A KEY FOCUS IN THIS EDITION OF COVER, IS THE GROWING RISK IN THE CYBER ENVIRONMENT

Several contributors are sounding the alarm, warning that the risk is much bigger than most businesses anticipate. I believe that the main reason for this stride mentality from the business environment and the insurance industry, is the fragmented manifestation of the risk and claims.

When looking at this through the riot risk and life/critical illness claims lenses, one can draw parallels. SASRIA was easily able to manage the huge uptick in social unrest related claims. In fact, many commentators were saying that they are sitting on a far too big piggybank. Until the July 2021 riots, when it hit on a massive scale. So big in fact, that SASRIA not only had to be bailed out, but they had to rethink their model and limits of cover.

The COVID pandemic saw the same results. Here we saw a health related event become a massive business insurance threat, with billions being paid out in business interruption related claims. It would be easy to see an epidemic or even a pandemic as a health and life insurance issue, missing the wider fallout.

As for cyber risks, these alarm calls should be heeded and the potential for a national or even global cyber pandemic should be a collective agenda. We cannot simply keep trying to make the defences bigger (residents building higher walls), we need to tackle the issue on a grand, collective scale.

MAIN STORIES

CLAIMS DENIED? UNDERSTANDING & OVERCOMING REPUDIATION IN EMPLOYEE BENEFITS

Shameer outlines the whole truth behind repudiation in employee benefits, arming employees with the knowledge to safeguard their loved ones.

CYBER RISK EXPOSURES IN THE FINANCIAL SERVICES SECTOR

There are approximately17 to 20 known or identified types of cyber crime and, since the pandemic, there has been an estimated 600% increase in the number of cyber attacks across the globe.

INSURERS BLACKLISTING AREAS DUE TO CLIMATE IMPACT

South Africa can glean valuable lessons from the critical situation unfolding in the USA where insurers are blacklisting areas due to climate impact.

FIVE USES OF GENERATIVE AI TO ENHANCE CUSTOMER SERVICE IN FINANCE

Now, with generative AI breaking into the mainstream, many financial institutions are examining where they can put this innovation to work.

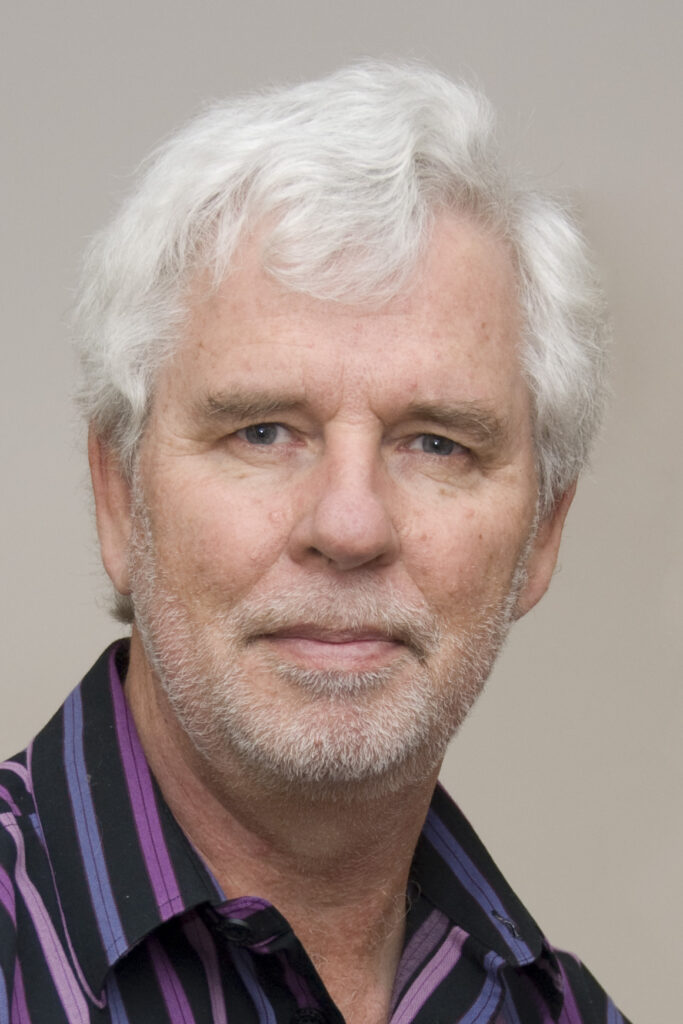

Enjoy the read.

View the flipbook version:

Great news for all Brokers!

WITH EVEN GREATER MUSCLE NOW,

RENASA WILL BE ABLE TO REACH A LOT MORE

BROKERS!

RENASA – THE BROKERS even better BEST FRIEND

Renasa Insurance Company Limited is an Authorised Financial Services Provider (FSP License 15491) and is licensed to conduct non-life insurance business (License No IN0140 )