By: Marius Steyn, Personal Lines Underwriting Manager at Santam

South African households imported over R2.2 billion worth of solar photovoltaic (PV) panels within the first five months of 2022. These statistics from a local solar provider demonstrate the upward trajectory is expected to continue amid South Africa’s ongoing energy crisis.

With the cost of power surge-related claims being exorbitant Santam supports the shift to renewable energy among homeowners, but it is important to understand that with the investment in solar power systems comes new risks.

Solar power systems are fixed to a property – they form part of a client’s homeowner’s building– insurance cover

Brokers should revisit clients who have upgraded their properties with a solar system to ensure they increase their building insurance sum insured, to cover the cost of the solar assets installed and avoid being underinsured in the event of a claim.

“The value of your buildings includes fixtures and fittings in or on the residential structures – this includes solar power systems. It is of utmost importance to ensure that the insured amount of the building is a true reflection of the current replacement value of a home and all other structures on the premises.

When a solar power system is installed, it influences the value of the building and therefore the building sum insured should be increased to accommodate the value of the investment in the solar power system. If the insured value of the building is not equal to the current replacement value, underinsurance (principle of average) could be applicable in the event of a claim and the claim will not be paid in full.

Adequate building insurance is essential to protect homeowners against total loss in the case of a fire, severe weather including lightning or thunderbolts, wind, storm, hail, fallen trees, and disasters like earthquakes. Aerial devices such as drones and other falling objects can also cause damage to solar panels. Building insurance will also provide cover if a property is maliciously damaged or damaged due to burglary or theft. To enjoy full accidental damage cover, optional cover like accidental damage to fixed machinery can be taken at an additional premium.

It’s important for clients to do their homework and hire a reputable installer

To avoid risks such as fire and explosion brought on by sub-standard or non-compliant installation, they should do their due diligence. Insurers generally do not cover damages resulting from implementation flaws or poor workmanship.

Damage caused to the roof as a result of the installation is excluded in general. Furthermore, loss or damage caused by demolition, alteration, construction, cleaning, renovation, repairs, restoration, or similar processes are generally excluded under the buildings section of a policy.

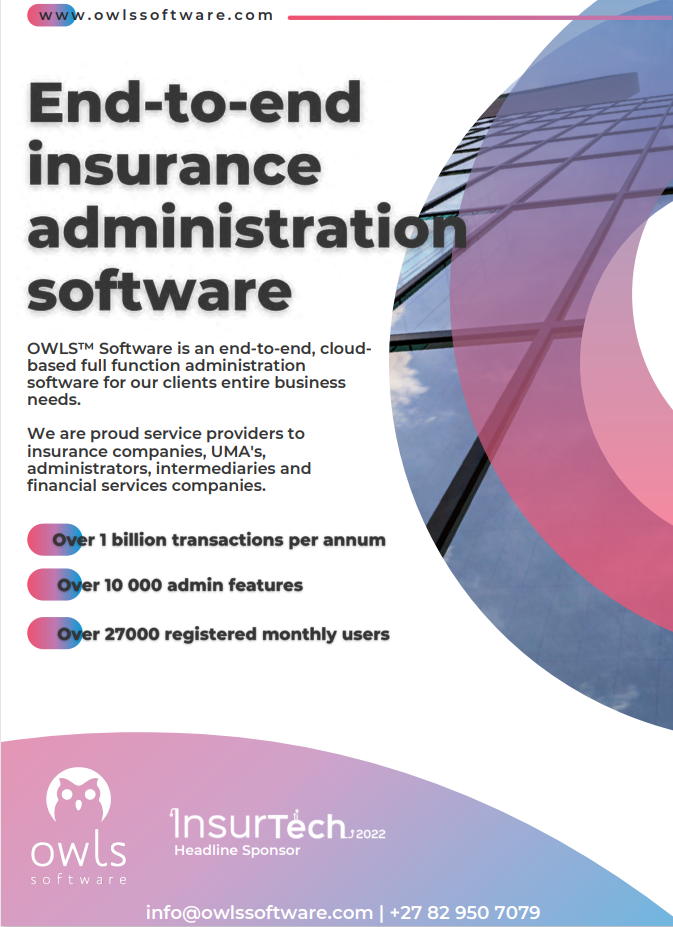

OWLS™ Insurance Software

Proud providers to insurance companies, UMA’s,

administrators, intermediaries and financial services companies.

Identifying a reputable installer

Santam advises clients to look for credentials such as references of previous work and how long the business has been in operation. A reputable installer should provide a comprehensive quote detailing the scope of work, components that will be used in the installation as well as, importantly, after-sales services, warranties and guarantees.

The installer should also advise clients of any potential issues that may compromise the installation and functioning of the solar power system prior to commencing the installation. If a building is damaged during the installation process, this should be covered by the installer under their Contractors All Risk Insurance policy. Pre-installation inspection is crucial to ascertain that the building’s roof structure and rafters is not compromised, rotten or damaged so that the solar panel installation can still be carried out.

It’s essential to obtain a certificate of compliance (CoC) when installing solar power generating systems as this is required by law and for the registration of the solar power generating system with the relevant municipality. This is something that any reputable installer will automatically provide.

A solar power generating system installation is a valuable asset to any home and should be treated as such by conducting a thorough due diligence on the installer and by updating insurance to protect the client’s value-adding (and cost-saving) asset.