Carli Jacobs, Head Life & Health Southern Africa, Swiss Re

Why a more gender-inclusive world is good for societal resilience and the insurance industry

Women are important contributors to the world economy and key insurance purchase decision makers in their households and their businesses. A Swiss Re Institute publication reveals, however, that women are often overlooked as a target segment, although their purchase behaviour differs significantly from that of their male counterparts. By transforming the way insurance products are designed, communicated and distributed, insurers have an opportunity to tap into a new consumer pool that could add up to USD 2.1 trillion of insurance spend by 2029. The rewards for society: more economic and societal resilience.

The pandemic has been tough in multiple ways for all of us but women in the workforce were arguably among the hardest hit.

In the early stages of the pandemic, the Harvard Business Review revealed that 54% of job losses during COVID-19, belonged to women, even though women only comprise 39% of the world’s workforce. So, it looks as though women’s jobs have been 1.8 times more vulnerable than men’s during the pandemic.

Many groups in society have long been working together to address gender inequality by helping to make the global economy more gender inclusive. A McKinsey study indicated achievements in the US workforce where female attrition rates had not only declined in the previous five years but were actually lower than those for men at that point in time.

The COVID-19 crisis, which we still haven’t shaken off, has sadly set back some of these accomplishments by several years and in some countries, by generations. Women are more vulnerable to COVID-19 related economic effects because of existing gender inequalities. Mc Kinsey estimates that female job loss rates due to COVID-19 are about 1.8 times higher than male job loss rates globally, at 5.7 percent versus 3.1 percent respectively. All of us need to get on top of this challenge because all of us have skin in the game. Cultivating economic growth and building societal resilience is, after all, in everyone’s fundamental interest, including the insurance industry.

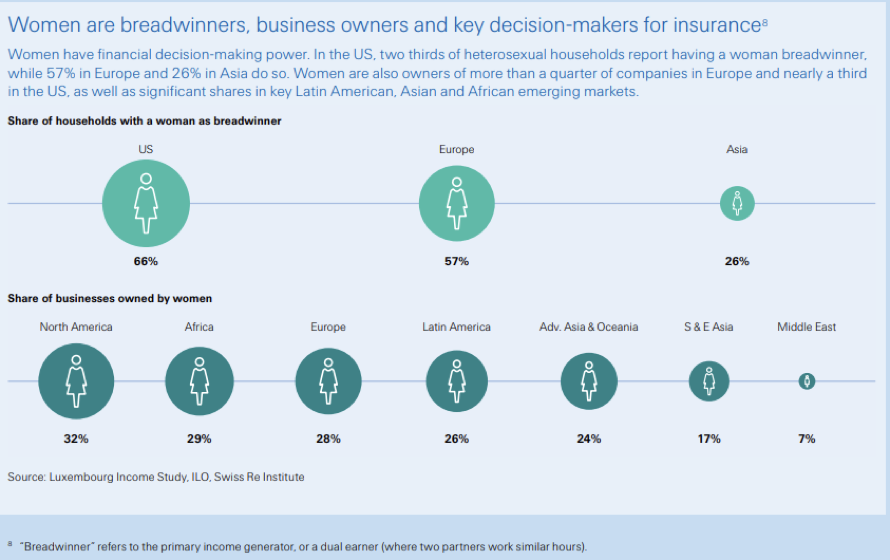

Women’s role in society has rapidly evolved over the last ten years. Now, more than ever, they are breadwinners, entrepreneurs and leaders in the private and public sector as per the figure below.

So, for insurers, there’s a compelling reason to invest in understanding and incorporating women’s roles as key decision markers with regard to purchasing insurance.

How is this significant?

