Bjorn Ladewig, Longevity Actuary at Just SA

The boiling frog metaphor stems from the belief that if you put a frog in a pot of boiling water it will instantly leap out. But if you put it in a pot filled with tepid water and gradually heat it, the frog will remain in the water until it boils to death. It is a metaphor for people’s inability to react to significant changes that occur gradually.

The crisis of unsustainable retirement income

We have not yet seen the crisis of unsustainable retirement income manifest, but it’s coming. The first living annuity was issued in the early 1990s which means more and more living annuity investors will be moving beyond their average life expectancy every year. The 1990s cohort of living annuity investors will start to live beyond their life expectancy in this decade.

When this happens, the risks associated with pure living annuities will be exposed. Living annuitants carry their own risk of money running out before they do. And where annuitants can’t afford to (or don’t) draw an income at a sustainable level to last beyond their average life expectancy, they face increased risks.

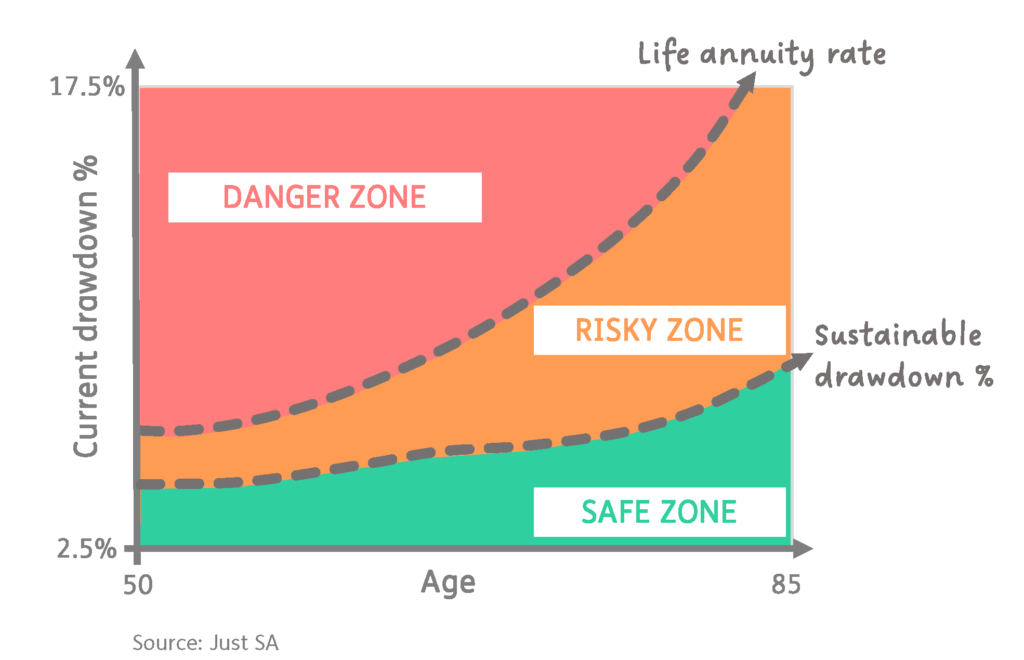

How drawdowns map to identified zones

At Just SA, we can identify living annuitants who are most at risk of outliving their savings. To do this we analyse their current living annuity drawdown in relation to the FSCA draft recommended drawdown rates and the rates of a new-generation life annuity. The latter is considerably more, given that this is determined to provide – on average – a higher income for life. The former is lower as it is effectively self-insurance, which means drawing less to ensure the income is sustainable.

The three identified zones are the danger zone, risky zone and safe zone.

Danger zone: Unsustainable drawdown, meaning living annuitants who are drawing more than the income a life annuity can offer – a major risk of running out of money.

Risky zone: Potentially unsustainable drawdown, meaning living annuitants who are drawing more than their recommended drawdown rate, but less than life annuity income rate – a material risk of running out of money.

Safe zone: Sustainable drawdown, meaning living annuitants who are drawing less than their recommended drawdown rate for their age – an acceptable risk of running out of money.

Which frog are you?

Since 2019, Just SA has analysed such scatterplots for more than 17 000 living annuitants. These showed that the average drawdown is 8.5% per year, with 32% in the Safe Zone, 34% in the Risky Zone, and 34% in the Danger Zone. Essentially a third of living annuitants in each zone.

How drawdown maps to an optimal retirement income solution

Living annuitants with high, unsustainable drawdown rates (in the Danger Zone) can mitigate the risk of running out of money by incorporating a switch to a lifetime income portfolio and prolonging their living annuity assets. However, even in a blended annuity, those drawing the maximum (or close to it) will still need to consider lowering their drawdown rates to avoid depleting their flexible assets and having to rely solely on guaranteed income from a life annuity.

Those in the Risky Zone will benefit most by switching from a pure living annuity to a blended living annuity. A blended annuity allows investors to get a secure level of income from the life annuity portfolio, allowing them to maintain their current drawdown level but effectively to draw much less from the living annuity assets. This means the overall income sustainability is vastly improved, and a more aggressive investment strategy can be followed on the liquid portion to better maximise returns.

Even those with very low drawdown rates (Safe Zone) can seek to improve their retirement outcome with a blended annuity as a diversifying asset class.

Don’t be the frog who doesn’t realise the water is boiling until it’s too late!