Nzwa Shoniwa, Managing Executive at Sanlam Umbrella Solutions

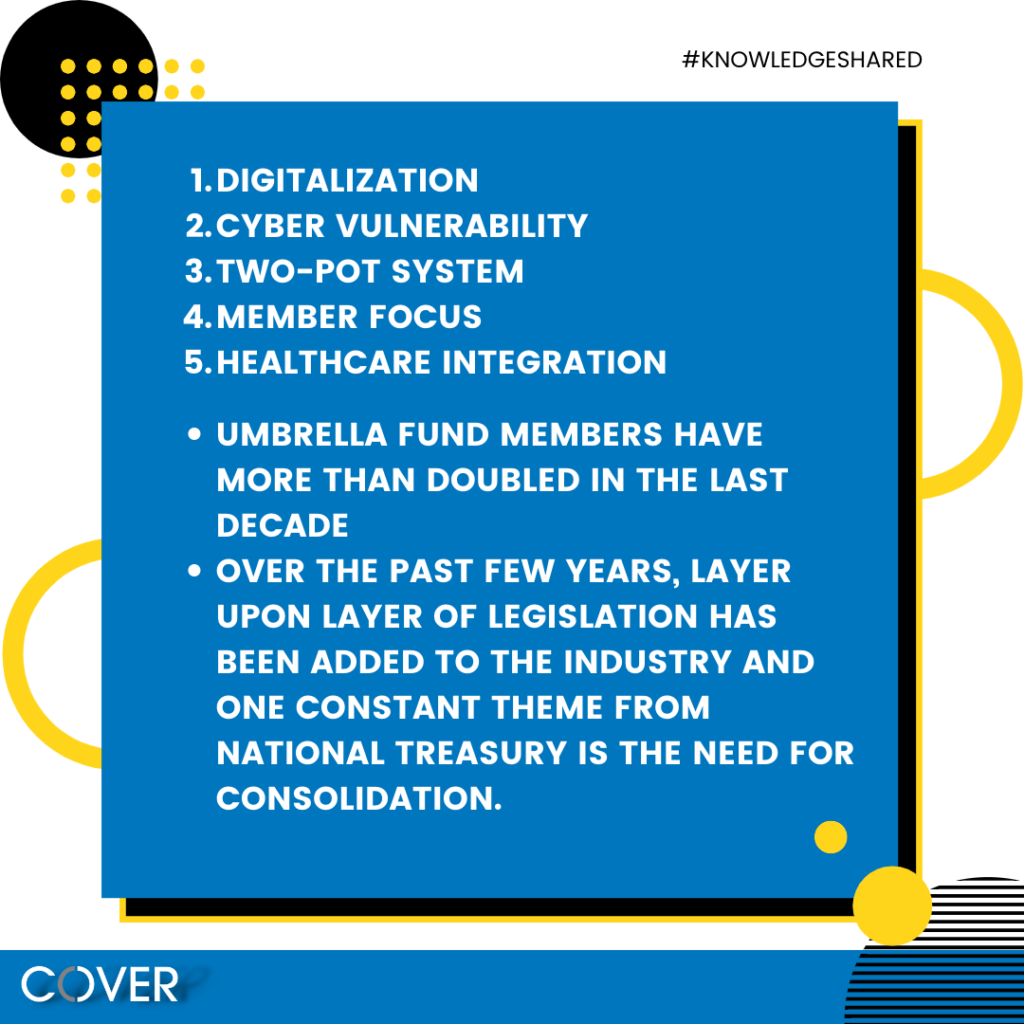

Umbrella fund members have more than doubled in the last decade and assets have more than quadrupled to just under half a trillion in assets, according to a report by National Treasury. Over the past few years, layer upon layer of legislation has been added to the industry and the one theme that has remained constant from National Treasury is the need for consolidation and its intent to improve governance within the industry, thus ultimately protecting the interests of members.

Recent times have been challenging on many fronts for all South Africans and research from our Sanlam Benchmark report from earlier this year showed how economic challenges placed additional pressure on the lives and finances of our members and participating employers. The industry should take educating and supporting the growing number of members of umbrella funds extremely seriously as we navigate this tough time.

