Dr Jerry Chetty, Head of Business Integrity at Santam, examines the interconnectedness of insurance crime and the need for it to be dealt with as a priority crime.

Over the years, insurance crime has succeeded in evading the label of ‘organised crime’ and its effects are often underplayed. But it is a serious crime, and it is certainly not victimless. If it continues unabated, insurance crime could impact the affordability of insurance for everyday South African and change the way underwriters view and assess risk. Seeing inflated and false claims as a criminal activity and helping South Africans reach a fuller understanding of the consequences, requires a fundamental moral and policy shift.

The insurance industry is not a standalone sector but is rather a connector of various industries and ultimately, an important component of economic development. Large-scale financial prosperity for example, is connected to increased motor vehicle purchases, and increased activity in construction, agriculture, and banking. The backbone of these industries is effective risk management, which is where insurance comes in.

For this reason, a blow dealt to the insurance industry – in this case in the form of growing insurance crime – can catalyse a series of knock-on effects in other sectors, which can hamper economic growth in the long term. This in turn, has direct implications for the individual wellbeing of South Africans as well as the welfare of the collective.

Insurance crime is typically committed in two ways. In the first instance, individuals inflate a legitimate claim by claiming for items not stolen, lost or damaged thereby dishonestly increasing the value of the claim. In the second instance, individuals submit false claims by staging incidents e.g. the theft of their assets or vehicles and thereafter submitting claims for these fictious events.

Criminals target the most vulnerable persons in society; include the poor, elderly and students. There have been cases, for example, in which students in search of accommodation have supplied their personal information to fraudsters under false pretenses – this information is then used in fraudulent claims. There have also been instances where criminals dupe the poor into providing personal information and these criminals thereafter use the said information in fraudulent claims.

According to data collected by Santam, the incidence of insurance crime is evenly divided between motor claims (48%) and non-motor (43%) claims. The most common strategies used by insurance criminals involves claiming for losses incurred prior to inception of a policy, claiming for false or staged incidents, and submitting false claim information.

Furthermore, while the onset of the digital age has clear benefits for the way in which insurance crime patterns are detected, the Forensic team at Santam has been successfully using technology to identify insurance criminals, their patterns, and the way they perpetrate insurance crime. The Forensic team has, through the use of technology, identified a new and emerging trend which the team termed “community participative” insurance crime. In these cases, family members or members of tight-knit communities share information and assist each other in committing insurance crime.

Typically, the emergence of new technology is often accompanied by the emergence of new, more sophisticated criminal strategies. Further down the line, this has implications for insurers, who are called upon to underwrite these novice risks and become exposed by paying out claims due to losses caused by these new criminal strategies.

