Offshore investing has become a vital part of clients’ investment portfolios due to its diversification benefits. If you currently have an investment portfolio, the chances are good that you already have an allocation to offshore assets. The question is, are you using the correct solutions, with the best tax outcomes, when investing offshore? Abigail Kitshoff, Business Development Manager at Glacier International, helps us understand how to optimise offshore investing through tax efficiency, by providing some tips of what to consider.

Tip #1: Understand how to access direct offshore assets.

There are currently two primary ways a South African client can invest offshore:

- Invest in rands through a local solution and access offshore assets using an asset swap, or

- Invest in foreign currency through an offshore solution and by obtaining SARS tax clearance.

The second option requires the additional steps of a SARS tax clearance and converting the funds to foreign currency. However, once you have completed this process, this and all the other direct investment options include the following benefits:

1. The tax is paid on foreign currency gains and not rand gains.

2. The solution provides access to a much wider investment universe.

3. You can withdraw funds to an offshore bank account in your name. Remember, investments via asset swap will be required to be returned to South Africa.

Tip #2: Understand the tax benefits of investing directly offshore when using the correct investment vehicle.

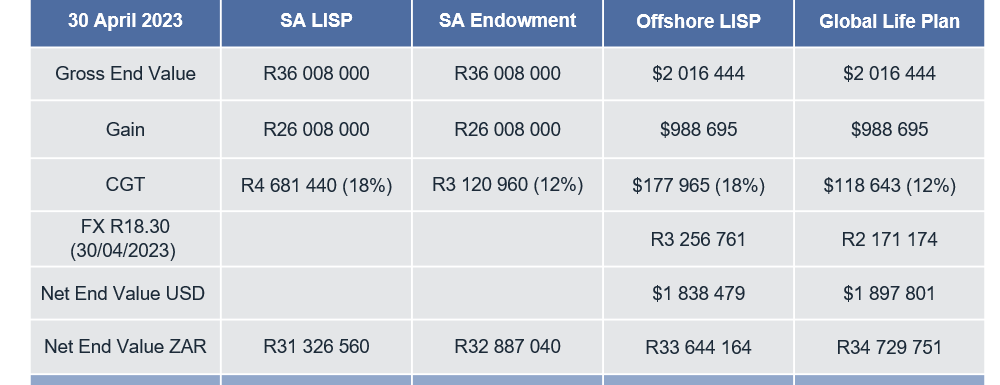

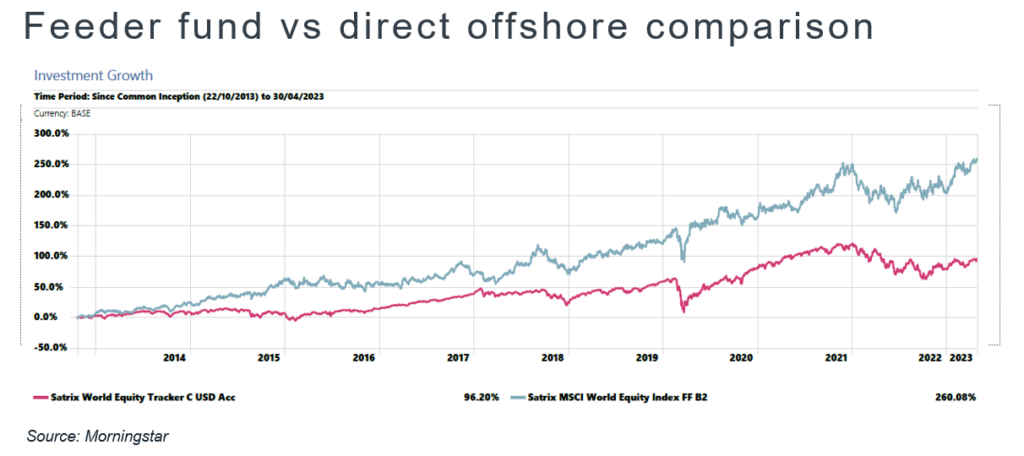

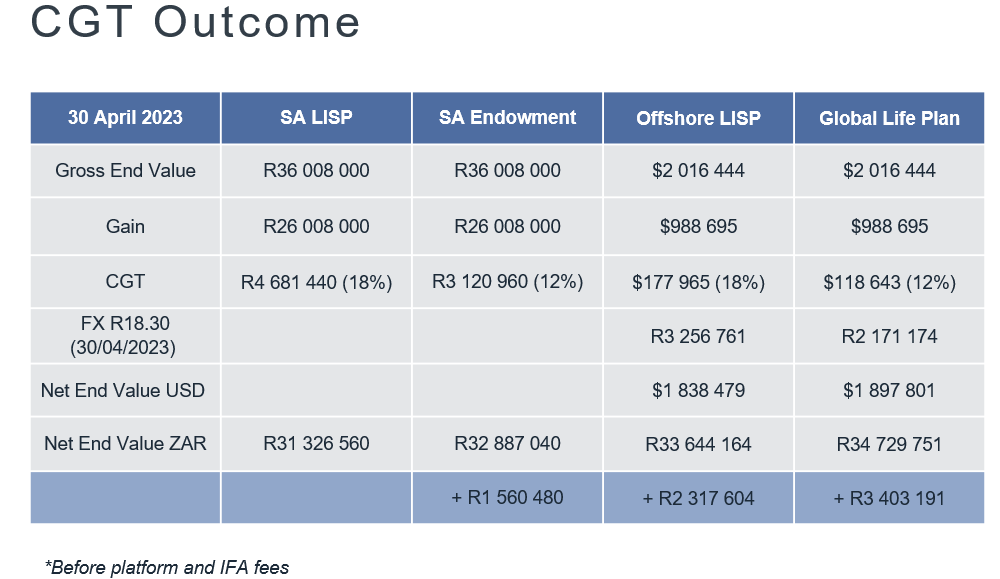

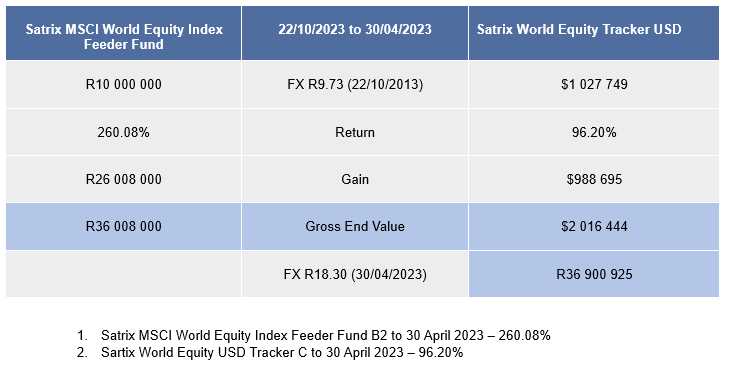

Let’s further unpack the tax consequences of using the correct solution. When you are using a local investment solution to access offshore funds, you are making use of a feeder fund, which is a local fund that invests or feeds into an offshore fund, and capital gains tax (CGT) will be applied on rand gains. This could result in a situation where your investment has not grown, but you could end up paying CGT of up to 18% on gains made due to a depreciating rand. The adverse can apply and depends on your view of where the value of the rand is headed. The below comparison illustrates what impact this can have on your investment return.

Source: Morningstar

Source: Morningstar

Tip #3: Understand the different investment vehicles and solutions when investing directly offshore.

At Glacier International, we provide a wide range of investment solutions designed to build offshore investment portfolios. Whatever solution you choose, you will need to take certain factors into account, by answering the following questions:

