A.M.Best‘s Market Segment Report: Sub-Saharan Africa Reinsurers

“For several years, the sub-Saharan Africa (SSA) reinsurance market, though limited in scale by global standards, has provided reinsurers with an opportunity for diversification and profitable growth“.

However, increasing economic volatility and elevated competition have led to a gradual deterioration in performance. In a new Best’s Market Segment Report, “Sub-Saharan Africa Reinsurance: Significant Growth Potential, Despite Challenging Operating Conditions”, AM Best points to the impact of the COVID-19 pandemic on local economies, volatility in global oil prices, and in some countries by high inflation rates and local currency depreciation as contributing to the difficult operating environment for both domestic and international reinsurers.A full complimentary copy of this report is available via the following link:

Best’s Market Segment Report: Sub- Saharan Africa Reinsurers

A.M.BEST, Market Segment Report

Increasing investment in infrastructure, together with steady levels of GDP growth, have contributed to the expansion of the region’s reinsurance markets

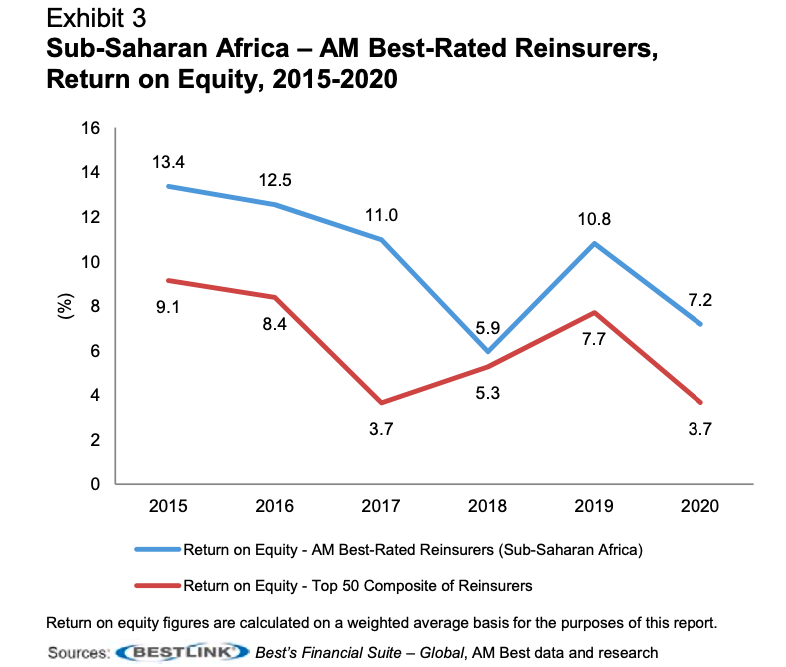

For several years, the sub-Saharan Africa (SSA) reinsurance market, though limited in scale by global standards, has provided reinsurers with an opportunity for diversification and profitable growth. However, increasing economic volatility and elevated competition have led to a gradual deterioration in performance.

Throughout 2020, the operating environment across SSA was difficult for both domestic and international reinsurers, largely due to the impact of the COVID-19 pandemic on local economies, volatility in global oil prices, and in some countries by double-digit inflation and local currency depreciation.

With the COVID-19 pandemic persisting through 2021, already high levels of inequality across the region have worsened, in some cases resulting in local pockets of social unrest, including widespread rioting in South Africa, the region’s largest insurance market. This is expected to result in significant losses for the reinsurance industry.

Despite the challenges, AM Best believes the growth potential for the SSA reinsurance segment remains substantial. The region has considerable and untapped reserves of natural resources, solid long-term projected economic growth rates, and increasing underlying insurance penetration.

Long-Term Growth of the Reinsurance Market

Increasing investment in infrastructure in SSA, together with steady levels of real gross domestic product (GDP) growth, have contributed to the expansion of the region’s reinsurance markets over the past decade, a trend that AM Best expects will continue.

