Baden-Baden feedback from Munich Re

- Uncertainties call for disciplined underwriting: high natural event activity, inflation, geopolitical and civil unrest

- Consistent partner to its clients, leveraging on best-in-class underwriting, Munich Re invests in teams and tools to stay ahead

- Munich Re is in a position to further grow its risk-bearing capacity in Europe

“Europe currently faces dynamic changes in the risk landscape. Due to our considerable expertise, strong diversification, and scale, Munich Re is in a good position to carry highly relevant risks, such as those related to climate change or cyber-attacks, even in challenging times. We are willing to expand our risk partnerships with our clients. To ensure that we can fulfil our role as a risk carrier in the long term, we are working together with our clients to adapt prices and conditions to the changing environment, exclude uncontrollable systemic risks, and jointly develop new risk solutions”

Clarisse Kopff, Member of the Board of Management

Insurance markets currently must cope with growing uncertainty: inflation, geopolitical crises, rising cyber risks, and an increased frequency and severity of natural events, also in Europe where we have seen an unprecedented series of natural catastrophe losses exceeding the 1- billion-euro mark this year. These changes will be at the centre of the upcoming renewal discussions. As leading provider in Europe, Munich Re is able to allocate additional capacities for natural catastrophes and other types of risks, provided that appropriate prices, terms and conditions can be achieved. Both delivering added value for clients and maintaining the quality of its own portfolio are top priorities in the renewals. To achieve this Munich Re will continue to pursue a policy of disciplined, technically sound underwriting, allowing it to make capacity commitments early in the renewal process and based on clear criteria.

Inflation: Exposure and loss expectations on the rise

In the Euro area, the unusually high inflation dynamic seen in the past two years recently abated. However, energy and food prices remain high, and wages are growing. Accordingly, in the baseline scenario Munich Re Economic Research predicts an inflation rate of around 3% for 2024, more than twice the mean inflation rate for the 2010s. Moreover, Munich Re expects inflation in the Euro area to remain above the long-term average beyond 2024.

In insurers’ portfolios, still-palpable price increases are producing higher exposure and loss expectations alike. This is particularly true for the motor book in the underwriting years 2021 and 2022. To offer suitable cover for future losses, in addition to general inflation, insurers and reinsurers need to factor in segment-specific inflation factors – such as higher prices for replacement car parts, higher construction costs, wage increases. Inflation will remain a key feature in pricing.

Natural catastrophes: 1-billion-euro market losses becoming more common

The frequency and severity of weather-related natural catastrophes are increasing – and Europe is no exception. The year 2023, with its extreme heat, has continued this trend, and provides some further evidence that climate change is already aggravating weather-related risks.

Through September Europe saw extreme weather events including heavy rainfall, flooding, flash floods and severe hailstorms, producing overall claims expenditures that were once again a major burden for insurers.

Individual insured market losses per event more often cross the 1 billion euro mark per event. According to a Munich Re analysis (from late September), at least seven natural catastrophes in Europe fall into this category (2022: 5 / 2021: 4):

- Earthquakes in Turkey and Syria in February

- Flooding in northeast Italy and adjacent countries in May

- Storms Kai and Lambert in Germany in June

- Severe weather due to Storm Unai in northern Italy, Slovenia, and Croatia in July

- Flooding in Slovenia, Austria, and Croatia in early August

- Storm Hans in northern Europe in August

- Storm Denis with hail, especially in southern Germany, in late August

Munich Re continually invests to better understand natural hazards and underlying trends. Findings of internal and external scientists improve the basis for modelling natural catastrophes and provide valuable information for developing targeted measures to prevent risks and mitigate attendant losses, as well as for adequate pricing.

Thanks to the quality of its underwriting, the underlying mix and diversification of risks in its portfolio, paired with its considerable financial strength, Munich Re offers consistent – and for Europe, increasing – capacities, which are stringently defined based on ensuring profitability. Clarisse Kopff: “Natural catastrophes have always been at the core of Munich Re’s business. When top capacities are called for, we are a stable and dependable provider. We can see that, given the challenges posed by climate change and its growing economic impacts, there is a lasting demand for our core competences on the market.”