- Am I investing as an individual or through a company or trust?

- Where is my tax residency?

- Does my income tax exceed 30%?

- What is the amount I intend to invest?

- What are my investment preferences?

Tip #4: Consider using the recurring option of the Glacier Offshore Investment Plan to start investing directly offshore.

If you are just starting out and want to build a direct offshore portfolio without having to follow the SARS clearance and currency conversion process, the Glacier Offshore Investment Plan with the recurring investment option offers ease of offshore investing. The minimum investment amount is R5000 per month and would form part of your R1 million single discretionary allowance (SDA). If you feel you would benefit from using Glacier’s other solutions, the processes are equally as simple – you can transfer your investment once it has reached USD25 000 (or a currency equivalent).

For a comprehensive overview of the solutions on offer, the Definitive Guide to Glacier International is a well-considered road map that gives details about solutions and product options. This comprehensive guide can help you on your journey to a resilient, diversified investment portfolio with solutions that enable you to combine the best of all worlds – locally and abroad.

Tip #5: Appoint a professional.

Making any kind of investment decision – whether local or offshore – requires skill, knowledge and experience, especially around all of the technical aspects regarding the tax implications. Appoint an appropriately authorised financial planner to help you on your investment journey. They will help you navigate a sometimes tricky, daunting world and design a portfolio with your needs and investment objectives at its centre.

Glacier Financial Solutions (Pty) Ltd is a licensed financial services provider.

Sanlam Life Insurance Ltd is a licensed life insurer, financial services and registered credit provider (NCRCP43).

Glacier International is a division of Sanlam Life Insurance Limited, a licensed financial services provider in South Africa.

Portfolios and wrap funds are managed by Glacier Financial Solutions (Pty) Ltd., a Licensed Discretionary Financial Services Provider, FSP 770, trading as Glacier Invest.

Sanlam Multi Manager International (Pty) Ltd FSP 845 is a licensed discretionary financial services provider, acting as Juristic Representative under Glacier Invest.

As Juristic Representative of Glacier Invest, Sanlam Multi Manager International (Pty) Ltd manages the retail investment solutions.