The Two-Pot Retirement System necessitates a recalibration of business models for financial advisers, and by adapting advice strategies to accommodate the new structure’s implications, advisers can provide effective guidance to their customers.

Lizl Budhram, Head of Advice at Personal Finance, says that with the Two-Pot Retirement System’s imminent implementation, South African financial advisers must prepare for a profound paradigm shift with significant implications for them and their customers.

“Vigilance regarding official updates and regulatory guidelines will empower advisers to offer informed advice. Equipped with comprehensive knowledge, advisers are poised to guide their customers effectively through this transformative phase, safeguarding the long-term success of their retirement plans,” says Budhram.

Under this system, starting on 1 March 2024, every rand contributed to retirement funds after 1 March 2024 will be split between the “savings pot” and the “retirement pot”. The savings pot is earmarked for their lump-sum withdrawal upon retirement and may be accessed earlier if necessary. The remaining two-thirds nestle into the retirement pot, inaccessible and reserved to ensure a steady income during the golden years.

Budhram said the changes for advisers meant an increasing significance of strategic customer management in navigating impending changes. The first was understanding the tax implications of withdrawals from the savings pot before retirement.

“Advisers must ensure customers grasp the tax consequences of withdrawals, as it can profoundly affect their financial future. Sound decision-making regarding early withdrawals is crucial for securing a stable retirement. Each withdrawal will be considered taxable income for the corresponding tax year, subject to taxation at the applicable marginal rate, potentially impacting their retirement savings,” she said.

Despite the impending reforms, the tax deductibility of contributions remains unchanged under the Two-Pot Retirement System. Customers can continue benefitting from tax deductions on their contributions, offering consistency in an evolving landscape.

Budhram noted that the Two-Pot Retirement System will not disrupt their ability to preserve and maintain member fund balances using inter-fund transfers as per Section 14 of the Pension Funds Act. It would continue to enable employees to transfer their accumulated retirement savings seamlessly without incurring any tax penalties or losing the tax benefits associated with their retirement funds.

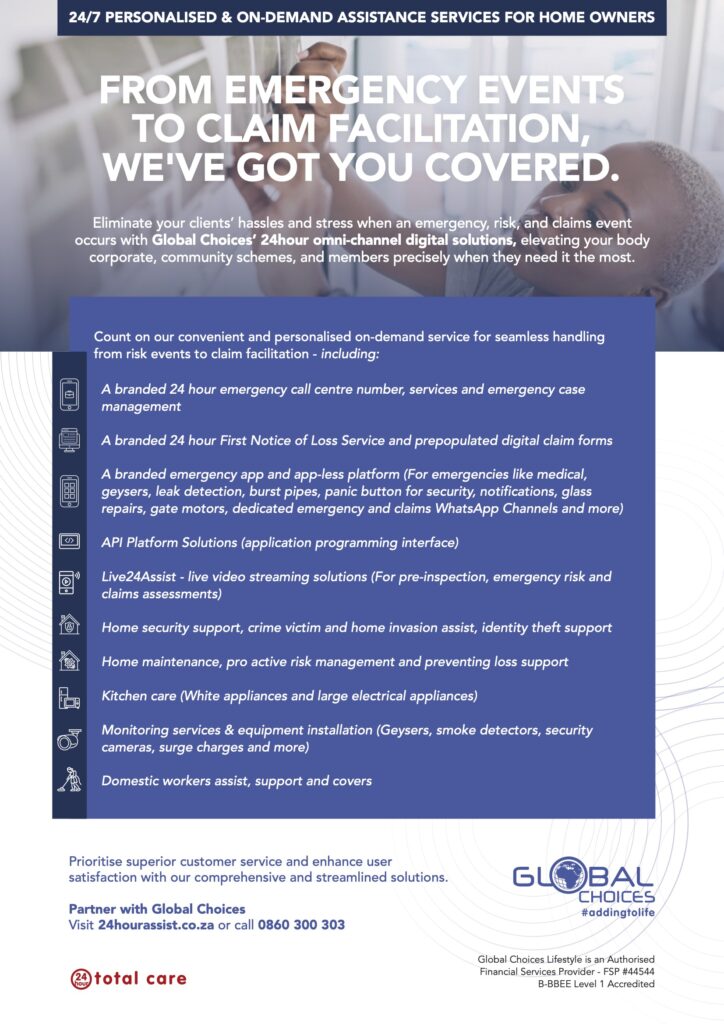

FROM EMERGENCY EVENTS TO CLAIM FACILITATION, WE’VE GOT YOU COVERED.

Eliminate your clients’ hassles and stress when an emergency, risk, and claims event occurs with Global Choices’ 24hour omni-channel digital solutions, elevating your body corporate, community schemes, and members precisely when they need it the most.

Prioritise superior your customer service and enhance user satisfaction with our comprehensive and streamlined solutions.

Global Choices Lifestyle is an

AuthorisedFinancial Services Provider – FSP #44544

She emphasised the importance of financial advisers mastering the changes.

“It is essential to underscore that the system will not inherently alter an individual’s risk profile. Investment recommendations will continue to be tailored to each customer’s unique circumstances and long-term financial goals. The mission of long-term retirement funding remains central, and financial advisers are critical to getting the best outcomes,” she said.

Regarding vested rights, Budhram clarifies that the Two-Pot Retirement System is designed to protect members’ existing rights, safeguarding their retirement benefits for the long term. Advisers must note that all contributions and savings before the effective day (1 March 2024) will continue to be subject to the current rules governing pension funds.

“The one important technical exception to note is that members of provident funds over 55 as of 1 March 2021 were ringfenced and given vested rights to their benefit when the new annuitisation rule changes were implemented on 1 March 2021,” said Budhram.

“According to the current proposals, they can continue contributing to their vested provident fund pot as they have been (i.e., elect to be excluded from the two-pot rules). Alternatively, they can opt to move into the new Two-Pot Retirement System. It will be critical for financial advisers to speak to these members to ensure they fully understand the choice they will be given.”

Budhram noted that the Two-Pot Retirement System will provide a new structure for future contributions for those close to retirement and some new options at their retirement date. She said this would require financial advisers to reassess their retirement strategies, considering the accessibility of the savings pot.

“The Two-Pot Retirement System heralds a transformative era for South Africa’s retirement fund industry. Armed with insights, financial advisers should be ready to embrace the challenges it presents. They will be pivotal in ensuring financial security and better retirement outcomes,” Budhram concluded.