Debra Slabber, Portfolio Specialist at Morningstar Investment Management SA

It is fair to say that 2021 was an extraordinary year in so many ways. Ex-US president Donald Trump refused to admit defeat in the US presidential election, the US finally withdrew its forces from Afghanistan, the Olympics took place in Tokyo two years later than planned and chaos erupted when one of the world’s largest container ships blocked the Suez Canal for six days – to name but a few examples (and not even including the continued Covid-19 lockdowns globally).

From a market perspective, there were definitely a few landmines but there was also ample opportunity and money to be made. Overall markets were kind to investors and 2021 had one of the lowest annual volatility levels and performance drawdowns on record.

Fast forward to four months into 2022 and we are back to a period where market volatility and uncertainty are the order of the day. Investors are navigating their way through a time when it feels like everything is going up (and not in a good way) – inflation, interest rates, the oil price, geopolitical tension and possible rate hikes, to name a few. Understandably, clients are asking “where to from here?”.

Today, more than ever, there are enormous pools of capital that are driven by sophisticated algorithms and aided by leverage. Should sentiment be swayed in any one direction, be it via a constant flood of news headlines and/or Robinhood traders, price movements can be amplified in magnitude and speed from one day to the next.

Howard Marks once said that no one can succeed in predicting things that are heavily influenced by randomness. And the world today is filled with randomness. Over time, humanity has developed highly sophisticated financial models to predict anything from currencies to GDP and so too, very comprehensive risk management tools which are widely used. Still, none of these sophisticated systems could predict that Covid-19 would bring the world to its knees, or that Russia would invade Ukraine and the massive repercussions that would follow for capital markets.

It is easy to fall into the trap of thinking the world is unusually complicated these days and to long for simpler times. At times like this, I think back to lyrics from a song by famous country singer Kenny Rogers – “They don’t make ’em the way they used to”. While the troubles of today usually seem very difficult at the time, and we often like to remember the halcyon ‘earlier’ days, the past certainly wasn’t as comfortable as we remember it, and there were often more challenges than we recall.

What to do about short-term volatility?

Markets are inherently unpredictable in the short term; the range of outcomes is wide and investors have very little advantage in trying to predict what will happen from one day to the next.

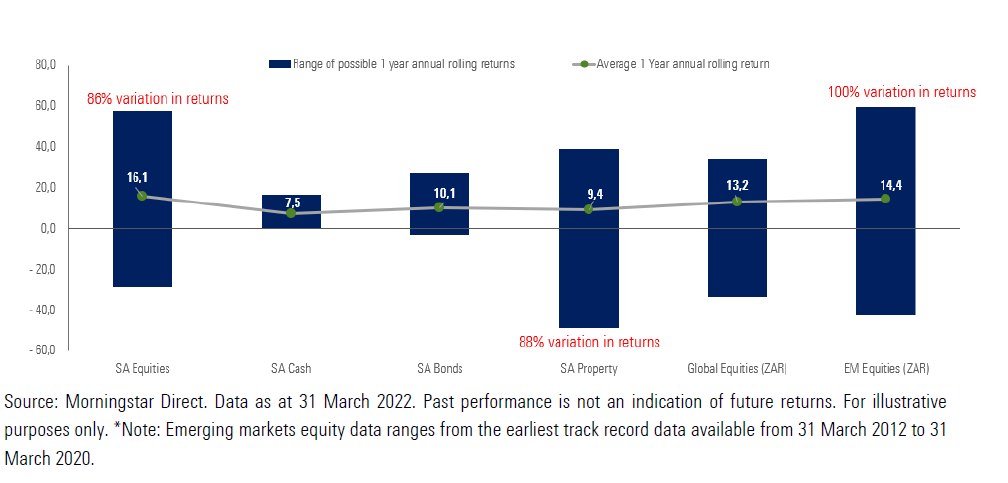

The chart below shows you the range of possible outcomes over any rolling one-year period per asset class that is broadly investible from a Rand perspective. The green dot is the average annual one-year rolling return per asset class. What is quite clear is that the variability in returns is far greater than one would think. Emerging market equities for example have gone from -40% to +60% in one year, giving it a 100% variability rate. That is pretty extreme.

OWLS™ Insurance Software

Proud providers to insurance companies, UMA’s,

administrators, intermediaries and financial services companies.

What about the long view?

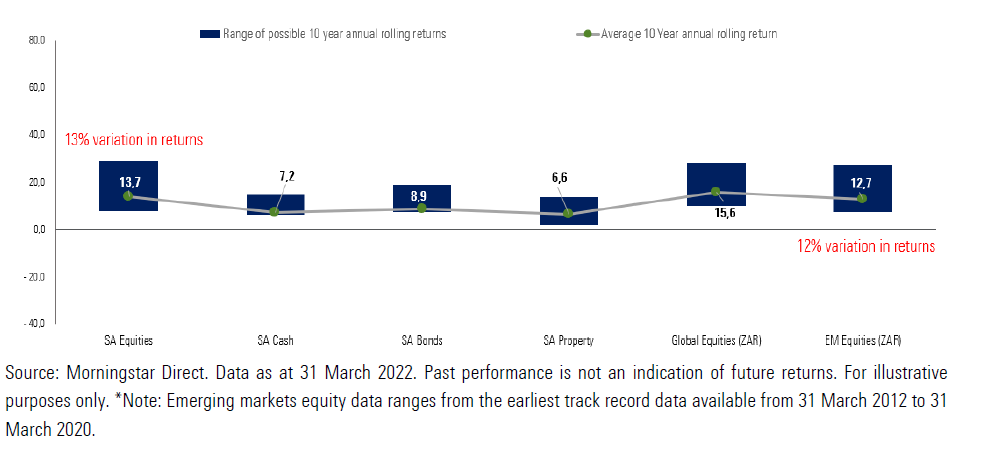

If you look at the same graph, but on a rolling 10-year basis instead, the picture looks materially different. Two observations that can be made from the graph below

- All asset classes are positive over any 10-year rolling period.

- The variability in returns is drastically reduced.

Are markets more predictable over the long term?

Yes, markets are more predictable over the long term and the reason for this is that ultimately the price of securities is driven by fundamentals (earnings growth, inflation, starting valuation). That is why at Morningstar we spend very little time trying to predict the near-term future, and we don’t try and forecast geopolitics or macro factors.

We rather choose to invest our time in understanding the fundamental drivers of companies, sectors, asset classes and regions through our Capital Markets framework.

So where does that leave us?

Markets are and will always be complex. There is a constant oscillation between euphoria and depression and/or celebrating positives and obsessing over negatives. Markets are inherently unpredictable over the short term and driven by factors no machine or person can predict accurately.

If, however you extend your timeframe, the behaviour of the market and asset classes look much more certain and the range of outcomes mostly always narrows.

So, take the long view on your investments and ensure your portfolio is diversified to withstand bursts of volatility that may be experienced in the short term and accept that you will find very little advantage in trying to predict the future from one day to the next. Patience, perseverance, good savings habits and a good sense of value will help you reach your financial goals.