By Martiens Barnard, Marketing Actuary at Momentum Investments

The perception that offshore equity markets will consistently outperform our local equity market drives many individuals to invest offshore.

Others might want to invest offshore as they believe that the rand will weaken (ie depreciate). This belief that the rand will depreciate against currencies in developed markets, aligns with the theory of purchasing power parity (PPP). Developed markets generally experience lower inflation rates, and PPP suggest that exchange rates adjust to equalise the prices of goods and services between countries over time.

Analysing the first claim: Do offshore markets truly outperform?

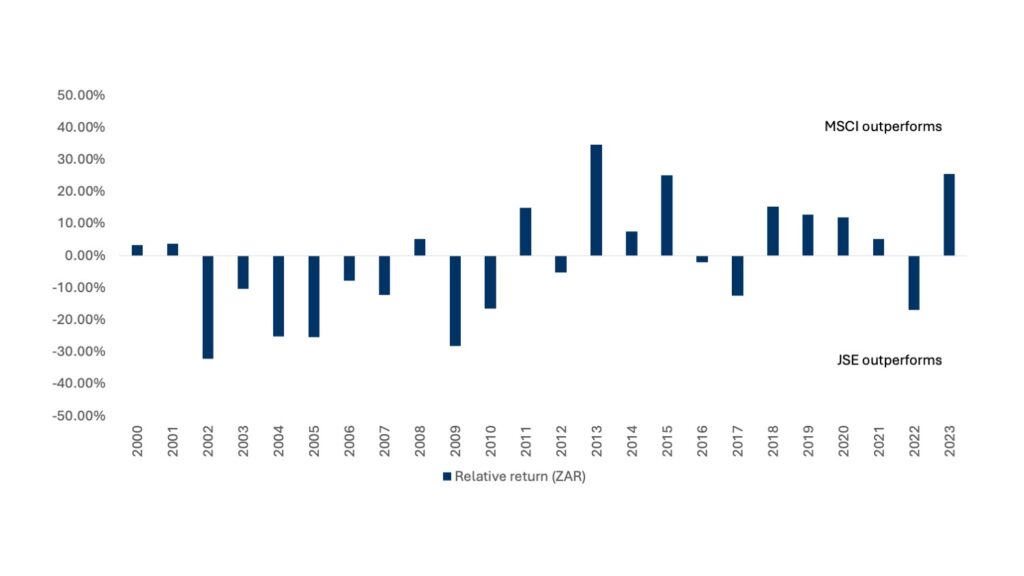

Last year, the MSCI World Index provided a return of 34.54% in rand terms compared to the 8.98% return from the JSE Top 40. This is an outperformance of more than 25%.

Performance of the local and international markets

Looking at recent years, there has been a trend of offshore markets outperforming (except for 2022), but this has not always been the case. Since 2000, the number of times where one has outperformed the other in rand terms is split equally at 12 each – although the local market outperformed on a cumulative basis over this time.

The long-term relative returns

A further analysis gives more insight into the cause of the relative performance, to see whether it was pure market outperformance or due to exchange rate movements. The chart below shows the same relative performance (in blue) and alongside it, the difference between the performance of the JSE Top 40 in rand terms and the MSCI World Index in US dollar (USD) terms.

The long-term relative returns

When viewed like this, we see that about 10% of the outperformance in 2023 was due to the rand weakening. We also see that the MSCI World Index, when viewed in USD terms, offered meaningful outperformance in only six of the last 24 years (2003, 2013, 2016, 2019, 2020 and 2023).

This means that most of the outperformance of the MSCI World Index in rand terms was due to the exchange rate and not the performance of offshore markets. This was also true in the recent past. In the last few years, the rand’s depreciation has also increased the performance of the offshore markets (when viewed in rand terms) as it has depreciated five out of the six years.

If your reason to invest offshore is based on your belief that “international equity markets will consistently outperform our local equity market”, consider how much your judgment has been influenced by the weakening of the rand.

