By: Ray Mhere Momentum Investments Head of Distribution

What is offshore investing?

The world of offshore investing can seem quite daunting, but doesn’t have to be. Offshore investments are made in a foreign currency and the investment is housed offshore, which means that there may be exchange control regulations to consider should the investor want to take money out of the country or bring the money back to South Africa. These investments typically have requirements for larger minimum lump sums in dollars and are not very flexible when it comes to ongoing contributions, unless the investor can meet a high enough monthly contribution.

Why should one invest offshore?

Investing in offshore assets that are not in rands denominate can yield great benefits for your investment portfolio. A key benefit is global diversification to reduce risk. The primary goal of diversification isn’t to maximise returns, but rather to limit the effect of volatility on your investment portfolio.

As part of your investment journey, it is imperative that you partner with the right experts who have a combination of global reach and local presence, as well as deep industry expertise across markets. Partnering with financial experts such as Momentum Investments, which has various products available in the market that will suit your personal circumstances, is a key formula to your journey to success.

How our human behaviour can prevent us from investing offshore

When it comes to money and investing, we tend to let our emotions cloud our decisions. In the case of investing offshore, one of our prejudices is a so-called equity home bias. An equity home bias is the tendency to place the majority of our investments where we feel ‘safe’, in local assets. It’s easier to stick to what we know and ignore the benefits of spreading our eggs across the different baskets of foreign markets.

But is investing offshore always daunting? At Momentum Investments, we believe, with a little extra knowledge and by simplifying the choices for you, it doesn’t have to be. Thus, if you have a need to invest offshore, here is why you should consider going abroad with your money, and how to do it.

What should an investor consider?

Key benefits of investing offshore include:

- Benefit from more opportunities

South Africa makes up less than 1% of global gross domestic product. So, by only investing locally, you could be missing out on a significant portion of the global economy. Diversification is a key principle in reducing investment risk. By investing in international markets, you gain access to countries with different currencies and economic cycles to ours, as well as asset classes and industries that are not available locally.

- Reduce emerging market risk

As an emerging market, South Africa often feels the pain of how temperamental international investors can be. They are more likely to invest in emerging markets around the world while the good news lasts, and to disinvest when investment sentiment sours. This rapid change in demand and supply for our shares and bonds brings about greater volatility in emerging markets such as ours.

- Counter the effect of the weakening rand

Even though it doesn’t always hold true, economic theory suggests that, compared to our major trading partners, South Africa’s currency should depreciate in the long run. This is because our inflation rate is higher than the rates of most of our trading partners. In the short to medium term, the rand can depreciate significantly on the back of unpleasant financial markets or political news. The fact that we import lots of goods and services with a weak rand, adds to the inflation rate we experience. In times when the rand depreciates, the rand value of your offshore investment will benefit from the weakening currency, thus offsetting the increased cost of living.

- Hedge geographic and political risk

Governments everywhere do and don’t do things that citizens and investors agree with. Investment returns can invariably suffer when governments make unpopular decisions. In the same way, disasters such as earthquakes can cause havoc. These risks can be reduced through international diversification.

- Plan ahead for being overseas

If you are considering living abroad for a while or permanently, or that your children may study there, it may be sensible to have your money there already. The growth on your local investments may not be enough to make up for a depreciating rand. Rather maintain your offshore currency spending power by having offshore investments.

What are the options available?

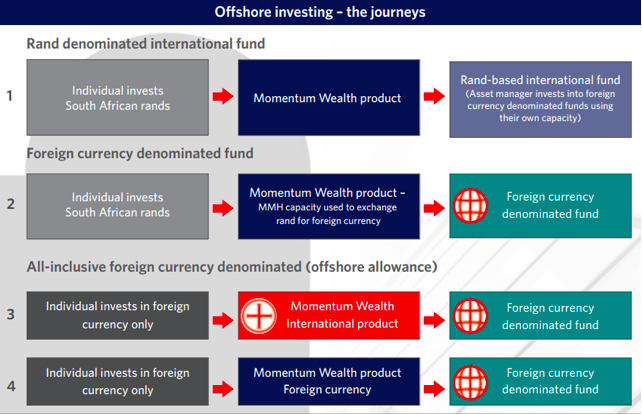

If you are investing as a South African individual older than 18, you have a yearly allowance to exchange rands for foreign currency, which you can invest abroad directly. With us, you may make use of either of our investment platforms, which are Momentum Wealth (when using the Flexible Investment Option) or Momentum Wealth International (MWI).

While both options give you access to your investment from wherever in the world you are, the MWI platform is seen as the purest form of offshore investment. This is because you are invested with a Guernsey-based entity as opposed to a South African-based entity. The Guernsey jurisdiction offers an effective regulatory and fiscal framework with investor protection policies through trustee and nominee company structures.

South Africans have two types of offshore allowances:

- A discretionary allowance of R1 million per adult every year. It’s straightforward to get foreign currency for this option. The authorised dealer usually only needs documentation like your identity number, tax number and an application form. If you want to travel internationally during the calendar year, don’t use the full allowance for investing.

- An offshore investment allowance of R10 million per adult every year. For this option you need tax clearance from the South African Revenue Service. You can use your bank to arrange the foreign currency. You can also use the services of an authorised dealer to help with tax clearance, currency conversion and depositing the foreign currency into the product provider’s offshore bank account.

There are also other ways to investments offshore without having to use your yearly offshore allowance, particularly for local trusts and companies, which don’t have an offshore allowance. This can be done through Momentum Wealth, by investing rand into:

- rand-denominated international funds (using the local collective investment scheme manager’s allowance to invest into funds denominated in a foreign currency)

- funds denominated in a foreign currency (using the allowance of the investment company where you are investing, which suggests the use of an endowment or a retirement product)

Offshore investment journey

Products offered by MWI

MWI administers the International Endowment Option and the International Investment Option.

Who can invest in the MWI products?

Natural persons, offshore companies and trusts can invest in these products. However, SA companies, close corporations and trusts do not qualify for a foreign capital allowance and can therefore not invest in these products.

Tax legislations for products

In most instances, an investor’s tax residency will dictate the tax legislation, subject to double taxation agreements. Various countries have double taxation agreements in place to determine where income or capital gains are taxable if the income or gain could be subject to tax in both jurisdictions. SA has a residency-based tax system. This means that, if a person is an SA tax resident, all worldwide income is subject to tax in SA, provided the double taxation agreement does not dictate otherwise.

When investing in an endowment policy governed by the Long-term Insurance Act, the normal rules pertaining to the restriction period and access to funds apply. However, the product is specifically structured with 100 underlying endowment policies to allow for multiple withdrawals.

Where to get help

To cut through the all the complexity, we have launched a world-class portal at https://www.momentum.co.za/momentum/personal/products/invest-and-save/offshore-investing to address all your offshore investment concerns, challenges and even share best practice. Visit our Global Matters portal for independent views on offshore investment advice, legislation and top-of-mind matters to structure and get your clients to their investment goals.

All the expertise, products and service to help you to keep your clients focused on the destination.

Momentum Investments is part of Momentum Metropolitan Life Limited, an authorised financial services (FSP6406) and registered credit (NCRCP173) provider.