Duggan Matthews, Marriott Asset Management

Our investment philosophy is to buy high quality, diversified and resilient companies with a history of reliable and consistent dividend payments. We take a long-term view and select companies we are comfortable holding in our portfolios for 10 years or more. This strategy has served our investors well over the long-term and is proving to be beneficial for our investors through the current COVID-19 crisis.

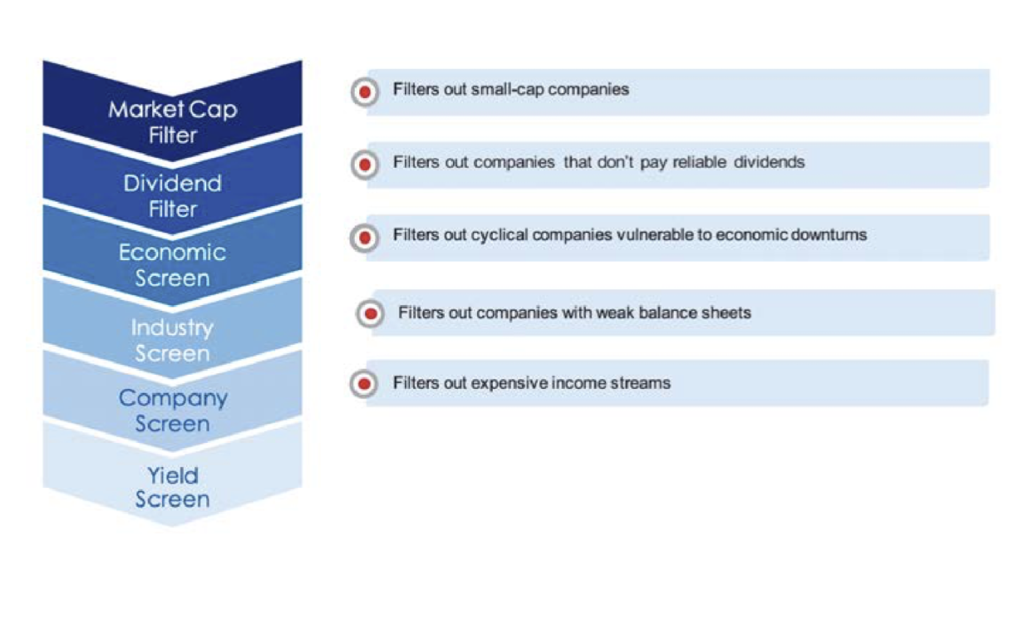

We apply a stringent filter process when selecting companies for our portfolios. This ensures we hold only top-quality companies that can reliably grow their dividends through all stages of interest rate, business and economic cycles for a successful long-term investment outcome. The diagram below outlines how the filter works.

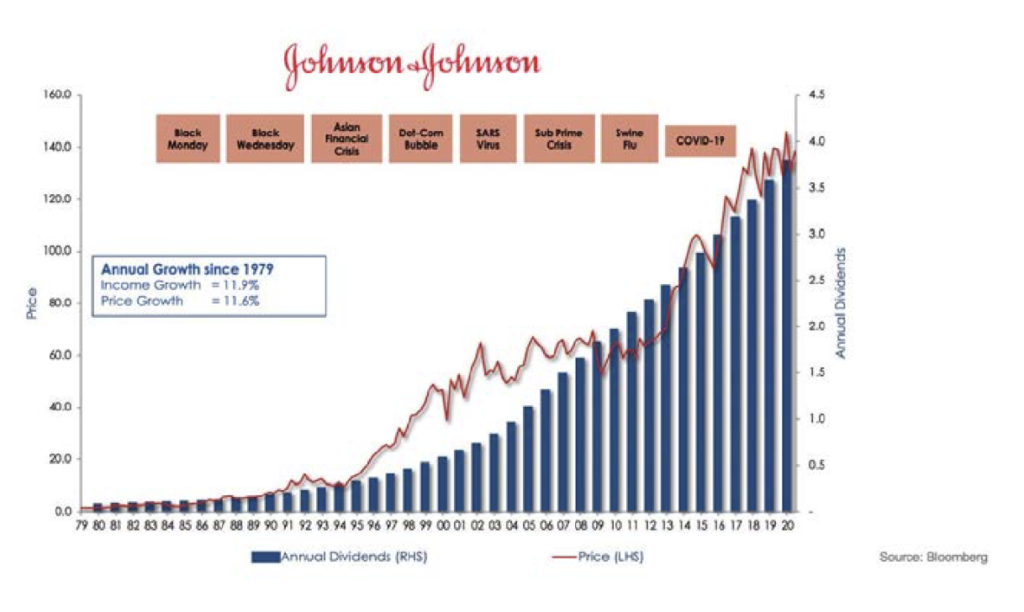

The companies that make it through the filter process tend to be market leaders with strong brands and pricing power, boast robust balance sheets and cash flows, and produce goods or services that are integral to the lives of their customers. These are qualities that are often under- appreciated when times are good but become increasingly valued in adverse market conditions. Johnson & Johnson, for example, has managed to continue to deliver growing dividends over time.

