Emerging commercial liability trends

Research summary March 2023 – The Geneva Association (Full report here)

By: Darren Pain, Director Cyber and Evolving Liability, The Geneva Association

Societies are complex and economic and technological development, as well as changes in prevailing social customs and institutional structures, continue to add to that complexity. Outsourcing and interdependent supply chains, for instance, increase interconnectivity while new digital technologies provide unprecedented access to information and globalise potential problems. As a result, the ways in which individuals, companies and other legal entities may cause harm to third parties is expanding and, with it, the potential to be held liable to compensate victims.

Drivers of commercial liability

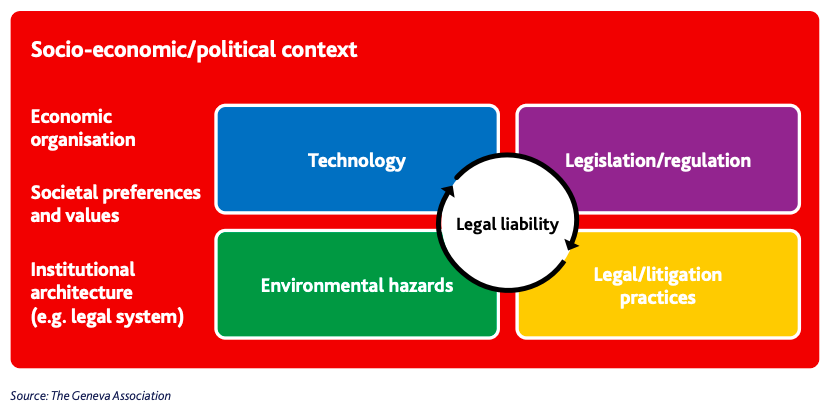

Broadly, corporate liability risk exposure can be traced to one or more of five underlying drivers:

- Socio-economic/political context. Developments in the way economic activity is organised and how individuals/firms behave or interact will influence the type and scale of harm or damage that can occur as well as societal attitudes to risk bearing. For example, past periods of industrialisation, electrification, urbanisation and, more recently, digitalisation all shape the commercial risk environment and potential liabilities firms may incur.

- Technology. New materials, techniques or methods open up new ways of producing, working and communicating, yet they may not work as intended and/or have unexpected damaging side effects. For example, the use of a new medical device or procedure could create unforeseen bodily injuries to patients.

- Environmental hazards. Private actions that threaten the surrounding natural environment or adversely affect peoples’ health can create liability and a corresponding claim for compensation. Industrial pollution is a classic example, giving rise either to temporary, localised harm or contributing to secular adverse shifts such as climate change and biodiversity loss.

- Legal/litigation practices. The pursuit of claims and the success of victims in establishing liability will depend on the types of cases litigated and any associated extension in the scope of legal doctrines (e.g. negligence under tort law) and practices that support the cause of action. For instance, a plaintiff may bring lawsuits under novel legal theories, or procedural mechanisms may develop that allow combined legal actions by a group of claimants, which can strengthen the chances of a successful claim.

- Legislation/regulation. Legislatures codify individual rights and legal obligations in statutes or regulations and impose sanctions against those who breach the rules. Statutory and regulatory infringements may give rise not only to enforcement actions but could also form the basis of civil (and criminal) lawsuits. Examples include claims under consumer protection legislation, against issuers of securities who may have misled investors or claims based on breaches of directors’ duties under company law.

You know your industry best.

Choose an insurance partner that does too.

Insure your business with Bryte. Visit bryteinsure/co.za or contact your broker.

Bryte Insurance Company Limited is a licensed insurer and an authorised FSP (17703)

These drivers are not independent but interact. Socio- economic/political conditions often set the backdrop to the adoption of technological innovations as well as shifts in business activities that impact the natural environment and/or human habitats. To the extent that those developments harm others in society, this may create an obligation on individuals or firms who are responsible to compensate victims, or at least curtail the activity. However, legal liability will only attach if some law or regulation has been broken and/or a cause of action can otherwise be established against the culprit – for example, a claim for negligence or nuisance.

By the same token, laws and regulations are not static. New legislation is passed, novel cases are litigated and legal accountability determined through judicial adjudication. Ultimately, the law changes over time to reflect societal preferences over what is perceived as fair, who is best placed to absorb risk and who should be accountable for harm or damage caused to others.

FIGURE 1: UNDERLYING DRIVERS OF LIABILITY

Role and types of liability insurance

Liability insurance typically provides protection against claims resulting from injuries and damage to third parties and their property/assets. Such policies help ensure that innocent victims are appropriately compensated, regardless of the financial well-being of the insured. Furthermore, well-designed terms and conditions in insurance contracts incentivise policyholders to take steps to reduce the risk of harm or injuries. For instance, increasing premiums, reducing limits of liability, restricting coverage terms or refusing to underwrite certain risks altogether, ensure policyholders face some of the potential liability costs, which may encourage them to take preventive actions.

Although definitions vary across countries and insurers, commercial liability insurance can broadly be distinguished between casualty and management/professional lines. Casualty policies protect against liability for physical damage to other people’s property or bodily/psychological injuries arising from regular business activities or the use of a product. Management/professional liability policies cover third-party claims for financial losses and include policies such as Directors and Officers (D&O) and Errors and Omissions (E&O) insurance.

A survey of re/insurers

To shine more light on some of the current uncertainties affecting future commercial liabilities over the medium to long term, The Geneva Association surveyed its member firms. The survey provides a unique, collective perspective from the insurance sector and, compared with other surveys about emerging corporate risks, focuses specifically on firms’ potential liability exposures and the fallout for their insurers. While other surveys concentrate on particular areas such as D&O,1 ours focuses on the full range of liability insurance – both casualty and managerial/ professional lines – providing a more complete take on the contours of the commercial liability risk landscape.

In terms of their relative importance for future commercial liability, each of the five drivers outlined above were all ranked highly by at least some survey respondents. Legal/litigation practices appear to be the top influence, with close to 40% of respondents ranking this the highest. This chimes with recent re/insurer worries about a re-emergence of social inflation in the U.S. and its potential to spread to other countries. Social inflation is often linked (in part at least) to developments in litigation practices and legal doctrines that shape and ultimately impact insurers’ liability claims costs.(2)

Source

1 For example, WillisTowersWatson publishes an annual Directors’ Liability Survey Report. See WillisTowersWatson 2022.

2 For a fuller discussion of recent social inflation trends, see The Geneva Association 2020. Author: Darren Pain.

FOREWARNED IS FOREARMED: Emerging commercial liability trends

Research summary March 2023 – The Geneva Association (Full report here)