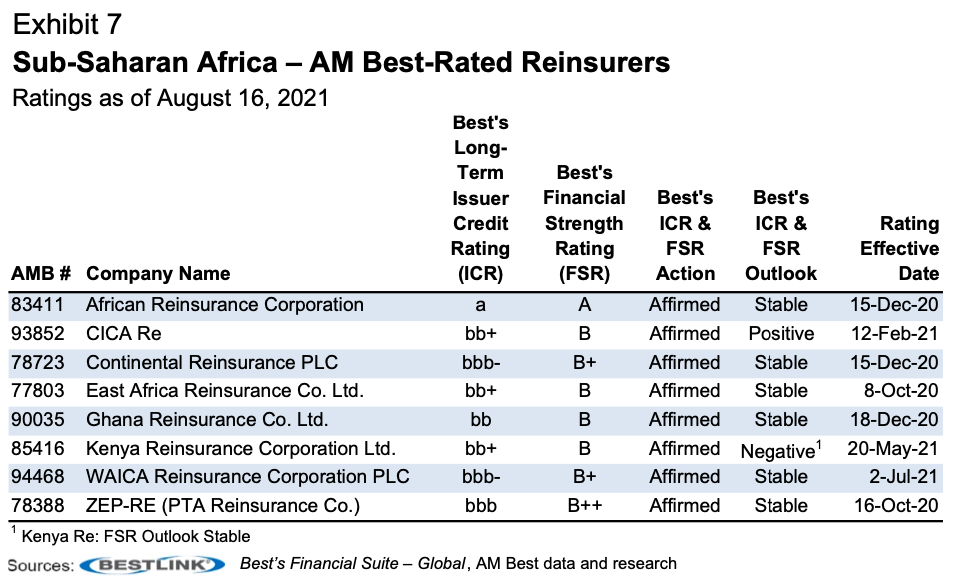

SSA reinsurers rated by AM Best have experienced good growth over the longer term. Gross written premium (GWP) has grown at a 10-year compound annual growth rate (CAGR) of 5.8% (calculated in US Dollars). GWP growth has been driven predominantly by the non-life insurance segment, with the life segment at a nascent stage of development in many of the region’s countries.

Over the past decade, steady growth in GWP (see Exhibit 1) has been achieved, despite the significant depreciation of local currencies against the US Dollar. The Nigerian Naira andSouth African Rand, representative of the region’s two largest economies, depreciated against the US Dollar by 63.5% and 54.8%, respectively, between 2011 and 2021. More recently, the economic recovery following the 2014-to-2016 oil price crash bolstered reinsurers’ revenue, as is demonstrated by a four-year (2016-2019) GWP CAGR of 8.9%. However, this trend was curtailed by the COVID-19 pandemic and associated recession, with GWP growth of just 2.1% in 2020.

Over the medium term, the growth of the SSA reinsurance market is expected to pick up again, supported by the region’s economic recovery. The International Monetary Fund projects that SSA will achieve real GDP growth of 3% in 2021, rising to around 4% per annum in the five years thereafter, comfortably exceeding the long-term forecasts for both Western Europe and North America.

Profit Margins Continue to Narrow

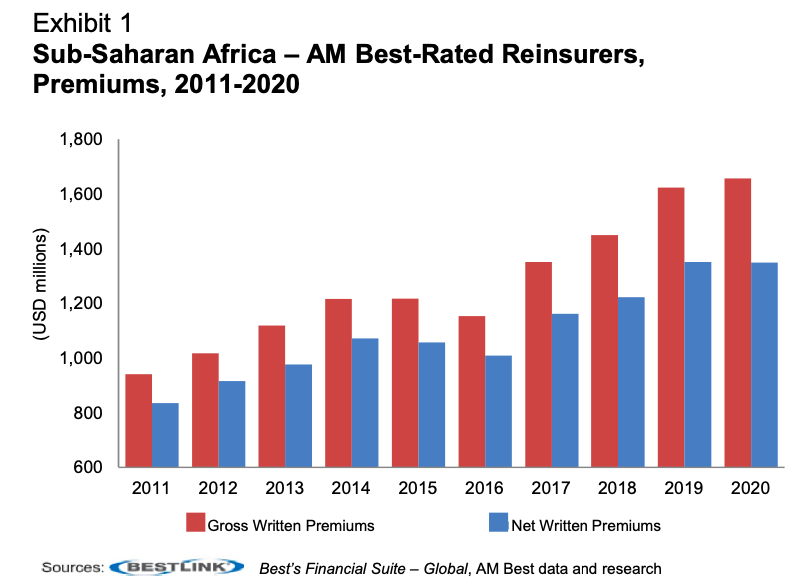

Traditionally, SSA reinsurers have focused largely on local African risks. As a result, the region’s AM Best-rated carriers were not exposed to the major natural catastrophe losses experienced by the global reinsurance market over recent years. In 2020, the weighted average loss ratio for AM Best-rated reinsurers in SSA was 59.5% (see Exhibit 2), compared with an equivalent figure of 72.6% for the top 50 composites of reinsurers1.

