By Fazila Manjoo, Portfolio Manager, Mergence Investment Managers

Since early 2023, digital disruption has been a key driver of global equity returns. We have seen increased capital spending at companies that have embraced digital technologies. Technology companies have had new product launches, and cost-savings and efficiency gains have driven significant earnings growth for companies in the AI infrastructure supply chain.

Despite elevated valuations in this segment of the market, it is still early days. We define digital disruption as a mega-theme. That is, it is not a short-term tactical trend but instead a key area of change that is expected to have a profound impact on the future of the global economy.

We expect this theme to continue as technologies improve and progress is made in the application of AI across several industries.

At Mergence, we construct and monitor various screens of global stocks with exposures to several mega themes, including digital disruption, a low-carbon economy, and demographic divergence.

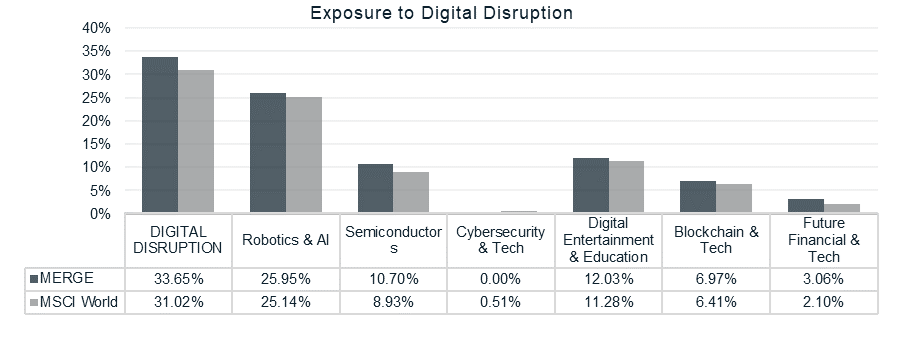

For digital disruption, we currently monitor six areas of interest that we anticipate will be beneficiaries of this theme. They include everything from robotics and AI to semiconductors, cybersecurity, digital entertainment, and blockchain, as well as companies exposed to technology disruption across areas in finance.

The chart below illustrates the exposure of digital disruption stocks in the MSCI World (an index of developed market stocks) versus MERGE, the Mergence Global Quant Equity Portfolio.

Source: Mergence Investment Managers, Factset data as of July 2024

Partner with an Insurer you can trust

In an uncertain financial climate, our client-centric approach of developing strong relationships with partners and clients, while boasting a deep understanding of their business, helps us to create unique solutions.

Centriq’s insurance subsidiaries are authorised financial services providers

Key findings:

- About 31% of the market cap of global developed markets now has exposure to digital disruption as a theme.

- More than 25% of the market share of global developed markets now has exposure to the robotics and artificial intelligence theme.

- We are overweight digital disruption stocks in the Mergence Global Quant Equity Portfolio, notably in semiconductors.

Digital disruption has transformed semiconductors from a cyclical industry into a force of earnings growth that has far outpaced the broader equity market. Semiconductors are the hardware and basic building blocks of any application of artificial intelligence.

We believe that the demand for companies that provide semiconductors, data centres, networking, and servers—the underlying infrastructure and utilities of digital disruption—may outstrip supply in the foreseeable future.

We hold a diversified selection of stocks in digital disruption, driven by various quantitative factors. We find that digital disruption stocks look attractive on measures of profitability, earnings quality, price momentum, analyst sentiment, and liquidity. Digital disruption stocks we like include semiconductor stocks like Applied Material, KLA, Qualcomm, and Nvidia, among others. Nvidia has returned 171% in USD over the last year and has been our biggest contributor to alpha year-to-date.

Nvidia is a full-stack computing infrastructure company. The company’s segments include its data centre accelerated computing platform, networking, graphics segments for gaming platforms, and platforms for virtual computing and infotainment. With a rich and comprehensive set of software and technology products, it features multiple disruptive themes, including robotics and AI, semiconductors, digital entertainment, and blockchain.