In an environment characterised by low interest rates, companies that are able to grow their earnings, and produce reliable dividends, are an attractive long-term proposition.

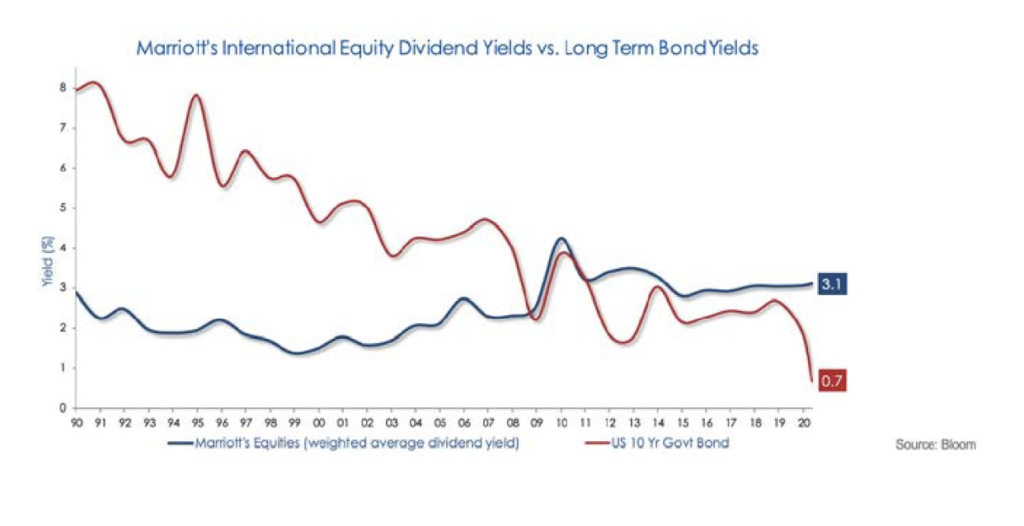

ATTRACTIVE DIVIDEND YIELDS

We only invest in companies that pay reliable dividends. In our opinion, companies of this nature are currently offering very good value as the differential between their dividend yields and the 10-year US Government Bond yield is the widest it has been in over 30 years. An added benefit is that these dividends tend to grow over time, whereas the coupon from a Government Bond is flat for the term of the

bond. The graph on the following page highlights the weighted average dividend yield (3.1%) of the international equities held in the Marriott portfolios, compared to the 10-year US Government Bond yield (0.7%).

RESILIENT DIVIDEND GROWTH

Our income focused investment style emphasises multinational companies which are defensive in nature and offer timeless products and brands. As such, we anticipate that 90-100% of the businesses we invest in will either maintain or grow their dividends in 2020 despite the current uncertainty.

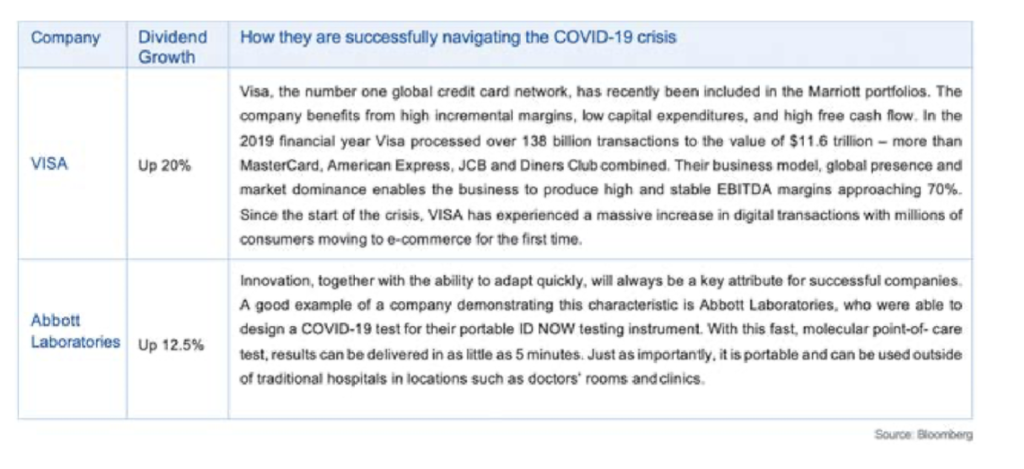

Below are details of just two of the companies we hold in our international portfolios:

INVESTORS CAN ACCESS THESE COMPANIES WITH MARRIOTT IN TWO WAYS:

• Using their individual offshore

allowance of R11 million per annum to invest directly into:

o Marriott’s direct offshore share portfolio (International Investment Portfolio), or

o Marriott’s international unit trusts

• Using Marriott’s asset swap capacity to invest in our local feeder funds which invest directly into our international unit trust funds.