Old Mutual Wealth Investment Strategists Izak Odendaal and Dave Mohr

We’re halfway through the year, and global investors are reassessing some of the broad views that have held for the past six or seven months.

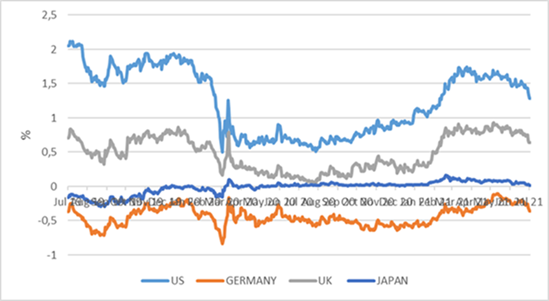

In particular, we’ve seen long bond yields falling sharply. Taking the US as an example, since it has the most important bond market, its 10-year Treasury peaked at 1.7% in March but has since pulled back to 1.3%. This means the yield curve has flattened, which is just another way of saying long bond yields have fallen faster than shorter-dated yields (the latter being very low already).

Treasury yields matter greatly, since they influence borrowing costs across the world, but they also reflect the market’s collective view about inflation, growth and short-term interest rates over the lifetime of the bond, which can range from a few months to 30 years.

Why are bond yields declining when growth is strong, commodity prices high and business consumer confidence rising? Is the bond market pricing in a future of low inflation, sluggish growth and by implication, very low short-term interest rates? There are a number of theories.

Chart 1: 10-year government bond yields, %

Source: Refinitiv Datastream

Delta blues

Firstly, while progress with coronavirus vaccines are everywhere, including laggards like South Africa, the fast-spreading Delta variant is a problem for those who are not vaccinated. Even in countries that have been very successful with vaccinations, such as Israel, the UK and US, between 30% and 40% of the population is not fully vaccinated, leading to outbreaks. Outside of these countries the impact can be devastating, as we are seeing in South Africa. It is in the interest of the more successful countries to assist the laggards, for as long as the virus is free to rampage, even nastier variants can evolve.

The fact that the Tokyo Olympics will take place under state-of-emergency conditions says a lot about the risks the virus still poses.

However, while the virus remains a deadly menace, it seems very unlikely to be able to shut down the entire economy as it did in March of 2020. Back then, the threat was so new and so big that policymakers felt they had no other option. There are still lockdowns and restrictions today, but much more targeted and regional. And of course, workers, businesses and consumers have adapted to new ways of working, selling and buying. Renewed outbreaks represent setbacks but seem unlikely to fundamentally derail the global recovery.

Peak growth?

A second theory is the idea of “peak growth” particularly in the US. The world’s major economies are experiencing robust growth rates as they (largely) put the virus behind them and benefit from continued policy support. However, at some point this initial euphoric reopening phase will ease into the next phase where economic growth rates revert closer to long-term averages as extraordinary policy support fades. Markets try to price in the future, not the present or immediate past.

In the US for instance, the Atlanta Federal Reserve Bank estimates that the annualised economic growth rate in the second quarter was 8%, which if confirmed would be one of the strongest on record. Such a heady pace is abnormal, lifted by the reopening and pandemic-related financial support to households. As things return to normal, we should expect normal rates of growth and an economy not reliant on (or receiving) government cash injections. In fact, as it is normalised, the impact of fiscal policy on the economy can turn negative. President Biden has ambitious infrastructure plans but these have not finalised yet, and the impact will be measured in terms of years, not quarters. If passed, the biggest boost is likely to be to the supply side – the economy’s longer-term growth potential – not the demand side.

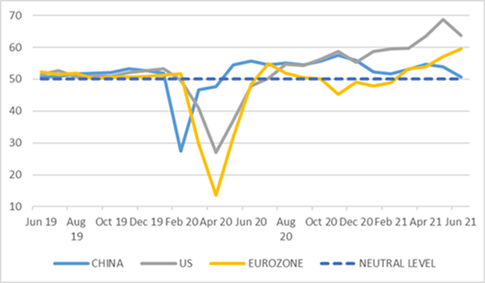

Since China was the first major economy to put the pandemic behind it, it stands to reason that it has already hit peak growth. The latest round of purchasing managers’ indices confirm this loss of momentum. China’s pre-crisis growth rate was still very high by global standards, and a return to average for China still implies rapid growth, just not as rapid as in recent months (think 5% to 6% annual growth instead of 8% or 9%). After all, authorities in Beijing are still grappling with fears over excessive debt levels,

Chart 2: Composite purchasing managers’ indices

Source” Refinitiv Datastream

Europe’s growth lags the US somewhat, having been harder hit by the Northern Hemisphere winter wave, and should therefore be further away from peak growth. However, the key tourism sector in Southern countries is at risk of Delta. It is summertime there and the likes of Portugal, Spain and Italy are clearly torn between the economic need to welcome tourists and the concern that they will bring the virus with them.

None of this suggests that the world economy is about to go into recession or even slow materially. Just that the first year or so after a recession usually sees very rapid growth, and this pace naturally slows. It can pick up again as there are usually smaller cycles contained within the bigger cycles.