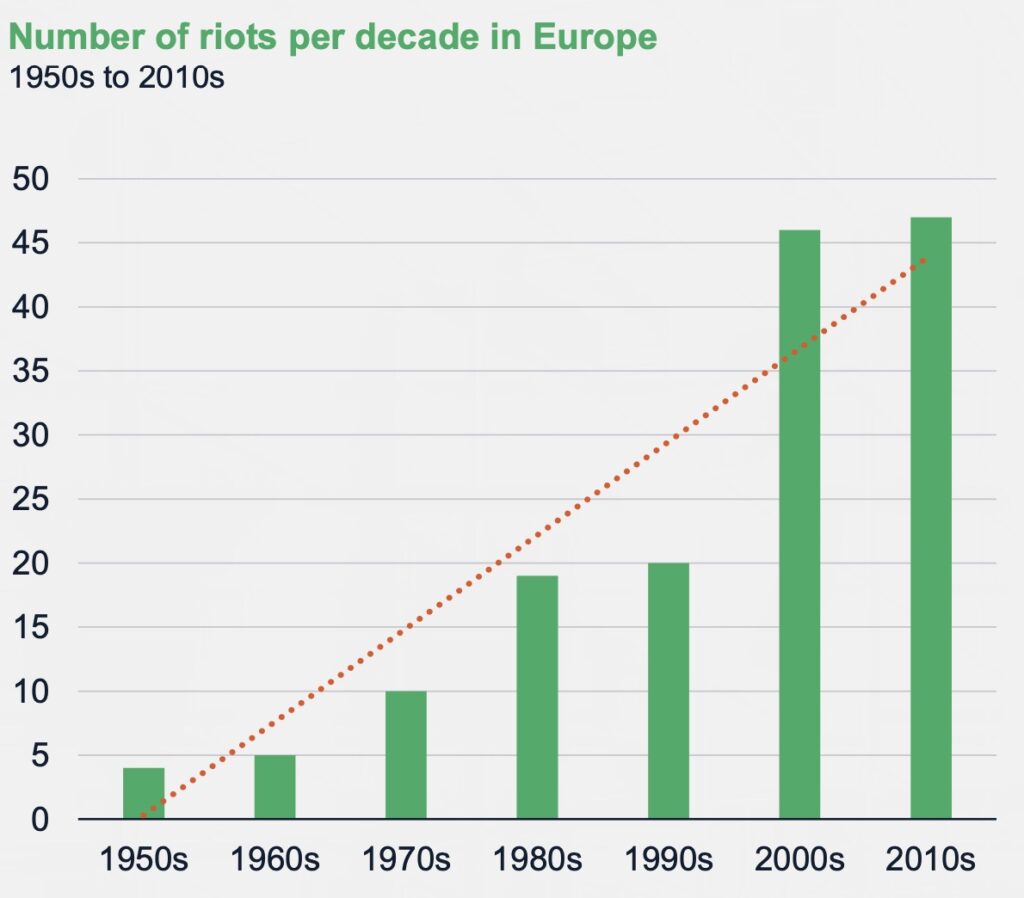

Increasing civil unrest in Europe

Civil unrest has worsened over the past several years, both globally and in Europe. These risks are only insurable as local events under property insurance and based on individual coverage designs (clear wordings with event definition and temporal and geographic limitations on events). Further, they must be assessed using a stringently technical underwriting approach. In terms of monitoring this dynamic risk, it is essential that the potential accumulation risk be continually evaluated.

Leading progress forward

We believe insurance extends beyond financial security, and that progress is more than just moving on. In every part of our business, we pioneer the industry, harnessing the power of evolutionary innovation and 140 years of expert vision. Our focus is on delivering insights that guide people and businesses to a future that is more confident, inclusive and impactful. A future we invest in, and that you can trust in..

The potential for unrest and riots to spread both temporally and regionally could be seen in this year’s events in France. In the city of Nanterre, what began as a vigil for a teenager shot dead by the police escalated into prolonged violent protests against the police in several cities. Retailers, supermarkets, banks, and restaurants were damaged, as well as public buildings and facilities. According to initial estimates, the riots resulted in economic losses in excess of €1.1bn.

