Anet Ahern, CEO at PSG Asset Management

2022 sparked unprecedented soul-searching within the investment community. Arguably, investment managers are used to market gyrations. After all, stock markets are expected to correct from time to time.

What triggered the introspection this time around, however, was not market volatility per se, but rather a breakdown in one of the global asset management industry’s most hallowed tools: the 60:40 (equity : bonds) portfolio. The introduction of Markowitz’s modern portfolio theory revolutionised the asset management industry in the mid-1900’s and brought with it the belief that we could trade off risk and return to reach an optimal portfolio allocation.

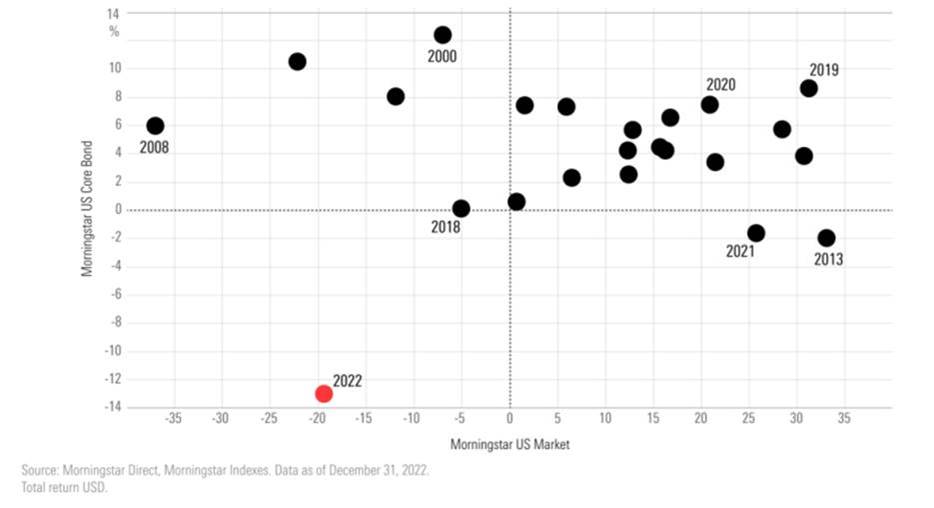

At the heart of this, has been a reliance on the long-term pattern of negative correlation between stocks and bonds. For over 70 years, it has been common wisdom in the investment community, and the formula has proven itself indispensable in smoothing the investor’s ride many times in the past. As if the preceding years were not stressful enough, 2022 was one of the few years on record when a 60:40 portfolio failed to deliver on its promise of reduced risk as advertised.

With a (very) few exceptions, the negative correlation between bonds and equities have served investors well. The extent of the downturn, especially in the earlier half of 2022, surprised many. While there had been some speculation that the bull-run in equities was overdone (and an equity market correction should not be surprising), the sharp fall in the bond market delivered an unexpected double-whammy to investors. Instead of bonds offsetting equity losses, rather, they contributed to negative overall portfolio returns. And not just a drop relative to what was expected, but the worst in over 100 years.

U.S. Stock and Bond Performance Since 2000

In the wake of the market turmoil, many have been asking whether the 60:40 portfolio has outlived its usefulness. Have the market correlations we have come to rely on, ceased to exist and should we reconsider the relevance of this well-worn portfolio construction stalwart?

Correlations by their nature, apply in the long term. Datasets over many, many decades have been studied and we believe they reveal something fundamental about the nature of investors, and how markets work. It is a human truth that you will require a return or reward before parting with the money in your pocket. In this sense, we cannot abstract investment from an understanding of risk and reward.

CPD FOR YOU.

Supporting personal & professional growth.

Our Continuous Professional Development (CPD) Hub enables financial services providers to effortlessly fulfil their CPD requirements by completing online training courses in the specific applications of telematics and vehicle recovery.

But does a long-term correlation apply in the market on any specific day? That is a different question entirely.

At their most basic level, correlations are driven by how the market values securities under different conditions. Under normal conditions, a market that is bad for equities will tend to be good for bonds, and vice versa, driving the long-term inverse correlation between bonds and equities and laying the foundation for the 60:40 portfolio. And underpinning the market behaviour of stocks and bonds are market dynamics around inflation and interest rates. This much is basic theory.

However, what people tend to lose sight of, is that over the past decade and more, our financial markets have been manipulated to an extraordinary extent. In a world of ‘easy money’, interest rates were not only kept artificially low, but developed market governments also flooded the financial system with liquidity through quantitative easing programmes. It resulted in artificially low bond yields, and at the same time caused a sharp run-up in the prices of risk assets that promised higher returns. The more speculative the asset, it seemed, the more prices were inflated (think crypto and special purpose acquisition companies – SPACs – as examples).

Given that both bond and equity markets shared a common driver for their return behaviour over the past decade or more, it should not come as a surprise that when uncontrolled inflation and rising interest rates started to undo the ‘easy money’ bubble, both markets would be impacted at the same time. And so, on the face of it, long-term correlations break down.

Could investors have seen this coming? We think so. Valuations at extreme levels have been signalling that all is not well in markets for some time. Market cycles became preternaturally elongated while indices became ever more concentrated. Focusing on the price paid for an investment is central to our 3M investment philosophy, as we believe overpaying for assets handicaps the return investors can expect in the long run. As such, we have avoided over-hyped segments of the market for some time. However, our research shows that many funds are still positioned for the sectors that worked well in the past, even as the drivers of market returns have changed significantly. We do not believe, however, that the sectors of the market that fared well during the easy money era will be the ones to do well in a more cash-constrained environment. We do think the market experience going forward will mirror that of the last ten years.

Does all of this mean that investors should abandon the 60:40 portfolio? We don’t believe so. Within a long timeframe, the fundamental truths of the market are sure to reassert themselves. But we do believe 2022 made a strong case for why investors need differentiated thinkers as part of their portfolios. Even members of the professional investment community become caught up in the powerful narrative of the times.

It takes faithful adherence to a tried-and-tested investment philosophy, detailed research and robust debate to see the bigger picture emerging beyond the short-term noise and to question both common wisdom and long-held beliefs, placing the price paid above well-worn patterns. 2022 provides a cautionary tale of the importance of valuations, and reminds us that in investments, the price always matters.