), relying on the traditional methods of underwriting and risk evaluation may no longer be adequate. Therefore, underwriting a security company effectively will require a more collaborative approach, particularly through close partnerships with brokers and the security company to gain a comprehensive understanding of the security company. Portfolio managers should in addition to standard risk factors focus on the experience of the personnel responsible for the day-to-day operations and compliance, evaluate the security company’s standard operating procedures (SOPs), training programmes, recruitment and vetting practices, disciplinary procedures, and accident response plans.

Additionally, evaluating the firm’s primary customers, their experience in the type of security services rendered, and their approach to contractual risk management is essential.

During the 2024 underwriting year, the SHA team applied this approach, and we can confirm that the collaborations were fruitful and resulted in good engagements on important issues facing the security industry.

For example, when we engaged with security companies to understand how they are addressing some of the most common and aggravating factors challenging security companies, we learnt about some of the following mitigating factors being used:

Control rooms and 24/7 remote monitoring: This tool enables security companies to monitor sites remotely as opposed to the site itself. The monitoring technology used integrates the use of artificial intelligence, smart alarms, sensors and cameras allowing security companies to monitor multiple sites simultaneously with little to no actual human involvement with the operator just having to respond to an alert. Operators in the control room are subject to strict vetting procedures and access to the control room uses advanced biometrics systems. The combination of these features and controls allows security companies to combat and reduce the risk of the ‘Achilles heel’ which is probably the most common aggravating factor contributing to the failure to prevent theft, robbery, fidelity-type losses, and harm to security guards.

Drones: One of the security companies we engaged with started using and operating drones remotely from their control room. Aerial monitoring allows the security company to monitor large areas and difficult-to-reach sites (i.e. farms, mining operations, forestry, and remote estates) more frequently and in a time-effective manner. However, it should be noted that one of the challenges security companies will face in this space is the lack of legislation and/or regulation addressing the use of drones in the security industry.

Extensive firearm training including real life simulations: In addition to theoretical firearm training, during our site visits we witnessed practical training on shooting firearms including real-life scenario-based simulations training. The training is conducted and facilitated by ex-military and police officers. The purpose of this is to enable and help armed guards improve their decision making under high stress situations, develop their judgement and problem-solving ability based on various scenarios, improve their shooting skills and muscle memory, and help guards better adhere to protocols to ensure compliance with industry standards and legislation. This type of firearm training may help prevent “trigger happy” scenarios highlighted earlier.

The examples highlighted above are only some of the methods security companies are using to address their challenges, but they also illustrate some of the benefits of a more collaborative approach to managing a portfolio as it enables portfolio managers to improve their knowledge and understanding of the industry which will in turn improve underwriting practices, risk evaluation and selection.

In addition to the above, portfolio managers should consider monitoring PSIRA’s (Private Security Industry Regulatory Authority) performance. PSIRA’s performance is critical because it is responsible for the oversight, regulation, and enforcement of the security industry rules, standards, and practices. PSIRA releases an annual report available on its website. This report shares information in relation to the authority’s performance of various objectives which includes important areas such as their administration ability which focuses on how PSIRA achieves their strategic initiatives, objectives and goals.

The report also has a dedicated section focusing on the PSIRA’s ability to enforce the law. This section’s primary focus is ensuring that all security industry players operate and comply with regulations and standards and it takes appropriate action where violations happen and where necessary prosecute players who do not comply. The report includes key performance indicators such as the number of security companies inspected, the number of security companies firearm-related activities inspected, the number of complaints investigated, and the number of security companies prosecuted for non-compliance.

The annual report also covers the research and development activities of PSIRA which shares articles and surveys based on the research and investigations conducted by PSIRA, for example, in a report called “TRACKING THE VALUABLE: THE USE OF TRACKING DEVICES IN THE PRIVATE SECURITY SECTOR”, the report researched and investigated the tracking sector which can be split into the following 3 segments:

- Technology: this segment includes the manufacturing and assembling of tracking devices and accessories;

- The installation and monitoring segment which consists of companies that are fitting tracking devices and providing monitoring for motor vehicles, trailers, human beings, and animals;

- And the segment responsible for tracking and recovery of vehicles, property, or people.

One of the interesting findings of the report highlighted several companies providing the services listed in the three points above are not registered service providers and recommended that service providers who fall within these segments are obligated to register and be certified with PSIRA.

Reviewing the annual PSIRA report may share valuable insights into the security industry which can enable portfolio managers to proactively address and prevent possible gaps that may exist in their security industry insurance portfolio.