Cyber coverage: Demand remains high

The demand for cyber risk coverage remains high: According to Munich Re estimates, the premium volume in Europe, the second-largest cyber insurance market after North America, amounts to US$ 2.3bn (as of the end of 2022). Munich Re’s Cyber Team expects a total market volume of around US$ 8bn by 2027 with an annual growth rate (CAGR (Compound Annual Growth Rate) 2019–2027) of 31%.

Regarding writing cyber risks, too, Munich Re’s focus is on ensuring profitability, hence an accurate understanding of accumulation potential. As a market leader in the cyber business, Munich Re in Europe predominantly assumes risks for SMEs, and for private clients in its portfolio of cedants. Claudia Hasse, Head of Cyber for Europe and Latin America and Chief Executive Manager (Non-Life) at Munich Re Germany: “Munich Re maintains a profitable and diversified cyber book in Europe and is poised for further growth. We understand cyber insurance and the limits of the business. Accumulation risks need to be transparent in the portfolio and beyond. Minimum standards for cyber security must be met. Our consistent underwriting approach is absolutely essential.”

Given the progression of digitalisation, cyber cover is becoming highly relevant for more and more companies. As a cyber pioneer in its sector, Munich Re can draw on years of experience and an outstanding database. In addition, it continually invests in the expertise of its cyber teams and improved modelling.

For the cyber market to enjoy sustainable growth, certain fundamental conditions must be clarified. First, it is vital that we arrive at a better understanding of accumulation potentials, meaning losses that can affect not just one insured party, but major portions of the business insured simultaneously. Whereas losses resulting from viruses or malware, data breaches or interruptions of IT services, e.g. for cloud service providers, can largely be insured with good accumulation control, breakdowns in critical infrastructure and above all losses from cyber war, are uncontrollable, systemic risks, that must be excluded from coverage. In an effort to improve clarity and transparency, there are currently several reformulated cyber war exclusion clauses on the market. In terms of its own portfolio, Munich Re’s aim is to add adequate cyber war exclusion clauses to original policies. Thus, it offers primary insurers support with the appropriate modifications to the wordings

Germany: Focus on sound risk management

In its home market, Munich Re offers reliable capacity at adequate prices, both for its core business in property-casualty reinsurance and for much sought-after cyber coverage. Munich Re continues to invest in its technical and digital expertise, while also offering its cedants a partner for risk sharing. Claudia Hasse: “In the renewal talks, my goal is to translate our risk expertise into concrete protection with added value for the client in question. I can only grant cover if the calculated prices, terms, and conditions are sound.” On this basis, this year Munich Re can once again provide offers early on, affording its clients more planning certainty.

Munich Re supports its clients on the German insurance market with the expertise and capacity needed to meet market-specific challenges:

- Both the frequency and severity of natural catastrophes are on the rise, also in Germany. Differing both regionally and in terms of the perils covered, insurance coverage shows room for improvement. No matter the outcome of the public debate on compulsory insurance, Munich Re is prepared to allocate additional capacities. However, this is contingent on both technically adequate prices and acceptance of the fact that prevention and mitigation of the perils worsened by climate change must take on a new prominence for all parties concerned.

- Given that, in the short term, inflation will remain high in Germany, insurers must suitably reflect both general and specific price increases in their loss estimates.

- This is especially true for motor insurance in Germany, the largest line of business and a highly competitive one, characterised by high combined ratios.

- To reverse the trend in commercial industrial fire insurance and make it a cycle- independent, sustainable line of business, all market players will have to do their part.

- Volatility is on the rise for insurers, and they must carry more risk in their own books. Munich Re is developing tailored solutions for capital relief to support clients.

Digitalisation offers opportunities

The societal trend towards digitalisation, while posing challenges for insurers, also offers new opportunities. Munich Re supports its clients from product development to the qualitative optimisation of their portfolios, to sales.

Two examples: The data-driven analytics service ImRiSc identifies critical risks in connection with water leaks and systematically reveals the root causes, enabling insured parties to take targeted countermeasures that help reduce losses for insurers.

In turn, the digital platform REALYTIX ZERO allows clients to directly, digitally configure new and existing insurance products. The cloud-based solution requires no programming on the part of cedants and has already begun saving them time and money.

In future, an AI-based co-pilot will implement users’ written instructions, making product design and modification even faster and easier.