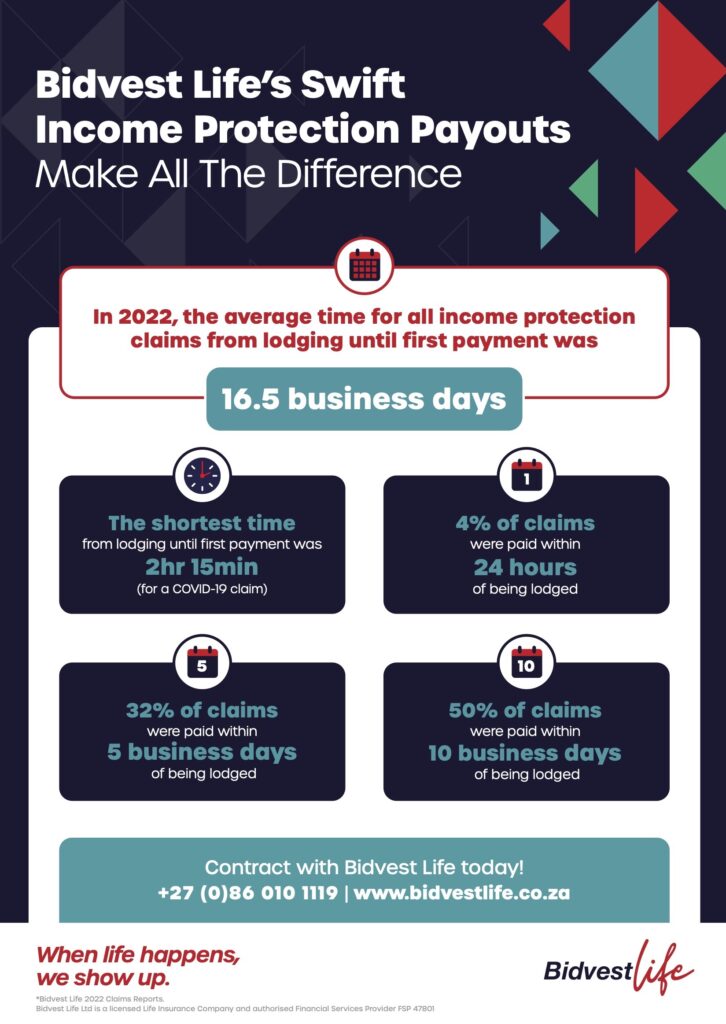

Bidvest Life’s Swift

Income Protection Payouts

Make All The Difference.

In 2022, the average time for all income protection claims from lodging until first payment was 16.5 business days

*Bidvest Life 2022 Claims Reports.

Bidvest Life Ltd is a licensed Life Insurance Company and authorised Financial Services Provider FSP 47801

The increase in claims related to the theft of keyless cars illustrates this interconnectedness of criminal activity. Tech-savvy criminals have developed tools that can interrupt the signals transmitted from key fobs to keyless cars. These incidents are known as CAN or relay attacks.

Another example of this interconnectedness relates to corruption in driver and car licensing departments. Corruption results in individuals illegally obtaining drivers licenses which are then used to purchase cars and take out insurance cover. This is illustrated in an article “Hawks arrest two in KZN learners’ licence scam” published on IOL on 16 November 2023. The authorities are investigating this matter to determine how many individuals obtained their driver’s licence fraudulently. The authorities have confirmed that they will revoke the licences of such individuals. This event has an impact for insurers as they would have to check if such individuals were insured with them and if any motor accident claims were paid out. This incident again demonstrates the impact relating to the interconnectedness of insurance crime.

Similarly, criminals have been found to clone vehicles or use damaged vehicles in insurance crime scams.

To safeguard against these occurrences, Santam has partnered with the South African Fraud Prevention Services and has maintained a close working relationship with the South African Police Services in the criminal prosecution of insurance crime cases. We also engage closely with the Insurance Crime Bureau (ICB), an industry body responsible for representing the insurance industry in dealing with organised insurance crime.

We also utilise an internal team of skilled forensic investigators who are tasked with investigating insurance crime cases where necessary, this specialist team will report these cases to law enforcement for criminal prosecution. The team has achieved great success in achieving criminal convictions. Most recently three (3) insurance criminals were given direct imprisonment ranging from 10 years, 8 years, and 5 years.

As a holistic risk mitigation strategy, an insurance crime working group from several other leading insurers was established to advocate for insurance crime to be declared a priority crime. One of the major pitfalls is that insurance crime is seen as a breach of contract, rather than a crime. This requires a change from all stakeholders in terms of how they view insurance crime. A more meaningful and collaborative process amongst stakeholders to deal with insurance crime will serve as a powerful deterrent and reinforce the measures taken by insurers to protect the sustainability and financial viability of their businesses. This is what the working group hopes to achieve.

While many insurers like Santam have committed to changing this narrative in a bid to curb insurance crime and prevent the subsequent economic fallout, the process is not without its difficulties. Insurers must strike a delicate balance between bringing insurance criminals to justice while preventing innocent and honest policyholders from shouldering the true cost of crime through higher premiums and more stringent terms and conditions.

As a result, we believe preventing the proliferation of insurance crime is not only the responsibility of insurers and law enforcement agencies; the responsibilities also rest with society. Society should be frowning against individuals who celebrate their efforts of defrauding insurers. Rather, the ability of insurance crime to affect lives and livelihoods, makes fighting this scourge everyone’s business.