Despite the generally lower and less volatile loss experience of SSA reinsurers when compared to their global peers, AM Best has observed a general deterioration in underwriting performance for the reinsurers that it rates in the region. The weighted-average loss ratio of AM Best-rated SSA reinsurers has risen steadily since year-end 2016, when it was as low as 53.2%, to 59.5% in 2020.

While domestic markets have not reported any major loss events in recent years, stiff competition and subsequent rate erosion have contributed to the decline in underwriting performance. In addition, the underwriting results of a number of AM Best-rated SSA domiciled reinsurers were negatively impacted by the poor performance of the non-core overseas business, most notably in the Indian subcontinent. The aggressive expansion into the Indian agricultural segment by a number of SSA reinsurers in particular, has played a noteworthy role in the deterioration of the average loss ratio. AM Best has however observed a drastic decline in the region’s appetite to write this business going forward.

Furthermore, negative exchange rate movements—particularly in the Nigerian Naira—in almost all years between 2016 and 2021 has led to claims inflation, especially on lines of business that rely on the import of goods and spare parts. While inflation is typically priced into (re) insurance products, it has contributed to the gradual deterioration of the loss ratio, particularly for those African reinsurers that do business in US Dollars and report in local currency.

Performance is also affected by the generally high cost of doing business in the region and the relatively small size of individual reinsurers, with many market participants unable to realise economies of scale. Consequently, the weighted average expense ratio reported in 2020 for the region compared unfavourably with the broader reinsurance market at 38.4% (see Exhibit 2), versus an equivalent figure of 28.7% for the 50 largest global reinsurers.

