Layve Rabinowitz | Stonehage Fleming Head of Family Office Middle East Africa

Zennials (Millennials and Gen Z) are set to inherit an estimated $100 trillion over the next century – the greatest wealth transfer in history. But it’s also expected to be an unusually challenging financial handover from one generation to another, given a more complex wealth creation environment and the younger generations’ vastly different financial aspirations.

Why are Baby Boomers such a wealthy generation?

The most recent US Federal Reserve data shows that Baby Boomers hold 50% of the wealth in the US versus the Silent Generation that came before them, comprising a much smaller 11.9% of the wealth in the fourth quarter of 2022.

The extent of the wealth accumulated by the Baby Boomers can be attributed to what economists call the Goldilocks era, when economic and financial market conditions are described as not being too cold or too hot. That meant a $100 investment in an S&P 500 Index Fund in 1980 multiplied 120 times to $12 000 today, and US home values increased about 300% over the same period.

What will make this wealth transfer so challenging

While decades of low inflation, low interest rates, soaring house prices and rising stock markets enabled baby boomers to generate more wealth than any previous generation, the next generation faces a more unpredictable investment landscape, likely to be characterized by greater new macroeconomic and geopolitical risks, financial market volatility and uncertainty and potentially higher inflation and interest rates.

It’s not only this unpredictable and trickier wealth landscape that will pose challenges for successfully transferring wealth from one generation to another. The vastly different financial aspirations of Zennials compared to the older generation further complicate the smooth handover of this considerable wealth from generation to generation.

Chief among the differences in financial priorities include:

- Younger generations tend to prioritize living life to the fullest, whereas older generations have generally prioritized work to build wealth.

- Younger investors prioritize green investment considerations, while older investors have focused predominantly on investment performance.

- Younger investors tend to prefer passive investment products, while most investors in the previous generation have preferred to invest in actively managed investment products.

- Younger investors are also more tech-oriented than their older generations, making them open to investing in disruptive but less predictable investments like cryptocurrencies.

UNHW families worry most about passing on the money to the next gen

Against this backdrop, it’s little wonder that the results of the Stonehage Fleming Four Pillars of Capital survey saw sustaining family wealth and failing to engage the Next Generation foreseen as one of the top three risks for ultra-high-net-worth families.

Poor investment outcomes and political risk entered the top three for the first time in a decade, highlighting the financial concerns weighing on the minds of the 300 ultra-high-net-worth family members (20% of which are South African) participating in the survey.

