By: Tim Eppert, Life/Health Senior Actuary, Cologne

What is a cancer – and what is not? While the answer to this question is obvious in many cases, it is not always straightforward.

A disease is deemed as malignant or cancerous when there is an uncontrolled growth of cells that is invasive, i.e., the cells break through the natural boundaries of the body to places they do not belong and have the potential to spread to the lymphatic system and distant places of the body.

As life is always a continuum, it is not always clear where to draw the line. How likely is a tumour to spread and how fast must it grow to be considered cancerous? Next to purely medical questions, the label that is given to a disease will also change the perception of the person receiving the diagnosis. Therefore, redefining a disease as cancer is not that uncommon.

In Critical Illness (CI) insurance, cancer is the core condition and typically responsible for 50% to 90% of all claims. All definitions depend either explicitly or implicitly on the medical definition of cancer, and when the medical classification of a disease changes from non-cancerous to cancerous (or the other way around), it can change the decision whether or not a claim for this condition will be paid.

Reclassifications over time can make the decision of a claim’s validity more challenging – and reduce the policyholder’s understanding and acceptance as well. If reclassifications only affect rare conditions, the total effect on the insurance portfolio is limited and other changes such as in screening programmes or lifestyle behaviours will be more important for the long-term portfolio experience. But when changes have an impact on common cancers, insurers must consider how their portfolios might be affected. This situation can arise as the result of either a complete reclassification of certain diseases or a reclassification of the severity of a specific cancer.

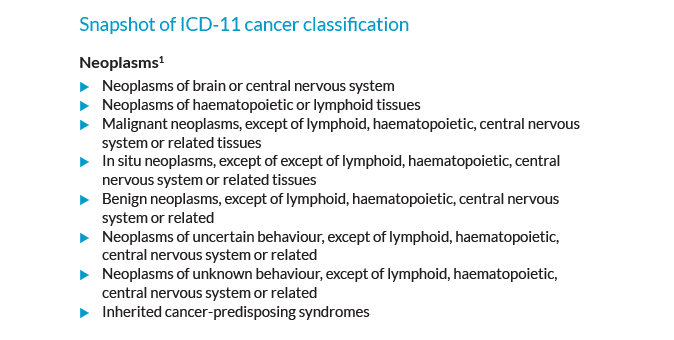

The revision of the International Classification of Diseases (ICD), a medical classification list by the World Health Organization, is such an event. Currently ICD-10 is in use, but ICD-11 has already been published and shall be used for reporting from 2022 onwards.

ICD-10 differentiates between malignant (C00-C97) and benign (D10-D36) neoplasms, and benign neoplasms are not considered as cancers. However, there are benign tumours of the brain that are life-threatening. They do not invade other tissue, but they grow and will increase pressure on the brain as the skull does not give additional space for the extra cells. ICD-11 does still differentiate between benign and malignant neoplasms for most types, but not for the brain and some other areas.

Policies that also cover benign brain tumours – and sometimes the less common benign spinal tumours – are not significantly impacted by the ICD revision, but this is different for more basic plans. While some brain tumours have always been classified as malignant, a significant number have not. And policies not covering a benign brain tumour also lack exclusions for less severe conditions of the brain e.g., brain cysts, a common and often incidental finding.

In CI markets with tiered benefits differentiate the benefit amount by severity, e.g., by TNM classification, which defines four cancer stages (and sub-stages) depending on Tumour size, affected Lymph Nodes and distant Metastases (see UICC, AJCC). With increasing understanding of tumour genetics, this classification may be replaced or at least supplemented by the genetic profile of the cancer. Breast cancer classification is most advanced in this sense, and the AJCC cancer classification uses both a staging purely on TNM, called anatomic staging, and a so-called prognostic staging including new markers, such as the existence of oestrogen receptors on cancer cells to describe the disease. Based on US cancer registry data, we analysed how strongly this can whirl the current classification, as is shown in the following chart. For anatomic stage II cancers, most will be staged differently when using the genetic information as well.

A worst-case scenario for an insurer with a tiered benefit structure would be to pay for the higher of the old and the new classification. This is not a necessary outcome, but insurers need to be aware of the risk and think about strategies to cope with changing cancer definitions.

This may be a combination of risk-mitigation measures, such as limited durations, carefully worded definitions, policy terms and conditions and others. Talk to us to find out more.

Endnote

Tags: cancer, ci 101, dread disease, insurance claims, medical underwriting issues, underwriting

All the expertise, products and service to help you to keep your clients focused on the destination.

Momentum Investments is part of Momentum Metropolitan Life Limited, an authorised financial services (FSP6406) and registered credit (NCRCP173) provider.