During the 2022 Sanlam Umbrella Fund Symposium, held in late October, a group of panellists touched on the challenges the industry is facing, including enhancing competition, transformation scorecards; and National Treasury’s (NT’s) proposed ‘two pot’ retirement funding solution and allowed the audience a behind the scenes look at how the Sanlam Umbrella Fund board plans to tackle these challenges.

Against the backdrop of this, five trends that will impact the Umbrella Fund industry in 2023.

Digitalization

The key digital themes for 2023 will be centred around improving digital adoption across members, measuring the clients’ experience, member engagement and alignment across varying solutions. However, expanding digital footprints will ultimately contribute to an increase in cyberattacks. At the end of 2021, Gartner conducted a survey to identify the top risks that will impact the financial sector in 2022. Cyber vulnerability was identified as the top challenge.

Cyber vulnerability

The Financial services industry is among the top three industries most affected by cyberattacks. They are 300 times more likely to experience a cyberattack than companies in other industries. The primary reasons include rapid adoption of new technologies, access management challenges, lapses in security control and increased employee vulnerability to social engineering. Over the years, financial organisations have witnessed an increase in the number and cost of cyber-attacks. Global ransomware attacks rose 93% in the first half of 2021 compared to the same period in 2020.

The need for information security has dramatically increased in the digital age. With updated legislation, regulatory interventions and demand from our stakeholders, financial services companies need to acknowledge the need to ensure that they remain compliant and secure all the information we manage in line with worldwide best practice principles.

CPD FOR YOU.

Supporting personal & professional growth.

Our Continuous Professional Development (CPD) Hub enables financial services providers to effortlessly fulfil their CPD requirements by completing online training courses in the specific applications of telematics and vehicle recovery.

Two-pot system

Early access to retirement savings is a burning issue highlighted by the pandemic. The financial struggles many South Africans face due to the COVID-19 pandemic have resulted in Government engaging with the regulators and other key stakeholders to work out relief measures for consumers. The move to a two-pot system, with the dual purpose of facilitating early access to one third of future contributions and preservation of the remainder for annuitisation at retirement, is a welcome development signalling a new era for the South African retirement industry and ending old age poverty.

The “two-pot” system will have a positive impact on people’s lives by providing a practicable and responsible solution to the real needs of members. The proposed reforms are necessary to balance members’ long-term retirement savings goals and to meet short-term financial needs (as has been highlighted following the Covid-19 pandemic). In the long run it should improve retirement outcomes. Set for launch in 2024, 2023 will be characterised by a great deal of preparatory work which will include administrators undertaking massive system enhancements, changes to forms, processes and procedures.

Member Focus

In light of the economic difficulties that participating employers and members continue to face, the importance of partnering with a trusted partner has never been more important.

For Sanlam Umbrella Solutions, our members remain the most important partners that we have, with our sole purpose to empower them to be financially confident about their future thus improving their retirement outcomes. It is for this reason that our focus has been shifting towards engaging members directly through different platforms.

Healthcare Integration

Sanlam’s 2022 benchmark research indicated that 51% (2021: 36%) of employers surveyed, believed a holistic integrated health and financial wellness programme delivered higher productivity and staff happiness, yet only 12% used integrated programmes reflecting a clear gap in the current services offered.

Employers are considering the ideal suite of benefits and services that should be included for their employees and these benefits to be integrated into a single value proposition. However, the research indicates that employees need additional healthcare benefits as the pandemic highlighted how members were not adequately covered.

One of the strengths of the Sanlam Umbrella Fund is to continuously seek ways to improve the value proposition and ensure that the right tools are provided to enable members to achieve a dignified retirement. Sanlam Umbrella Solutions and Sanlam Health have developed a set of health solutions that will be available exclusively to members and employers of the Sanlam Umbrella Fund in early 2023. These offerings will allow the Sanlam Umbrella Fund to offer holistic retirement and health solutions.

Health, both physical and mental, is taking centre stage, particularly within the context of a tough economic environment. Adopting a holistic integrated health and financial wellness programme is beneficial to members and participating employers. It is no secret that healthy employees are happier employees” concludes.