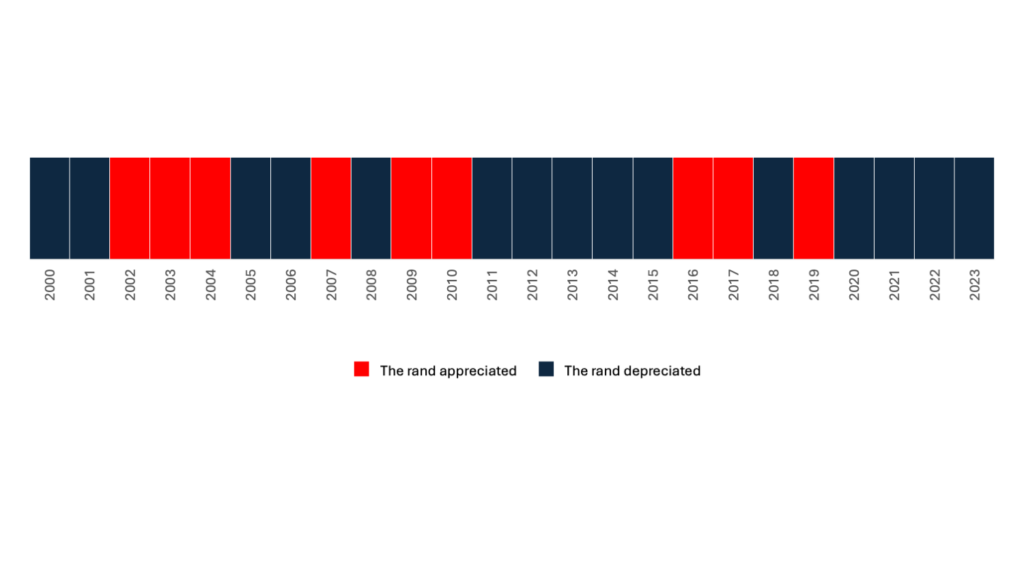

Then again, some people invest offshore to benefit from rand depreciation. This is a risky approach as currency movements are difficult to predict and their movements can be substantial. Since 2000, in seven of the nine years where the rand strengthened (appreciated), it was by more than 10%.

Looking at the below chart of how the rand compared to the USD, the direction of the movements is fairly difficult to predict, especially in the short term.

Year of rand appreciation/depreciation

Today, the valuation of the rand in PPP terms suggest it is oversold, but there are many fundamental reasons why it could weaken.

With all this being said, the question remains: Why should you invest offshore when offshore markets don’t necessarily outperform (without the help of a depreciating rand), and if the movement of the rand is so difficult to predict?

Reasons to invest offshore

In general, investors should invest offshore as a means of diversification: international markets offer a much larger opportunity set and exposure to asset classes, industries, companies and geographies that are less accessible in the local equity market.

This can lead to a better diversified investment portfolio, leading to a smoother overall return profile. For example, let’s examine an investment portfolio that is split evenly between the JSE Top 40 and the MSCI World Index.

Diversifying a portfolio

In 2018, the diversified portfolio would have softened the fall of a pure local equity investment from -8.31% to a mere -0.59% and in 2022, the fall of an offshore investment from -12.74% to only -4.27%.

Investing offshore is also a good idea to maintain your offshore currency spending power. If you are planning to live abroad for a while or permanently, or for your children to study there, it might be sensible to have your money there already.

How to invest offshore

You can invest offshore by using either of our investment platforms, Momentum Wealth or Momentum Wealth International.

Investing directly offshore through Momentum Wealth International offers you a yearly allowance to exchange rand for foreign currency.

Alternatively, with Momentum Wealth locally, you can invest offshore without using your yearly offshore allowance.

This can be done by investing rands into:

- Rand-denominated international funds

- Funds denominated in a foreign currency (when making use of an endowment or a retirement product)

Our comprehensive range of products, investment funds and other investment components positions us as leaders of international investment solutions tailored to meet every client’s offshore investing needs. Your client’s offshore investment isn’t just another investment. It’s personal to them. And with us, investing is personal. We can help you with your clients’ offshore and local investment solutions to help them achieve their goals.

Read more on our offshore investing page on momentum.co.za.

Momentum Investments is part of Momentum Metropolitan Life Limited, an authorised financial services and registered credit provider (FSP 6406).