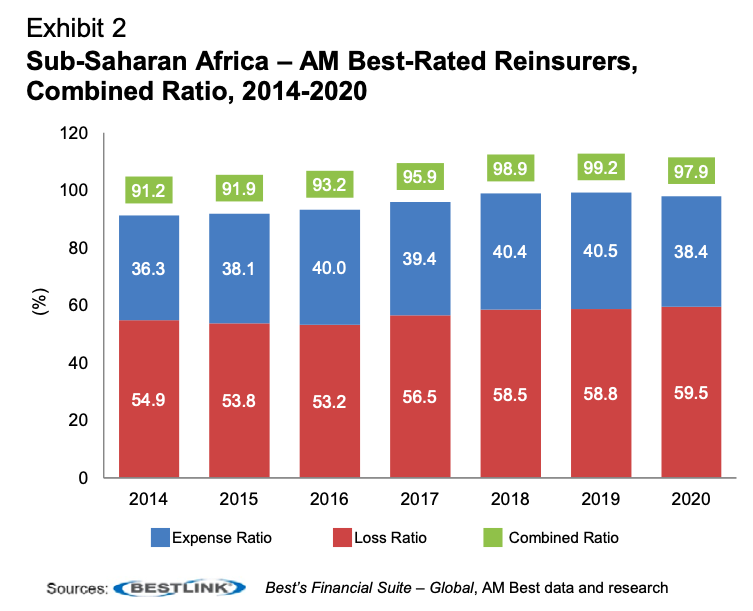

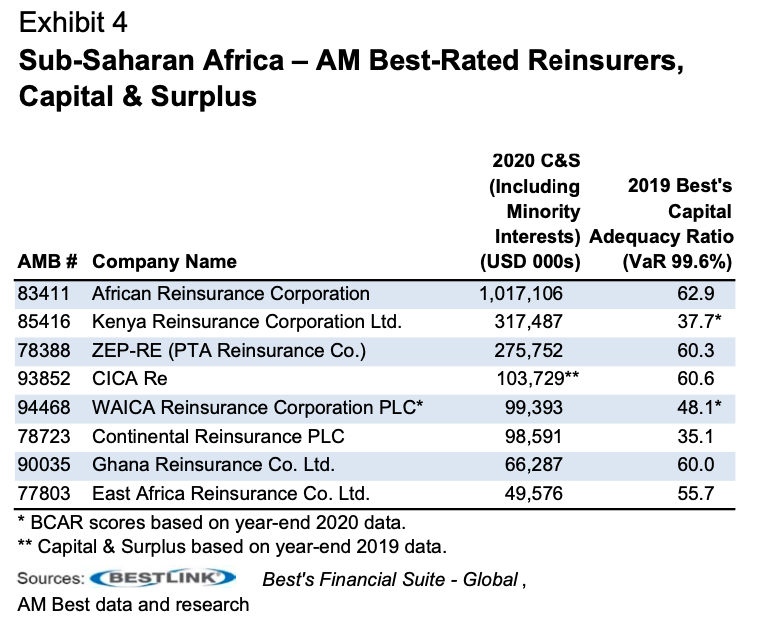

Despite the decline in underwriting results, AM Best-rated SSA reinsurers continue to return solid levels of profitability to their shareholders, demonstrated by a five-year (2016-2020) weighted average return on equity (ROE) of 9.5%, compared with 5.7% reported for the global reinsurance top 50 composites (see Exhibit 3). The SSA benchmark’s weighted-average ROE is heavily influenced by the performance of Africa Re and ZEP Re, both of which report in USDollars, which, to some extent, limits the impact of high inflation in their core markets on their reported net income. The ROE for SSA reinsurers must also be considered in conjunction with their generally high levels of risk-adjusted capitalisation, as measured by Best’s Capital Adequacy Ratio (BCAR) (see Exhibit 4), which tempers this metric.

AM Best expects the steady economic recovery of the region and a general hardening of reinsurance rates to bolster the results of the SSA reinsurance market. However, should the COVID-19 pandemic persist, the region’s projected economic recovery could be jeopardised, which in turn may curtail the reinsurance market’s revenue growth, impact the collectability of premiums, as well as introduce volatility into investment results.

Regional Capacity Is Limited

The larger reinsurers in SSA (excluding South Africa) tend to be either national or supra-national entities, which often benefit from compulsory cessions and have the mandate to develop the local (re)insurance industry. With a few exceptions, African reinsurers tend to focus on local and regional markets. Further competition comes from a relatively small group of sophisticated global reinsurers and a handful of smaller privately-owned African companies.

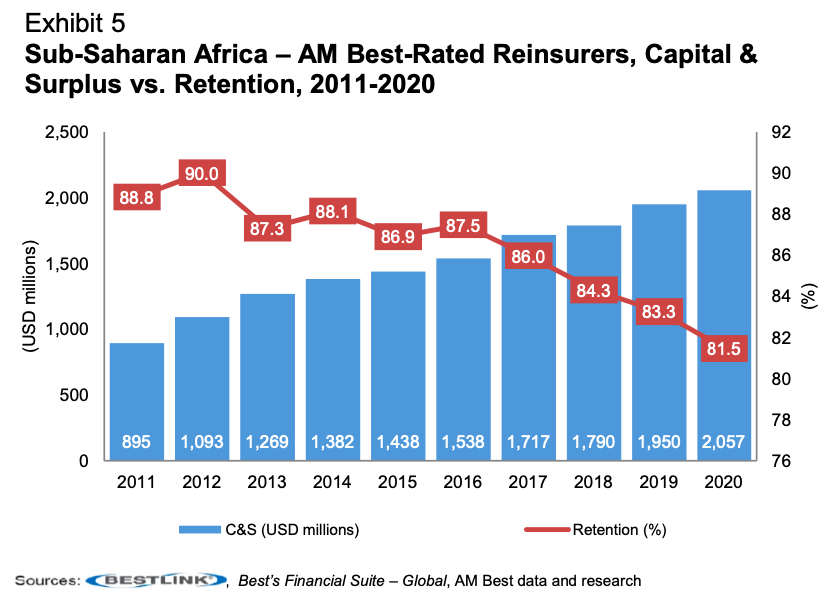

Despite solid growth in capital in recent years (see Exhibit 5), the capacity offered by Africa- domiciled reinsurers is still low, with the capital bases of the majority of SSA reinsurers too small to meet fully the needs of local primary markets, particularly where major construction and energy risks are concerned. As the region’s economies have industrialised, their insurance needs have grown, which in turn has contributed towards lower levels of retention for SSA reinsurers. Local players often lean on more sophisticated global reinsurers for the expertise and capacity needed to underwrite complex risks.

