By: Kyle Wales is a portfolio manager at Flagship Asset Management

A higher-for-longer investment narrative has been behind a steep decline in equity markets globally, with concerns that if interest rates stay higher than expected for an extended period, companies, and thus equity markets, will come under significant pressure. But, as with every cycle, there will be the winners and we pinpoint those we expect to benefit from what could be our “new normal” in the years ahead.

For most individuals and companies, higher short-term interest rates are a bad thing. At a very basic level, increases in central bank official interest rates (called the repo rate in South Africa) are designed to slow the economy down.

However, this is a cyclical phenomenon. Even if the SA Reserve Bank (SARB) is rigorous in sticking to its inflation target of 3% to 6%, there will always be periods where inflation overshoots and interest rates need to rise to bring inflation under control again.

Markets are forecasting a structural increase in interest rates

Unfortunately, the current rise in interest rates looks increasingly like it is not contained to the short-term. Year to date, in South Africa long-term interest rates (or the cost at which the South African government borrows money for 30 years or longer) have also begun to rise.

During the first week of October, this yield had increased from 11.4% to 13%. A similar situation unfolded in the US, Europe, and the UK. In the US, yields increased from 4% to 4.9% – a 15-year high. This means the market is beginning to price in the possibility of higher structural interest rates either based on the belief that inflation is set to remain higher for longer than expected, financial markets perceiving sovereign (country) riskiness as having increased, or a mixture of both.

If structurally higher interest rates are with us for a while and we know that this creates a climate that doesn’t favour most companies, where can equity investors find refuge from potential declines? Are there companies that not only tread water but do well when interest rates rise? Fortunately, the answer to this question is yes but also in this grouping of shares there are even some ideal investment candidates because their share prices don’t reflect their rosy prospects.

Your Efficient (Re) Insurance Broker

FACULTATIVE REINSURANCE

TREATY REINSURANCE

A high interest rate environment favours financials

A good place to start when looking for companies that are likely to withstand, or even benefit from, a structurally higher interest rate environment is amongst banks and insurers. For banks, higher interest rates can either be a blessing or a curse. When interest rates are high, they may experience credit losses if borrowers run into trouble. However, if they have lent prudently and put sufficient money aside (in the form of provisions), they can actually benefit from higher interest rates because of the “endowment effect”. This refers to the fact that when interest rates go up banks earn more interest on their assets (for example, mortgage holders have to pay more on their mortgages because they are linked to the prime rate – currently 11.75% in South Africa) while there isn’t a lock-step increase in the interest expense they pay on their liabilities (for example, you still earn little to no interest on your current account).

Insurers, on the other hand, are clear beneficiaries as they don’t have to worry about increases in credit losses. Short-term (property and casualty) insurers typically earn revenue from two sources firstly from their underwriting margin (calculated as the premiums they collect minus their claims and expenses) and secondly from the financial income they earn on their float, the money accrued from premiums that has yet to be paid out in claims. The higher the interest rate, the more interest the insurer earns on this pot of money.

Another type of insurer that benefits is an annuity provider. A fixed annuity (not to be confused with a retirement annuity) is a financial product where you receive a fixed regular income for the rest of your life in exchange for an upfront premium (typically you exchange your pension pot for a fixed annuity).

In essence, you pass the risk of running out of money before you die onto the insurer. The size of that regular income stream depends on the yield your pension pot generates when it is paid over to the insurer. When 30-year government bond yields in the US were 1%, you would need a very large pension pot to earn a sufficiently sized regular income. At current interest rates, annuities are beginning to look far more attractive resulting in an increase in new business volumes for annuity underwriters.

You can gain exposure to this theme through Pension Corporation, which is Reinet’s largest asset, accounting for 50% of its net asset value (NAV). However, a purer way to gain exposure is through Legal and General, which has the added benefit that you don’t have to pay a base management fee of 1% of assets under management (AUM) per year before performance fees.

Highly levered companies may see their debt inflated away

Another place to look for potential beneficiaries are companies with resilient revenue streams and large amounts of debt at fixed interest rates. These companies are beneficiaries of high inflation (which is often the cause of high interest rates) because it inflates away their debt. An example of this is AB Inbev. AB Inbev’s net debt to EBITDA peaked at 6.6X when they acquired SAB Miller but 95% of this debt is at a fixed rate, with a weighted average maturity of 15 years. We believe this stock offers compelling value at 16X forward earnings.

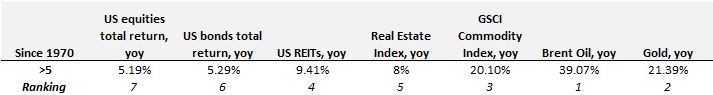

Commodities also perform well in a high inflation and interest rate environment

Finally, there are commodity companies, which are not beneficiaries of high interest rates per se, but they are beneficiaries of high inflation, which is often the cause of high interest rates. A UBS report showed how different asset classes behaved when developed world inflation exceeded 5% and found that the top three performers were oil, gold and other commodities, in that order.

Source: Bernstein

While high interest rates are not an ideal outcome for the broader economy and the stock markets, and a source of stress for many, investors should not lose sight of the fact that every economic climate provides opportunities and the resultant financial market conditions offer potential winners for those who dig deeper.