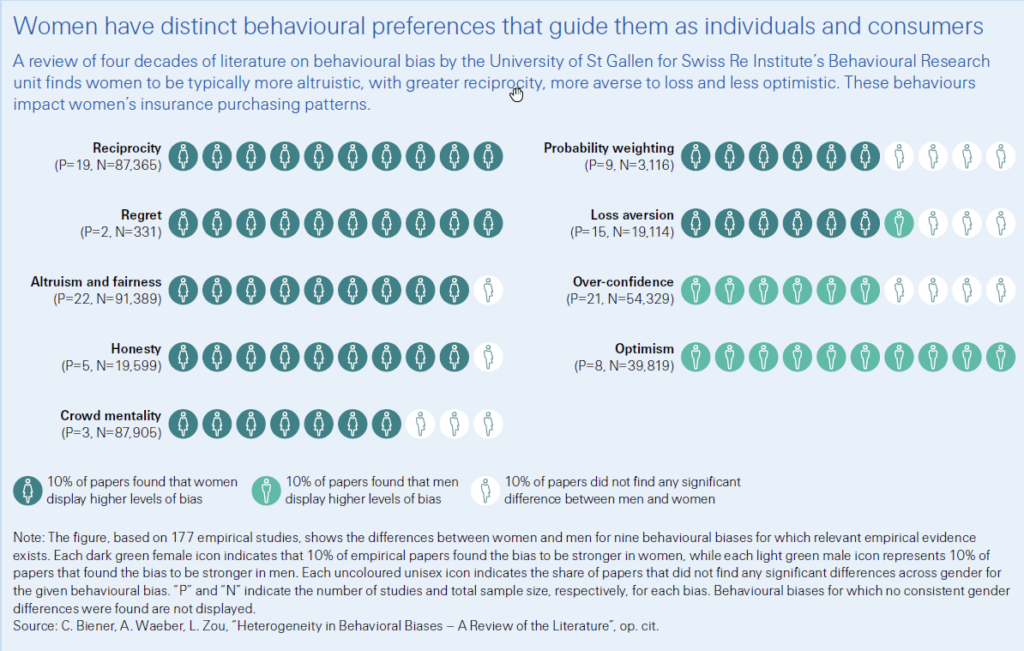

Generally speaking, basing decisions on alleged gender-specific behaviour is an intellectually flawed process and can open the door to bias. All that said, research has shown that women’s buying preferences tend to contrast with those of their male counterparts’. For instance, women attach more importance to recommendations from trusted sources in order to discover, evaluate and ultimately purchase new insurance coverage. For insurers, this could imply adopting a sales approach focused more on referrals and community consultation.

As for products, the Swiss Re Institute study suggests that women pay more attention to health insurance, especially for their children. But at the same time, they are less inclined to opt for life insurance, which makes them less prepared for their own mortality risk. They tend to be more loss averse than men, preferring safer investments rather than more attractive returns. Conversely, this means less focus on retirement savings, making women less prepared for their longevity risk.

Distinct behavioural differences observed between men and women

Source: Swiss Re Institute research

Bearing in mind such marked differences in buying behaviour, insurers potentially have an opportunity to proactively address the needs of women.

Access to capital still difficult for female entrepreneurs

Women entrepreneurs have become increasingly important guarantors of economic stability. Africa counted 2 million women-owned enterprises in 2019 representing 29% of business owners, up from 26% in 2010. The record is held by Rwanda with 52%, the highest ratio of women business owners globally. The US counts more than one million female-owned businesses, which generated USD 1.8 trillion in revenues and employed more than 10 million people in 2018. In Europe, women make up 30% of start-up entrepreneurs, while women Asia make up 40% of the world’s female-owned businesses.

Yet, despite producing higher revenue per dollar invested, access to capital remains a challenge for women. Insurance can help de-risk their businesses to expand their funding capabilities, while also providing them risk coverage for their business operations and the people they employ. So, it stands to reason that getting to grips with the challenges women entrepreneurs may face is going to help us better serve this customer segment.

What insurers can do

By better understanding women’s needs, we can help strengthen them as important economic contributors. The Swiss Re Institute’s publication highlights three steps in this direction:

- Transform the way insurance topics are communicated, demystify insurance technicalities and bring to the fore aspects that women value in industry literature.

- Consider specialised distribution channels that will facilitate women’s access to insurance as a complement to other forms of capital.

- Integrate attributes women value into insurance products with a particular focus on the risk management needs and preferences of women.

We will need to be aware of common misconceptions such as the distinction between cognitive bias, which influences buying behaviour, and gender bias, which has constrained women’s progress. Insurance needs to be conscious of the opportunity we have, to build a competitive advantage for the future consumer market by also bringing to the industry female talent, able to better understand and cater to the needs of female customers. Gender inclusion is both about social impact and business sense; and when there’s impact, the business will follow.

Big benefits

These topics need investment in research, data analytics and management time. But if we can get just some of these themes right and put together a product suite that more proactively addresses the insurance and risk needs of women, the benefits will be tremendous. By 2029, a more gender-inclusive world could generate an additional USD 2.1 trillion dollars of insurance spend for our industry. It could also create a global workforce that is more vibrant, resilient and inclusive.