High Barriers to Entry

Barriers to entry remain high in many African reinsurance markets and include protectionist local regulations and the presence of state-owned reinsurance companies or specialised state-sponsored pools. The limited competition from global reinsurers is due to a multitude of factors, including the expansive geography of the continent, the small size of national reinsurance markets, and the significant cultural and fiscal policy differences between countries.

Over the past decade, local regulators have become more active in championing their national markets, often forcing primary insurers to offer risks to local reinsurers of a generally weaker credit quality before they can explore international markets. Supra-national reinsurers such as Africa Re, CICA Re and ZEP Replay an important role in supporting the underlying insurance markets, maintaining a mandate that goes beyond a pure commercial existence.

However, high barriers to entry have not completely deterred new market entrants. In early 2021, specialty reinsurance start-up Africa Specialty Risks commenced underwriting from its Mauritius entity.

South Africa

South Africa has a relatively mature insurance market compared with other countries on the continent, with well-established life and non-life segments. In 2020, South Africa’s insurance market generated GWP of approximately USD 41 billion, according to Swiss Re Institute’s sigma report “World insurance: the recovery gains pace”.

However, the region’s largest (re)insurance market is facing turbulence. The COVID-19 pandemic exacerbated an already steep downward trend in the country’s economy, with business confidence and employment rates reaching their lowest level in years. Long-term economic and political pressures in the country have resulted in an operating environment that has not been conducive to profitable underwriting results.

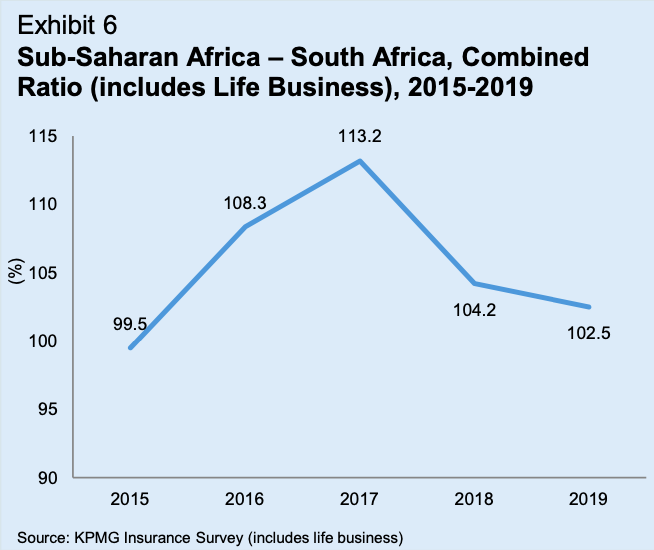

The weighted average combined ratio for the reinsurance market was 102.5% in 2019, up from 99.5% in

2015 (see Exhibit 6). The performance of the market’s reinsurers has been significantly impacted by soft pricing conditions and a spate of severe weather events between 2017 and 2019.

In 2020 and 2021, the COVID-19 pandemic has further impacted the South African reinsurance industry. Following the December 2020 court ruling, which overturned an appeal by Guardrisk Insurance Company Limited, the insurance market has commenced settling contingent business interruption (CBI) claims associated with the pandemic. In its year-end 2020 financial statements, market leader Santam Limited, which has a market share of 24%, estimates its gross and net CBI exposure to be USD 356 million and USD 136 million, respectively. This indicates a gross industry loss that significantly exceeds USD 1 billion. Reinsurers with policies written back-to-back are expected to bear a sizeable share of the costs borne by the primary market.

In addition, recent large-scale social unrest triggered by the arrest of former president Jacob Zuma, has led to rioting and looting in some of the country’s major urban centres. State-owned South African Special Risks Insurance Association (SASRIA) is the specialist insurer that solely covers losses relating to politically motivated crimes in the country. SASRIA’s latest estimate indicates an insurance industry loss of USD 1.3 billion. A material proportion of these losses are expected to ultimately fall on Europe’s largest reinsurers through their South African subsidiaries, along with Lloyd’s market.