Policy uncertainty

The third argument is that the decline in bond yields is linked to potential changes in monetary policy in the US. Simply put, over the past year or so, the outlook for monetary policy was pretty clear, but now the waters are muddied. It is no longer a one-way bet after the Federal Reserve’s June meeting, when officials gave the first indication of when interest rates could be expected to rise. Minutes of that meeting were released last Wednesday after the usual three-week lag. Some officials are keen to reduce monetary stimulus, particularly to the housing sector that seems to be doing very well on its own. But there is no consensus. As can be expected, there is a fierce debate happening within the Fed about the appropriate path of interest rates and asset purchases.

After all, despite its army of economists, the Fed cannot predict the future, because nobody can. It has to make assumptions about how the future is likely to unfold, carefully monitor whether the economy is on track to evolve as expected and set policy accordingly. Making it even more difficult is that changes in monetary policy take time to impact the real economy, but can impact financial markets immediately. In fact, even the hint of future changes can cause big, sometimes unwelcome, market moves as was the case with the 2013 Taper Tantrum. Financial market moves in turn can complicate policy choices for central banks. If markets are signalling discomfort with the growth outlook, it might make central banks reluctant to tighten policy.

Finally, there is the old standby of ‘technical factors’, including lower liquidity during the traditional holiday period in the North. In particular, the US government has been running down its massive cash balance at the Fed, issuing fewer new Treasury bonds. But demand for these bonds remains high. The Fed is still an active buyer of $80 billion each month, but so are many others. It might seem odd to South Africans accustomed to high interest rates that anyone would buy bonds at low yields, never mind the negative yields you see in Europe and Japan, but the world is still awash in excess savings and liquidity that has to go somewhere. Bank deposits are at record levels, for instance, but lending is sluggish. So banks are among the many institutions looking for yield in fixed income markets. Not everyone is allowed to invest in equities. And many investors who can buy equities are worried about valuations, particularly in the US. But as they drive down bond yields, it has implications for the equity market.

Growth vs value

Not all equities are equally sensitive to interest rates. ‘Growth’ companies generate their own earnings growth (often by taking market share) instead of relying on a strong economy as is the case with ‘value’ or cyclical shares. These future earnings of these growth shares, of which the big internet platform companies are examples, become more valuable when discounted to the present at lower interest rates. In contrast, low interest rates are bad news for cyclical companies because low rates normally imply sluggish economic growth.

Growth stocks did well in the early pandemic months because interest rates collapsed and demand for technology increased. From the low-point in March 2020 to end October, growth stocks have beat value stocks by 20% according to MSCI’s global indices. In early November, news of effective vaccines raised the global economic growth outlook and value stocks outperformed by 15% as bond yields increased. Since the peak of yields two months ago, growth has outperformed again as bond yields declined.

Chart 3: MSCI All Country World Growth and Value Indices, US$

Source: Refinitiv Datastream

Therefore, it is not a simple case of saying low interest rates mean higher equity values. If that was the case, Japan’s market would have been booming for the last 20 years of zero rates. European interest rates have been negative since 2015 without any discernible boost to equity prices. US shares have benefited most from low interest rates, because the US is more of a growth market, being home to the world’s tech behemoths.

US valuations are at elevated levels compared to history, but not at extreme levels when taking interest rates into account. However, even within the US market, there is a valuation dispersion across sectors and companies. And outside the US, global equities are not worryingly expensive.

What these valuations tell us is not that the market is about to crash, just that longer-term dollar returns from global equities are likely to be below average. South African investors can still expect currency depreciation to boost these returns over time, but remember the rand can stay uncomfortably strong for long periods too.

So what?

Firstly, there are always risks and uncertainties. It feels worse now in the pandemic, but an investment newsletter written at any point over the past 200 years could come up with a list of threats and reasons to be fearful. But there would also be a list of reasons to be optimistic, the main one being human ingenuity even in (or especially in) the face of adversity. Even as the world faces peril from disease and climate change, we are in the privileged position to be able to invest in the solutions and earn a return. The key is just not to put all your eggs in one basket, no matter how sure you are that it is the correct basket.

Secondly markets never move up in a straight line. Corrections take place from time to time. It can be because some specific event causes anxiety, or because an asset class has a strong run and enough investors decide to rotate (global equity benchmarks were hitting new record highs before last week’s wobble). Or a new narrative takes hold.

These narratives or stories change from time to time. The story over the past six months or so has been about reopening and reflation. These stories give traders a framework to guide their positions and commentators something to talk about. The narrative now seems to be changing. Long-term investors need not pay too much heed as long as they are appropriately diversified. A concentrated portfolio can get badly hurt when the narrative changes and one set of investments fall out of favour and another becomes popular.

Thirdly, just to repeat that peak growth does not mean no growth or even slow growth. Just slower growth. The outlook for the global economy remains that things get better, not worse, and that company profits will continue to expand, but not necessarily at the breakneck speed of the past few months.

It makes sense to remain invested.

At OWLS Software we offer 8000 insurance software features designed to automate any Insurers, UMAs or Brokers insurance admin.