Kenny Rabson, CEO of Discovery Invest

Amid a global longevity transition, local investors want more from the world. To keep abreast of the complexities of life and money, the local advice industry stands to benefit from global experience and technology

Two converging trends are disrupting the investment environment, necessitating a step-up in the solutions on offer to support the local advice industry.

Firstly, local investors want – and have been afforded, greater access to the world.

South Africans are increasingly looking to invest more globally and with the recent regulatory changes, pension funds and mutual funds are now able to allocate almost half – up to 45% in offshore assets.

This is undoubtedly a positive development.

Offshore investing not only provides access to themes and trends that are underrepresented locally but both the theory and evidence demonstrates that global diversification works to enhance expected returns for the same, or less, risk.

This holds true regardless of where you call home.

However, the global investment landscape has not only become more complex and sophisticated than ever before, but it is increasingly volatile and uncertain.

Consider how vastly different the challenging market regime we are in today is from the one we were in just two years ago.

Current uncertainties such as the global fight against inflation and the, increasingly worrisome, war in Ukraine have made concerns such as the global impact of the COVID-19 pandemic seem a distant malaise.

To keep abreast of these developments and take advantage of all the world has to offer, truly global research and understanding of the risks and opportunities that the global markets present is crucial.

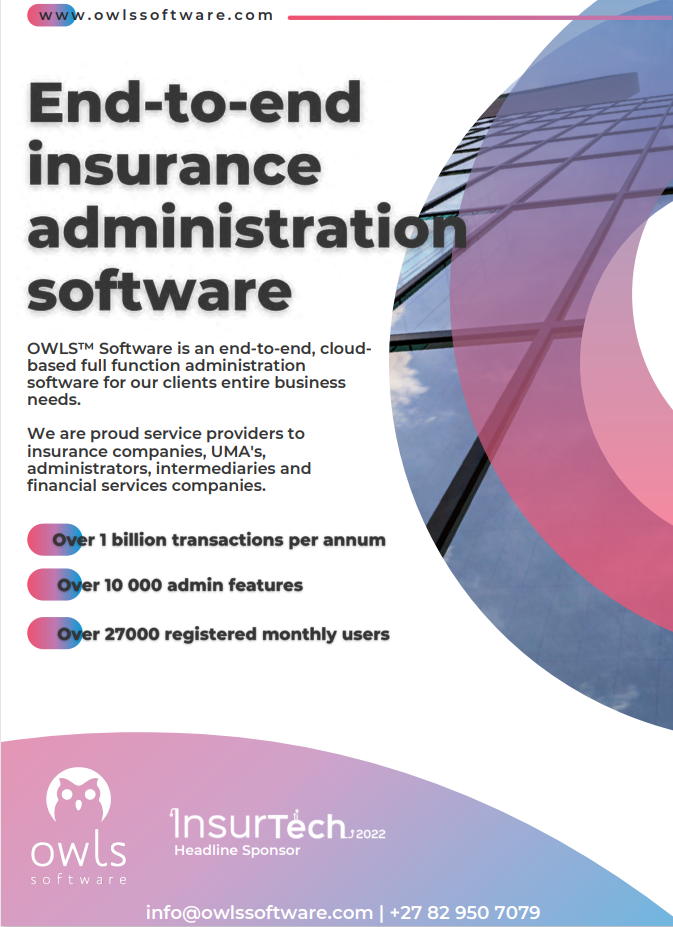

OWLS™ Insurance Software

Proud providers to insurance companies, UMA’s,

administrators, intermediaries and financial services companies.

Secondly, we need to recognise that returns are less than half of the picture when it comes to achieving an optimal retirement outcome for clients.

We’re all aware that the vast majority of South Africans are not able to afford retirement.

As populations across the world live longer, healthier lives than ever before this crisis is clearly not going to solve itself.

Furthermore, investment behaviours – such as how much we save and for how long – can have a far greater impact on a replacement ratio at retirement than returns.

Navigating financial planning for the future is multi-dimensional. Technologies that analyse behavioural and demographics metrics not only inform how long savers are likely to live but how healthy they will be throughout their lives.

As these dynamics inform how much money clients will need, technologies can play a vital role in supporting financial advisors in making recommendations to their clients.

Where it comes to strategic asset allocation, collaborations that offer global expertise with local applicability can help advisers to focus on providing indispensable advice at the times where their clients need it the most.

To this end, Cogence, a discretionary fund manager (DFM) seeking to significantly enhance the business of wealth creation in South Africa, was launched through the collaboration between Discovery and BlackRock.

Uniquely, Cogence combines the model portfolio asset allocation advice of BlackRock, one of the world’s leading asset managers, while leveraging the expertise of renowned local investment firm Riscura and personalised health insights from Discovery.

We believe that innovation can help financial advisors and wealth professionals navigate these complexities to achieve an optimal outcome for clients.