Colin Archibald, Regional Manager at Glacier International

Offshore investing has been in the spotlight again recently, but diversifying your portfolio across regions, currencies and industries has always been a good strategy.

Maintaining your spending power as the rand depreciates, is another good reason to keep a portion of your portfolio in foreign currency.

Broadly, there are two routes investors can choose when investing offshore. One way is to take funds directly offshore using either the annual foreign investment allowance of up to R10m, which requires tax clearance or, using the single discretionary allowance of up to R1m. The second is to invest in ZAR, which is then ‘swapped’ into foreign currency – known as an asset swap. Investors can access asset swap investments privately or via SA feeder funds.

Feeder funds and direct funds – what’s the difference?

A feeder fund is a South African unit trust fund that feeds into a direct offshore fund. The investment is made in ZAR which the investment company then converts into foreign exchange, using their asset swap capacity. It’s a less complex way of investing offshore as no SARS clearance is needed on the part of the individual. The investment minimums required are also generally lower than for direct offshore investment, making feeder funds more accessible to a broader market. Essentially, they provide a way for investors to get offshore exposure in their local portfolios, and they can be used in general savings investments, such as an investment plan and well as in retirement income portfolios.

A direct fund, as we’ve said, requires SARS clearance for amounts over R1m, and generally, a higher investment amount is needed. However, as will be shown in this article, the direct fund can be more efficient from both a tax (assuming a weakening ZAR) and cost point of view.

Let’s look at a comparison.

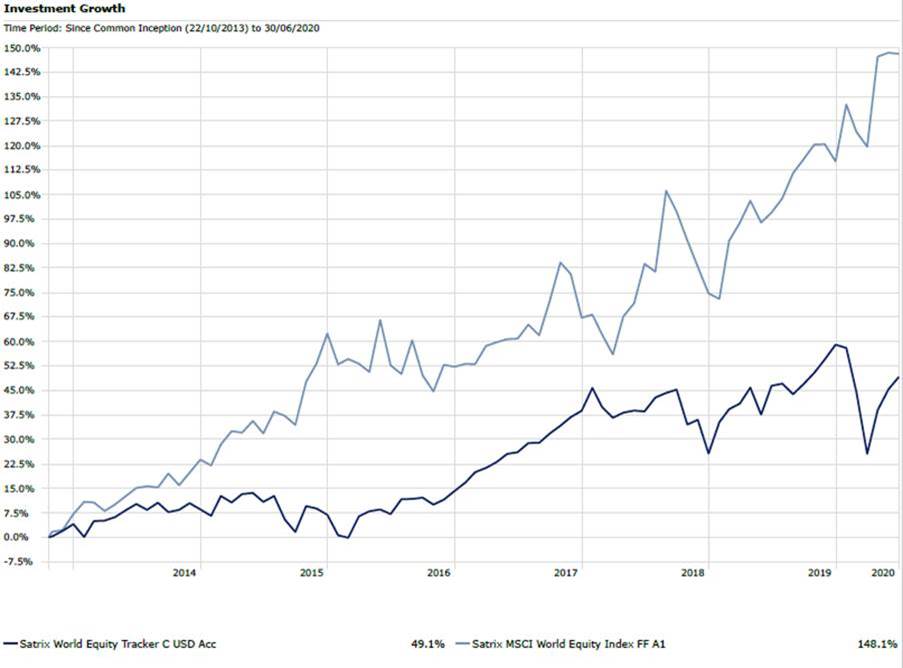

In the graph below, we’ve used the Satrix MSCI World Equity Index Feeder Fund in ZAR (light blue line) as a proxy for international investment in world markets. This feeds into the Satrix World Equity Tracker (dark blue line) which reports in USD. Essentially, they’re both the same fund, with one reporting in ZAR and the other in USD.

Looking at the returns since inception – at an initial glance – we see that the feeder fund appears to have outperformed the USD fund. But remember, the graph below is in the base currency. In Table 2 below we convert the USD back to ZAR to get a clearer view of the situation.

Graph 1

Returns since inception – base currency

Source: Morningstar

In Table 1 below, to give us a more accurate comparison, we’ve converted the amount in the USD fund (direct fund) at the end of the period ($153 238) back to ZAR on that date, which gives us an ending capital value of R2 660 212 – using an exchange rate of R17.36 to the dollar on that date. This compares favourably with an ending value of R2 481 000 from the feeder fund investment.

Costs matter

The return from the direct fund is higher in ZAR terms due to it having a lower fund fee than the feeder fund. The direct fund has a total expense ratio of 0.82% versus the feeder fund’s total expense ratio of 0.90%. If the total expense ratios of the two funds were identical, the values of the two funds would be identical in ZAR terms. But this scenario is highly unlikely due to the cost of the asset swap associated with the feeder fund and because of the added administration fees of having two unitised vehicles, one locally and one offshore. Although the above cost difference may seem small – on a compounded basis, this saving could have a material impact over time. Investment

platform costs were not taken into consideration in this example.

Table 1

Feeder fund vs direct offshore fund since inception: 22 October 2013 to 30 June 2020

| 1. Satrix World Equity Feeder Fund | 22/10/2013 to 30/06/2020 | 2. Satrix World Equity Tracker USD |

| R1 000 000 | FX R9.73 | $102 775 |

| 148.10% | Return | 49.10% |

| R1 481 000 | Gain | $50 463 |

| R2 481 000 | Gross End Value | $153 238 |

| FX R17.36 | R2 660 212 |

We’ve seen that costs can make a difference – but what about tax?

Tax considerations

The investor in the direct fund would have converted ZAR to USD in 2013 (investment

commencement date) and will then only pay capital gains tax (CGT) on the USD gains. When investing directly, currency movements over the investment period are not taken into account for tax purposes. In the case of a feeder fund, currency gains are included for CGT purposes.

In Table 2 below, the feeder fund has a gain of R1 481 000 against the direct fund’s gain of $50 463. CGT will be at the effective rate applicable to the investor, but we’ve used 18% (the maximum) in our example.

The CGT payable is R157 687 on the direct fund (the $9 083 gain multiplied by the R17.36 exchange rate on the day), versus R266 580 on the feeder fund, which is over R100 000 more. This shows that the direct fund is more favourable when it comes to capital gains tax (assuming a weakening currency over time) as well as cost.

Table 2

Capital gains tax comparison

| 30 June 2020 | 1. Feeder fund | 2. Direct fund |

| Gross Ending Value | R2 481 000 | $153 238 |

| Gain | R1 481 000 | $50 463 |

| CGT (max 18%) | R266 580 | $9 083 |

| X R17.36 | R 157 687 | |

| Net Withdrawal Value USD | $144 155 | |

| Net Ending Value ZAR | R2 214 420 | R2 502 531 |

| Difference | + R288 111 |

To recap

A feeder fund offers global diversification, a hedge against a weakening rand, and provides a relatively simple way for the average investor to include an offshore component in their portfolio, with a lower investment amount than required by a direct investment. The above examples have shown, however, that the costs are generally higher and the tax could be more onerous (if the currency depreciates) than with a direct offshore fund.

As always, an investment strategy should be particular to each individual’s needs and goals, and we urge you to speak to a qualified financial adviser to ensure your strategy will best serve your needs.

At OWLS Software we offer 8000 insurance software features designed to automate any Insurers, UMAs or Brokers insurance admin.