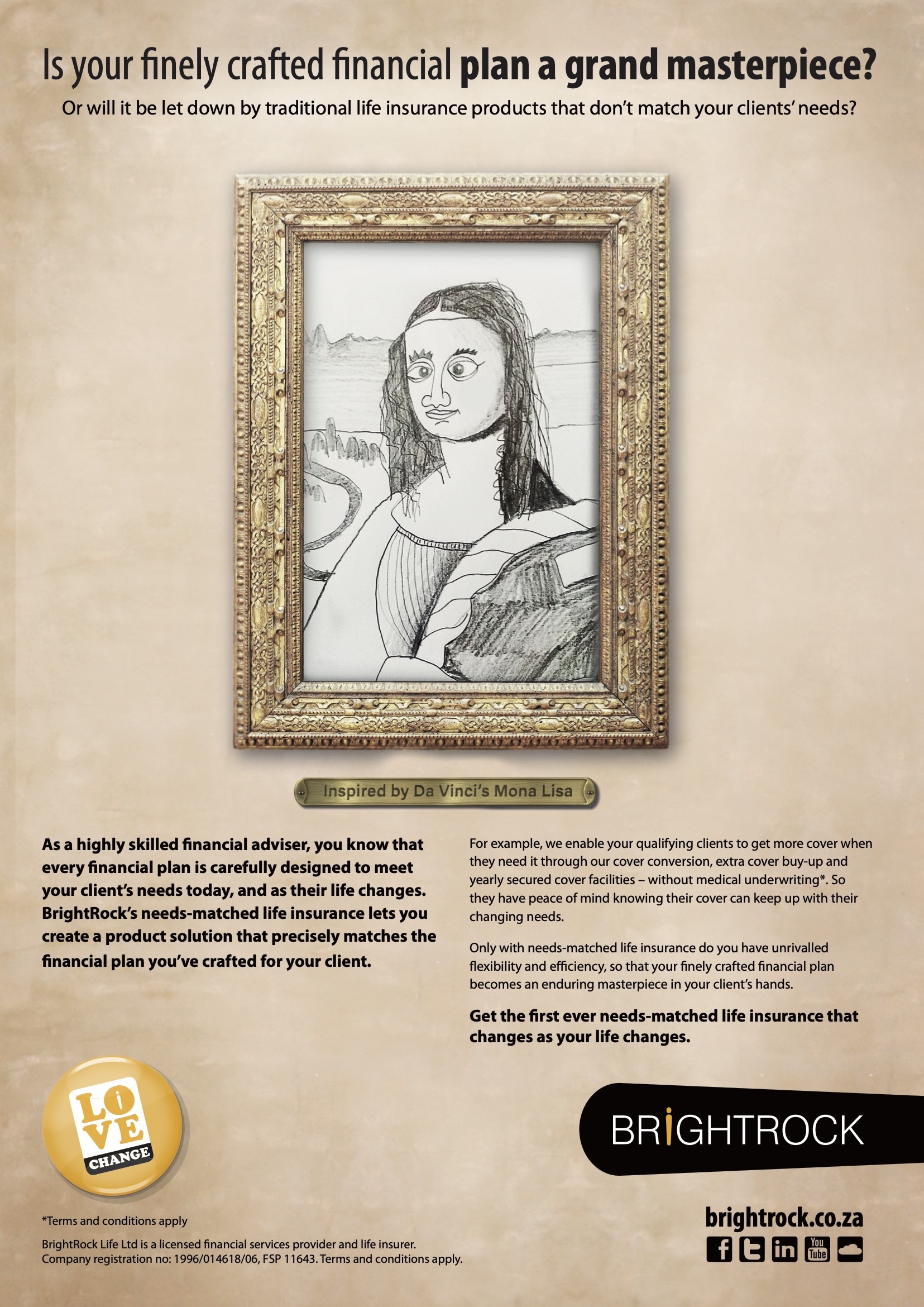

Is your finely crafted financial plan a grand masterpiece?

Or will it be let down by traditional life insurance products that don’t match your clients’ needs?

As a highly skilled financial adviser, you know that every financial plan is carefully designed to meet your client’s needs today, and as their life changes. BrightRock’s needs-matched life insurance lets you create a product solution that precisely matches the financial plan you’ve crafted for your client.

BrightRock Life Ltd is a licensed financial services provider and life insurer. Company registration no: 1996/014618/06, FSP 11643. Terms and conditions apply

This seismic shift in what ultra-high net worth families perceive to be the greatest challenges they face signals how acutely aware they are of the elevated financial risks that lie ahead. However, the lion’s share of the respondents in the survey (80%) indicated they have not yet established a formal process for identifying and mitigating these risks.

How they are preparing to sustain their family wealth

On a positive note, the 2023 survey reports that more than two-thirds of the families are already taking proactive steps to give the Next Generation a more prominent role in family decision-making and financial responsibilities, with the trend more advanced in Africa and the Americas than in the UK and Europe.

One respondent’s comment captured the importance of adopting a more formal and bespoke approach to succession planning: “Without proper preparation and education, the Next Generation can find themselves out of their depth and, with excess capital, they get into areas they don’t properly understand.”

Family offices are well-positioned to help ultra-high-net-worth families in this respect. They have the resources to bring together family members with disparate views and the expertise to provide wise counsel on preparing the next generation for the financial responsibilities they will take over in the next 25 years.

Reputational and mental health challenges are growing risks for UHNW families

In addition to the financial considerations, several non-financial challenges threaten to undermine a harmonious wealth transfer between Baby Boomers and Zennials. These include reputational risk arising from the next-gen’s active digital footprints and the mental health tsunami fast spreading across the younger generations.

Although reputation is everything for most ultra-high net worth families, the survey highlights that 90% of respondents are not tracking the digital risks of the family, notwithstanding the damage a single post by a family member or staff member could do to a family’s reputation.

Most worrying is the steep increase in mental health issues being experienced by the younger generations. Almost one in five young people in the US reportedly experienced a major depressive episode in 2021 – double the proportion of young people suffering from depression a decade ago. The UK’s NHS reports similarly worrying mental health problems among the young, with a quarter of young people aged between 17 and 19 having experienced major depressive episodes in 2023.

Considering these challenges, it’s clear that succession planning needs to extend beyond financial education and training to becoming digitally savvy and ensuring the next generation has access to mental health care and resources.

The old adage “shirt sleeves to shirt sleeves in three generations” aptly sums up the historical challenges of transferring wealth to the next generation. As the Great Wealth Transfer unfolds, families’ best chance of breaking this cycle is to prepare, educate and empower the next gen to take on the responsibilities of building wealth for generations to come.