Mariska Comins – Head of Technical Support at PSG Wealth

Financial literacy can be loosely defined as the knowledge and ability to manage monetary resources in a way that promotes financial wellbeing now and into the future.

Unfortunately, however, a large proportion of our population has low levels of financial literacy, and in many cases limited access to authentic, well-informed financial advice.

Financial goal setting is impossible without a financial plan (you could even call it a vision board or roadmap), which ultimately outlines a clients’ current position, medium- and long-term personal monetary goals. A financial plan helps to prioritise these goals, reflect on past decisions and make adjustments while keeping both you and your clients committed and accountable.

In an ever-changing world, our clients are bombarded with investment- and financial-related information and advice from various sources, with most unable to differentiate speculation from facts. Many struggles to understand how social, economic and political circumstances impact their financial plans.

Developing financial literacy is about understanding and nurturing the relationship with money, so a complete and honest budget is the cornerstone of any financial plan. With a comprehensive budget, you’ll have oversight of what your client’s limits are and what they can really afford to spend money on. It may be incredibly difficult to find ways to save with an already stretched budget, but the journey to financial wellbeing begins with small, simple steps.

Following the past couple of years, which have been characterised by uncertainty and volatility, you also may be questioning the way forward for a number of your clients. However, even within an ever-evolving landscape, there are a few foundational aspects of financial planning which should remain a constant amidst the change.

- A last will and testament

It is important to have a signed, witnessed and dated will. Clients should review their wills regularly and ensure that their final wishes are concise, clear and executable. It is also very important to determine whether your client requires an offshore will for foreign assets which will depend on the jurisdiction in which the assets are situated.

- Life insurance

A key part of financial planning is considering how much cover will be required to provide for the family should any of your clients pass away. You need to consider the amount of debt, other costs, and commitments that their estate will have to cover. Another important consideration is what will happen in the event that they fall ill or become temporarily or permanently disabled, as there are many hidden and additional medical expenses that come with adapting to a new lifestyle.

- Short-term insurance

Clients will often try and free up some capital for saving purposes by cancelling insurance or decreasing insured amounts on personal or commercial insurance. However, short-term insurance is important and protects clients from the inability to honour liabilities in unforeseen circumstances.

- Short-term and medium terms savings

It is crucial for clients to have an emergency fund to cover at least 3-months of living expenses and encourage clients to invest tax refunds, bonuses and other windfalls which will allow clients to increase savings for other goals like a vacation, tertiary studies etc.

Assist clients to evaluate their current debt situation and prioritise paying off high-interest debt. Encourage and assist them to free up cash flow by improving spending habits like implementing “no-spend” days or shopping with a list.

- Saving for retirement

When it comes to retirement, the preservation of retirement savings is key. It’s not uncommon for fund members to withdraw their savings when they change jobs and to use the money to settle debt or fund other expenses. This can however have a long-lasting negative impact on their long-term financial plans and set them back thousands in compound interest.

The reality is that some individuals had to use retirement savings to survive the financial challenges arising not only from the Covid-19 pandemic but other unprecedented challenges. As a ‘damage control’ mechanism, I suggest encouraging clients to increase retirement savings. For example, if your clients contributed 10% of their salary, suggest boosting this to 15% or 20% as soon as possible.

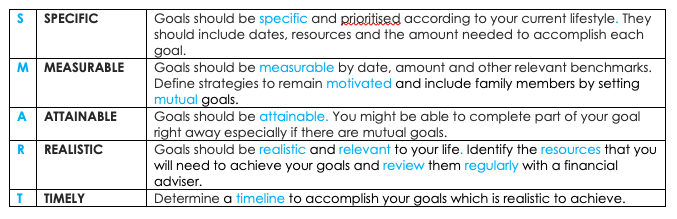

Managing your finances can be overwhelming. I, therefore, find that suggesting the SMART approach to clients can help them understand why a holistic plan is required:

Lastly, classify your clients’ goals according to the timeframe it will take to achieve each of them. For example:

- Short-term goals: Goals normally achievable within a 1-year period

- Medium-term goals: Goals normally achievable within 2 to 5 years

- Long-term goals: Goals normally achievable in 5+ years

Urge your clients to think of themselves as the experts of their life and you, as the financial adviser, the expert on all things related to money. It all comes down to teamwork.

As with all successful teams, you’ll often need to “train” together to ensure that your clients stay on course and adjust their financial plan without deviating from their financial goals.

Unforeseen circumstances happen – life happens, but if they have a close relationship with you – the ‘trainer’ –as a team you will navigate challenging times and remain financially fit