By Haydn Johns, Head of PSG Life and PSG Invest, PSG Wealth

Investment platforms, which enable investors to save and invest according to their specific needs, are gaining momentum in South Africa. These platforms, accessible online from any location and at any time, present a convenient option for wealth creation.

Where to start?

Many people start their savings journey by using banking products. While this is a good place to start, banking products typically offer a lower risk and return profile which can quickly become unsuitable for investors’ needs. Banking products can also introduce risks such as not keeping up with inflation and reducing savings in real terms, which is where the benefits of investment platforms come to the fore.

Younger investors, whose investment time horizons are usually longer, need to start taking on equity exposure early in their investment journey. According to a Nataxis Global Survey of Finance Professionals done in 2022, investing too conservatively is one of the top five biggest mistakes that prevent people from retiring comfortably. Investment platforms typically offer conservative solutions similar to those offered by banks, but they also allow investors access to higher equity exposure funds, which are shown to offer investors better returns over time.

PIONEERING INSURTECH

THREE DECADES OF INNOVATION AND PROGRESS

Adaptability and success are our goals.

Whether you’re a global insurer, UMA, or

innovative startup, we’re here to support you.

What to consider when moving from a banking product to an investment platform

When investors start their financial advice journey, and start to move from banking products to those offered by investment platforms, there are usually two key hurdles which can impede their access to investing, namely:

· high minimum contribution amounts required by many investment platforms, and

· high administration charges on smaller investment amounts.

Once investors have identified platforms with minimum investment amounts they can afford, fees become an important factor, as even a small change in fees can have a material impact on investment returns over time. Investors should consult a financial adviser to help understand the full picture of the impact of any fees on their returns and longer term outcomes.

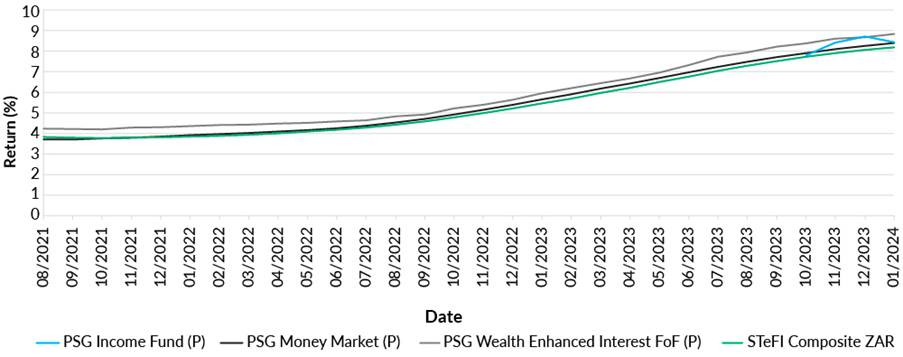

Comparing yields: One-year rolling returns

Money market funds generally publish daily ‘annual effective yields’. Keep in mind that these are based on recent daily accruals that are annualised. These published yields thus provide a short-term view of the funds’ returns. It is generally more useful to consider one-year rolling returns over extended periods to determine consistent relative performance.

Sources: PSG, FactSet. Data as at 31 January 2024

In addressing South Africa’s challenges, investment platforms offer enhanced financial access and can be effectively leveraged to accelerate wealth creation. Traditional banking products have many limitations, especially for younger investors, and low-risk investment products offered by investment platforms are a suitable alternative with additional benefits.

Contact a financial adviser today to help guide you on your path to financial security and prosperity.