By Gail Bosch, ArtInsure Product Head

When it comes to insurance, high-net-worth individuals have unique needs, as well as unique assets that they want to be protected, which means that they often form lasting relationships with their insurers based on loyalty, trust and confidentiality.

Unlike the average South African insurance client who is looking to be put back to the position they were in before an event occurred, the high net worth insurance client is protecting an investment. At the same time, there is also an element of the irreplaceability of the investment that is insured, so these clients require dedicated experts who can restore a unique and priceless item once it has been damaged.

According to data from the 2023 Knight Frank Wealth Index, high-net-worth individuals are most likely to invest in art, which saw a 29% increase in price over the past year, followed by classic cars (25% increase) and watches (18% increase), right down to diamonds (4% increase) and rare bottles of whiskey (3% increase). The index tracks the value of 10 investments of passion across the globe.

The quite staggering sums of money paid for investments of passion over the past 12 months highlight just how important these collections are to high-net-worth individuals and how resilient many of these asset classes are to economic and geopolitical events.

In South Africa, survey respondents indicated that there is an appetite to purchase investments of passion in 2023, with 50% of investors likely to purchase classic cars, compared to 34% globally.

Followed by a 45% likelihood in jewellery, 36% in art and 32% in watches and furniture, the Wealth Index reveals.

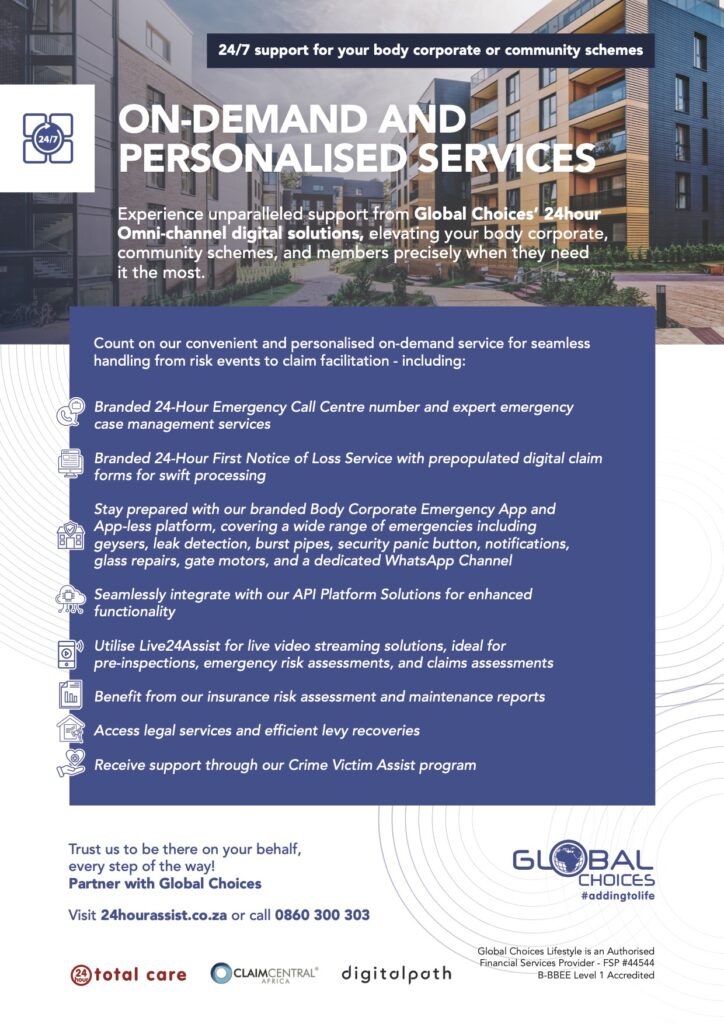

GLOBAL CHOICE’S 24HR

OMNI-CHANNEL DIGITAL

SOLUTIONS FOR BROKERS.

Experience unparalleled support from Global Choices’ 24hour Omni-channel digital solutions, elevating your body corporate, community schemes, and members precisely when they need

it the most.

Trust us to be there on your behalf, every step of the way!

Partner with Global Choices.

Global Choices Lifestyle is an

AuthorisedFinancial Services Provider – FSP #44544

This shows that the global art market is doing extremely well, and there is also still a huge appetite for collectibles not only overseas, but also in South Africa. These investments of passion must be specifically insured because the items themselves are the differentiators, as they continue to appreciate in value and thus need specialised cover.

The fact that the global investments of the passion market hit the fourth largest all-time high, at $16.5 billion (R315 billion), last year is evidence that high-net-worth individuals still have a significant appetite for investment, even in tough economic times.

This also sets them apart from the average insurance client who is likely to cancel their insurance policy during difficult times and hope that no unfortunate events will befall them. Wealthy insurance clients, on the other hand, understand that insurance not only protects their assets, but also an investment that grows over time.

Thus, high-net-worth individuals’ interest in ensuring that their collectible items are insured is not necessarily determined by market conditions. Instead, they value forging long-lasting relationships with specialist insurance companies that have a team of dedicated experts who can restore, clean, transport, store and evaluate an item when required.

Unlike standard content insurance policies – for both companies and individuals – that insure items for replacement value, collectibles are often once-off and unique items that cannot be replaced if damaged or destroyed. These items are insured for agreed value and to arrive at a figure, a specialist insurer will make use of the services of experts.

Hence the relationship between high-net value individuals often becomes something akin to partnerships. Specialist insurers understand that trust has to be built with the client, and the client not only needs to trust the insurance provider but also its team of experts.

High net worth individuals are demanding as clients as they expect expert assistance and are typically very sensitive to loyalty and bad service. Ultimately, a successful relationship between an insurer and a wealthy client needs to be underpinned by confidentiality, trust and expertise.