Deane Moore, CEO of Just SA

Current market conditions allow pensioners to secure 30% higher income that is guaranteed for life than they could at the start of this decade.

This is a window of opportunity for pensioners to lock in certainty of income for life, against an increasingly uncertain and volatile future: escalating war in Europe, rising global inflation, stalling global growth and the unpredictable future course and impact of Covid.

This is particularly important when you consider the Just Retirement Insights survey that showed that 74% of pensioners would need to adjust their lifestyles if investment markets fall below 10%.

I urge pensioners and their advisers to act now. We regularly see people seek the security of a guaranteed income after they lose money in a market crash. Rather use this great buying opportunity for life annuities to secure peace of mind for your retirement.

A with-profit annuity is a life annuity where increases are linked to the smoothed return of popular balanced funds provided by boutique asset managers. Two factors are combining to make the price of with-profit annuities attractive in current market conditions:

- Pricing alignment: The price of the with-profit annuity moves more-or-less in line with the market value of the balanced portfolio to which it is linked, so a retiree gets a similar level of guaranteed lifetime income whether markets go up or down.

- Rising fixed interest yields: The with-profit annuity has become cheaper as fixed interest yields have risen. Higher long-term interest rates often translate into good value for money for life annuities.

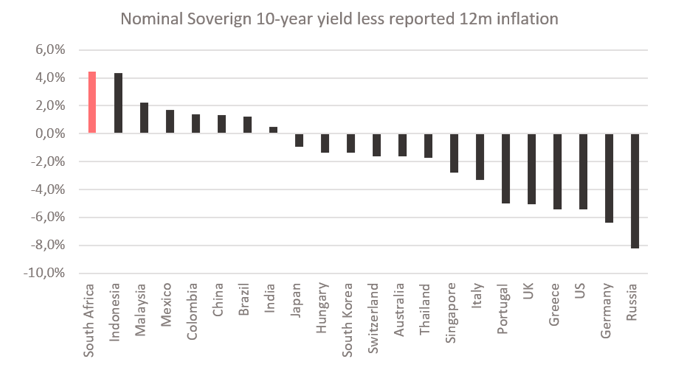

In fact, South Africa currently has the highest real interest rates in the world, as shown in this chart:

Source: NinetyOne (3 May 2022)

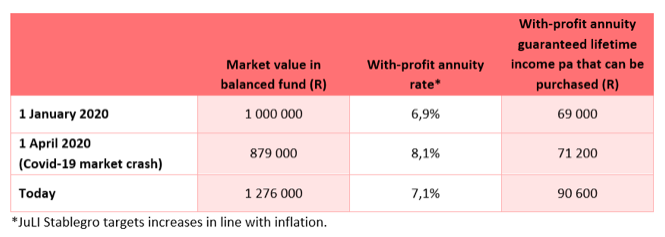

As a result, a person reaching retirement with their money invested in a balanced fund is able to purchase 30% more guaranteed income for life from a with-profit annuity linked to that same balanced fund, than they could two years ago. This graph illustrates how that level of guaranteed lifetime income has increased since 1 January 2020.

Source: Just SA

The table below illustrates this numerically for a typical retired couple – a male age 65, with a female spouse age 62. The annuity rate quoted is the income that is guaranteed to be paid for life. It also includes an income legacy – it is paid for a minimum of 10 years regardless of when death occurs; and after that, 75% of the income is paid to the surviving spouse for the rest of her life.

I suggest that pensioners should lock in sufficient income that is guaranteed for life to cover their essential expenses. They can secure this both in a standalone life annuity or as an investment option in certain living annuities.