By Garth Napier, MD Old Mutual Insure

Non-life insurance industry facing headwinds, but not all doom and gloom

Coming off the back of a challenging year in 2021, which saw the industry respond to the fall-out from an unstable grid, mass riots and looting, and weather-related losses, this year the hope for economic recovery has remained subdued.

Many of the dominant themes experienced this year are likely to continue creating a challenging environment for the non-life insurance landscape in 2023. But as with many e12t merging risks, there is also opportunity.

Climate change

One of the most significant risks to emerge in the insurance industry is the impact of climate change.

There has been an increase in both frequency and severity of natural disasters globally, and in South Africa. In the last three years, catastrophic events in the USA alone have risen to nearly 19, with the costs exceeding $102 billion. Back home, the severity of weather-related events has risen 10-fold over the last decade, while the frequency of large catastrophe (CAT) claims increased from 6 to 36 per decade since 1982.

Our data and research show that the average annual CAT claims in the last 10 years between 2012 and 2022 are ten times higher than they were between 2000 and 2011.

The insurance and reinsurance markets have said that the recent Kwa-Zulu Natal flood disaster was the single biggest CAT event in history. We predict that CAT claims will continue to increase in volatility resulting in an increase in the cost of reinsurance. We estimate that reinsurance claims have exceeded R80bn in SA over the last three years. We expect that reinsurers will have a reduced appetite to fund these events going forward. This will need to be balanced with the important responsibility that non-life insurers have of lessening the disastrous impact of climate change on society.

We are navigating a prolonged period of hyperinflation, and while our hope is that it will stabilise, it is likely to persist well into 2023. It will continue to significantly impact our industry, and consumers are likely to remain under pressure.

Inflationary pressures

Following the disruptive lockdowns of the past two years, global supply chains have struggled to normalise. The demand for used vehicles has exploded, with data showing that used car prices have risen by between 8% and 14%.

Against this background, the average cost per claim is increasing significantly. Our claims inflation has been on an upward trend since 2021, and this continued in 2022.

The market is already pricing in these inflationary pressures, with between 10 – 15% inflation expected. Against this, we are seeing significant premium rate and excess increases. It is critical that policyholders work with brokers to ensure that they remain adequately protected against loss events. We have already responded to the challenge by giving customers optional extensions and top-up cover to hedge against inflationary pressures.

Failing infrastructure

Increasingly, we are concerned about a potential grid collapse, which is looking ever more likely. The extended damage to many businesses would reach far beyond the actual blackout and some might unfortunately not be able to even recover due to the unparalleled nature of such a situation. This could have an even more devastating impact on the insurance industry.

Already we are seeing how loadshedding is causing an upswing in electronic equipment, burst geyser and power surge claims. Frequencies for claims impacted by loadshedding have almost doubled. Our data shows that since 2018 the number of electronic equipment, burst geysers and power surge claims has risen by 93%, 437 for the year to date.

Skills shortages

The insurance industry has been lagging other industries in productivity improvement for some time. We are experiencing a shortage of data, actuarial and IT skills, which is leading to a war for talent. Specifically, there is a shortage of experienced underwriting skills, and there are increased costs to attract and retain talent, with more entrants disrupting the insure-tech and bancassurance space.

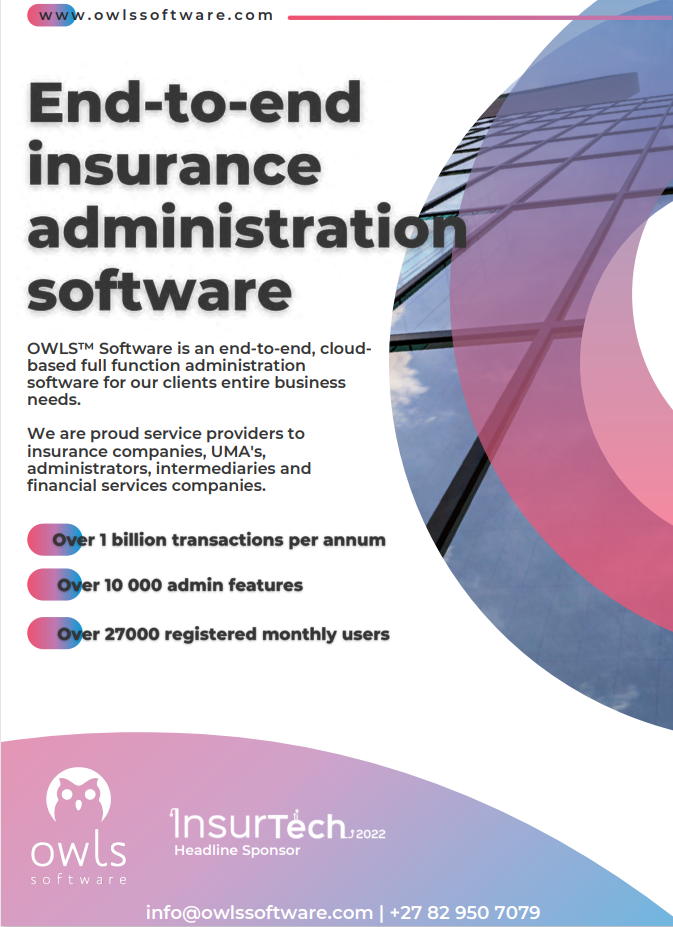

OWLS™ Insurance Software

Proud providers to insurance companies, UMA’s,

administrators, intermediaries and financial services companies.

The non-life insurance market will need to address the productivity imperative to overcome stagnation. The opportunity is to drive operational efficiencies through digitisation and automation.

What will it take to win?

It is not all doom and gloom as major shifts in the market force industry players to redefine ways of doing business.

We expect consolidation of the insurance market to increase as smaller players come under pressure. Mergers and acquisitions (M&A), as well as partnerships with Underwriting Management Agencies (UMA) are also likely increase in 2023 as the landscape for product innovation becomes even more competitive. These are key levers for growth and diversification in the SA non-life insurance market.

Historically there have been only a few non-life insurers who have played in the M&A space, but other players are catching up, with a major shake-up of the industry on the horizon.

We have already cemented significant deals in the last two years, characterised by our acquisition of ONE Financial Services in 2021 and Genric Insurance in 2023 (pending regulatory approval). We expect these to unlock new growth opportunities and add to our competitive advantage, as well as offer our customers specialist products and services. It also gives us an ability to rapidly test and scale new product ideas.

The broker market will also not be spared from consolidation and transformation. There is evidence that market consolidation is already underway with some small brokers having already exited, merged with similar entities, or sold their portfolios to larger brokers. This is being driven by legislative and regulatory change, the increasing cost burden which is leading to a need to centralise administration functions, and an aging broker force. It is likely that joint ventures in this space will increase and transformation becomes an imperative for the industry.

Historically non-life insurers have had an over-reliance on motor and property books, but this will impact margins going forward. Diversification therefore becomes an imperative. We continue to strengthen our distribution capabilities and non-insurance revenue streams, while simultaneously focussing on growing of some of our specialist areas, like marine and engineering, to hedge against this. This also needs to be coupled with ongoing innovation to meet ever-evolving customer needs. We have already brought several innovative offerings to market when it comes to user-based insurance (for example CommaInsure and Veesure), widening our omni-channel service offering, as well as integrating insuretech partners with our business.

Safety net

The non-life insurance industry has proven its resilience in providing a critical safety net to society during times of disaster and crisis.

Despite the challenging operating environment and headwinds in 2023, we expect the industry to play an even more important role in these uncertain times.