Coronation Fund Managers

South African investors don’t need much convincing on the merits of including global assets in their investment portfolios. Simply put, it’s about diversifying your asset base by not putting all your eggs into a single (and notably small) basket. The same diversification principle that applies to asset classes (equities, bonds, etc.) also applies to spreading your investment risk and return opportunities across geographies and, importantly, jurisdictions.

ACCESS INVESTMENT OPPORTUNITIES ACROSS THE GLOBE

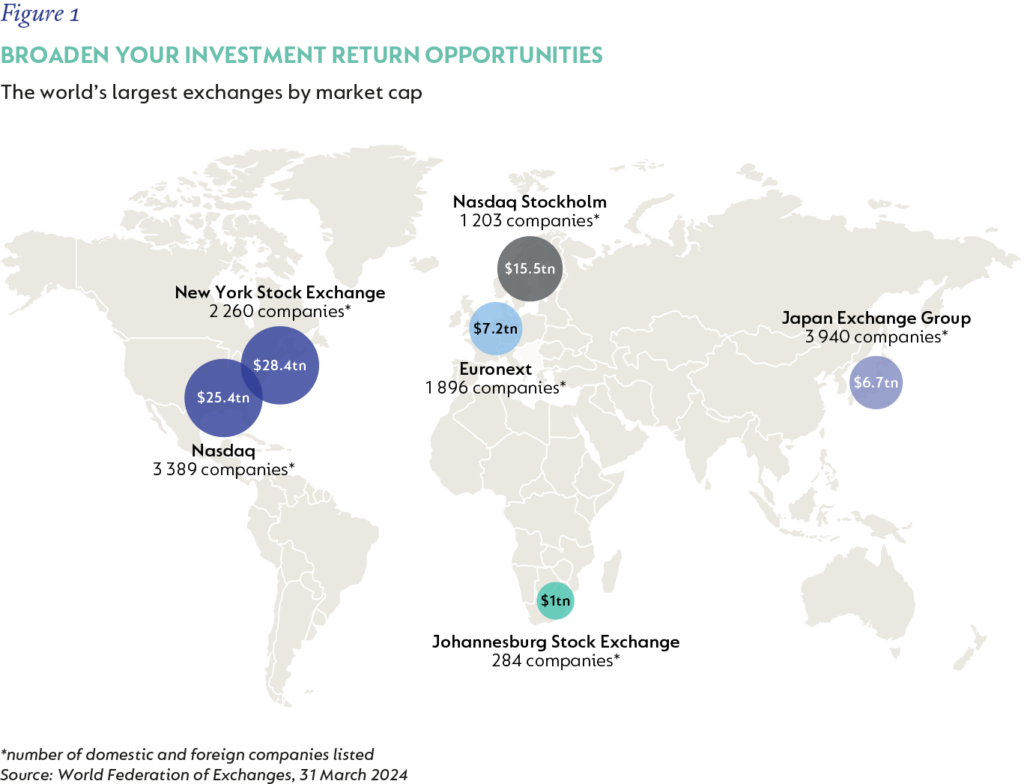

The sheer magnitude of investment opportunities outside our home market is evident in the combined market capitalisation of the world’s top five exchanges (see Figure 1), which exceeded $83 trillion (and comprising close to 14 000 listed companies) compared to the JSE’s ~$1 trillion as at the end of March 2024. When you widen your investment universe, you gain access to engines of innovation and growth, as well as deeper industries that may not be present in our home market, with the likely outcome of improving your overall investment outcomes.

DIVERSIFY ACROSS ASSET CLASSES, SECTORS AND GEOGRAPHIES

Another benefit of broadening your investment horizon is that of diversification across sectors and asset classes. When you add another asset class or sector to your overall portfolio that behaves differently to your local asset class mix, you reduce your portfolio’s overall investment risk.

INVEST IN HARD CURRENCY FROM ONLY $500

Over and above the benefits of access to more opportunities and diversification across asset classes and geographies, investing in hard currency (i.e. in an offshore fund that requires you to convert your rands into another currency) offers your investment portfolio a hedge against sovereign risk (for example the imposition of tougher exchange control regulations) and may be more tax efficient (currency gains and losses are not subject to capital gains tax in offshore funds).

And to help investors achieve these benefits, Coronation has made their offshore funds more accessible by reducing the minimum initial investment required to only $500 (or €500/£500).

A DEMONSTRABLE TRACK RECORD IN GLOBAL MARKETS

Coronation has spent the last 25 years steadily rolling out a considered global fund range to meet every offshore investment need. Today, this range has a demonstrable track record and it is one of the few local investment firms with:

- proven and established global capabilities across both emerging and developed markets;

- a single, valuation-driven investment philosophy and approach that has been tested through many market crises; and

- having successfully replicated its skills in building multi-asset class portfolios offshore.

When investing offshore with a trusted partner like Coronation, you gain access to a global team of skilled investment professionals (the large global investment team includes 15 members with more than 10 years’ experience) who consistently collaborate to identify the most attractive opportunities (regardless of asset class or geography) for inclusion in each of its global funds.

ALL ROADS LEAD TO MULTI-ASSET FUNDS, EVEN OFFSHORE

When investing directly offshore, it makes sense to simplify your fund choice by considering a multi-asset fund. These funds allow you as the investor to leave the difficult decision-making, such as asset allocation and instrument selection to the experts.

Choosing the fund that best matches your needs will depend on the level of risk that you are willing and able to take. Below are three global funds that have been designed to meet the majority of investor needs:

| What offshore need are you trying to meet? | What fund may be suitable? | What level of risk exposure can you expect? |

| I want to preserve my capital, but ideally, I want to do better than a US-dollar bank account. | Coronation Global Strategic USD Income | Up to 25% of the Fund may be invested in listed property, preference shares, and other forms of hybrid debt or equity instruments. |

| I want to preserve my capital and achieve a real return in US dollars. | Coronation Global Capital Plus | Exposure to growth assets (shares and listed property), which pose more risk than income assets, will typically not exceed 50%. |

| I want long-term real returns and am comfortable with moderate risk exposure. | Coronation Global Managed | The fund will have a sizeable exposure to equities, which typically offer the best returns over the long run but balances long-term real returns with the risk of loss. |

Ensuring that our asset base is appropriately diversified (including across geographies and jurisdictions) and selecting an offshore multi-asset fund as your vehicle with which to achieve that are two of the best gifts you can give yourself as a South African investor.