Andrew Williams, Investment Director – Equity Value, Schroders

The consumer sector looks ripe for the picking of value investors. We prefer stocks with stronger balance sheets that can be sustained in potentially tougher times ahead.

At this point last year, we wrote that the areas of the stock market where investors were most pessimistic were oil and gas, mining, and banking shares. During 2022 each of those sectors had a good year, although for reasons none of us would have been able to predict. We simply based our view on which sectors were most out of favour, which were cheapest, and therefore set to benefit the most if there was any alleviation of the negative headwinds those stocks had been facing. Last year, that worked out pretty well.

The most anticipated recession ever

Today, the most vexing issue for investors is the forthcoming consumer recession. It is rare for economists to forecast recessions; famously the Bank of England has never forecast a recession – until now. Today, however, forecasters in the US are as sure as they’ve ever been. A recession is coming.

Source: Federal Reserve Bank of Philadelphia, Haver Analytics, Apollo Chief Economist

A ‘cost of living’ crisis is affecting people around the globe already; higher food and energy prices coupled with increased debt servicing costs is providing an inevitable squeeze on consumers. That much we know. What we don’t know, is what we don’t know. Surprising things may happen to make things better. Surprising things may happen to make things worse. Those ‘unknown unknowns’ are what make forecasting difficult.

The consumer sector is very unloved

Stock markets, of course, are forward looking. Share prices don’t wait for recessions to be announced before going down, nor wait for positive GDP figures to be announced before going up. The stock market has been particularly ruthless over the past year in marking down the share prices of consumer-related stocks in anticipation of tough times ahead.

This makes them particularly attractive to us as value investors because, as you know, our hunting ground is those areas of the market that are most out of favour, where people are most pessimistic, and where valuations are lowest.

We are not oblivious to the likely difficulties this sector may face. However, we choose to focus our energies on stocks where balance sheets are strong and can be sustained in potentially tougher times ahead. We tend to avoid companies where balance sheets are stretched, or where liquidity is low.

OWLS™ Insurance Software

Proud providers to insurance companies, UMA’s,

administrators, intermediaries and financial services companies.

Our experience has taught us that financial leverage magnifies all the underlying risks within the business, and one needs to be very cautious about mixing cyclical risk with balance sheet weakness in particular.

While there are almost inevitably difficult times ahead, we’d like to highlight two bits of good news. The first is that that valuation spreads remain elevated. Although not as wide as they were coming into 2022, the gap remains sufficient to provide a strong tail wind for valuation-based investors over the coming years. We need to recognise that the tailwind may not blow in 2023 itself, but over the next three to five years, the outlook for valuation-based investors from a relative perspective is a strong one.

Value is still on sale on a relative basis…

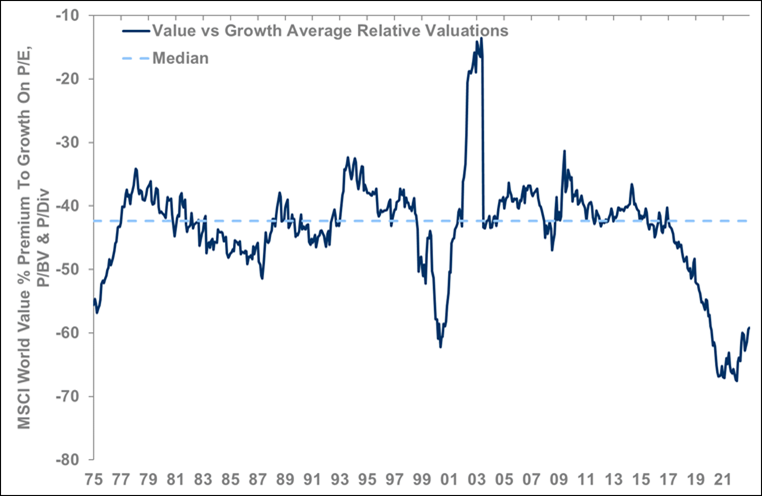

Value’s median discount to growth has been 42% since 1975. You can see that whenever the discount moves significantly above or below this level (dotted blue line), mean reversion kicks in to bring it back to this long run median.

Despite value’s recent strong run of performance, it still trades at a c.60% discount to growth, and far below the long-term median. Whichever region you pick the story is the same: in the UK, Europe, emerging markets or globally, value is still on sale.

There is only one precedent for today’s level of valuation dispersion: the post dotcom era. Proponents of the value style will hope mean reversion will continue to offer a powerful tailwind for its continued outperformance.

Of course, this argument is built on relative valuations. While the low relative valuations and the potential relative outperformance is welcomed, it is absolute performance that grows capital.

… and on an absolute basis too

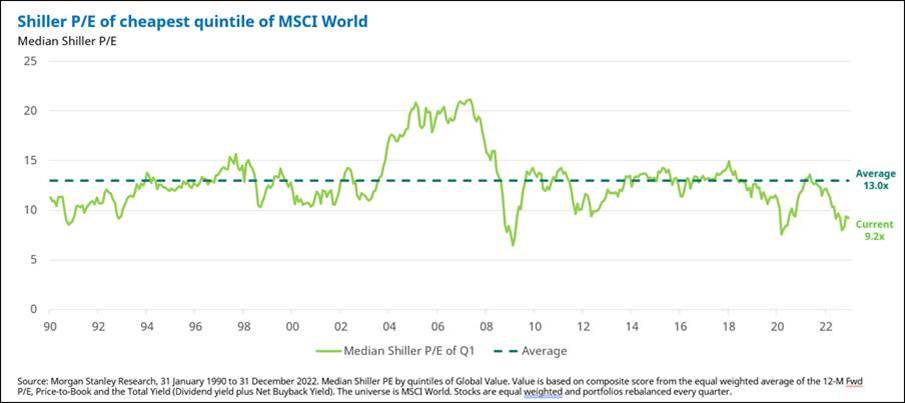

Absolute valuations remain extremely compelling. The cheapest quintile of the global equity market is trading 25% below its long-term average. Low absolute valuations give us confidence in for long-term prospective returns for the cheapest part of the market.

Patience is a virtue

The second thing to focus on is the remarkable opportunities there are for long term patient investors. For those of us willing (or able) to take a three- to five-year investment horizon there are significant numbers of stocks which screen as attractive, in diverse sectors, across the global equity market. This offers the opportunity (but not guarantee) for strong absolute returns in the coming years.