By Michael Kruger, CFA®, Investment Analyst, Morningstar Investment Management South Africa

2020 has been a wild ride for investors in local currency emerging market sovereign debt. The turmoil in global financial markets during the first quarter of the year following the rapid spread of Covid-19 as well as the sudden plunge in oil prices caused havoc in fixed income markets across the globe. Investors rushed to raise liquidity amid the uncertainty and panic, exiting positions en masse, particularly those regarded as having a hint of risk.

South African government bonds did not escape the pain, with significant sales of the asset class by foreigners, causing yields to spike and prices to move lower. This was not isolated to the South African bond market, with all emerging market local currency debt selling off in unison.

As an example, the nominal yield on the SA government bond maturing on 31 January 2030 (the R2030), moved above 12% at the height of the sell-off in March. This was well above the average yield for the bond in the 2019 calendar year, of just over 9%. Yields have recovered significant ground from the sell-off in March, and as can be seen in the above graph, the yield on the R2030 bond has come down to a level of just over 9%.

The question many investors have been asking is whether SA government bonds still offer value at current levels. Let us look at the different factors that contribute to our analysis of the asset class.

Attractive real yields

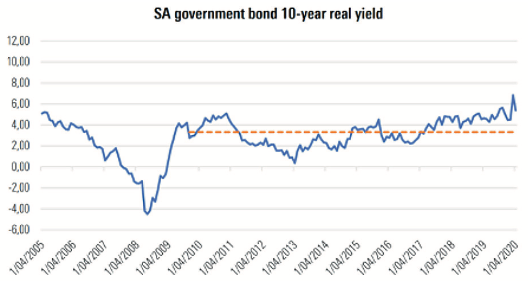

Our analysis indicates that the 10-year SA government bond has a real (after inflation) valuation implied return (VIR1) of 6.9%, which is above our assessment of fair value and compelling relative to history. This is based on the return that will be generated if the yield reverts to a fair level over the 10-year period.

The attractive real yields available are evident from the below graph, which tracks the real yield (nominal yield – headline inflation) of the 10-year SA government bond compared to the average real yield since the beginning of 2010.

SA government bonds are attractive compared to its peers

In our view, SA government bonds are attractive compared to our sub-investment grade peers. This is evident from the fact that the credit default swap (CDS) spread for SA government debt is higher than the spread for countries of a similar credit rating. This spread reflects the price that investors must pay to insure against a country defaulting on its debt and indicates the market’s perception of the creditworthiness of a sovereign issuer.

From a VIR perspective, South Africa is head and shoulders above other emerging markets, with the next best VIR for emerging market sovereign debt coming from Indonesia and Mexico – both with VIR’s of 3.9%.

Trajectory of SA sovereign debt levels

The trajectory of SA sovereign debt levels is concerning, as interest payments and the public sector wage bill continue to grow in the absence of the government’s ability to deliver muchneeded reforms. This is in addition to continued financial support given to bankrupt SOE’s (particularly Eskom).

SA is highly reliant on external financing to fund its joint current account and budget deficit and foreign holdings of SA government bonds have decreased significantly since 2017. We are concerned about recent credit ratings moves from Moody’s, S&P and Fitch, which are likely to increase the cost of servicing SA’s debt. The announcement of a R500 billion stimulus package (with R95 billion of this expected to come from loans from the IMF, World Bank and New Development Bank) is likely to place additional strain on the country’s finances. We also cannot discount the additional strain the Covid-19 pandemic will place on government finances.

We are slightly comforted by the fact that only 10% of SA’s debt is foreign denominated, which decreases the risk of debt becoming unsustainable in the event of significant rand depreciation.

Emerging market local currency debt as a broad asset class

Our analysis indicates that emerging market local currency debt as a broad asset class has gone from being in favour to sharply out of favour in a very short period. This is largely due to significant outflows and underperformance against other fixed income asset classes.

Despite the asset class being largely out of favour with global investors, we have observed that SA multi-asset managers have found SA government bonds increasingly attractive and have been increasing exposure accordingly.

In conclusion, what is our overall conviction?

SA government bonds earn an overall conviction score of medium to high. This is largely driven by the relatively high nominal and real yields, which offer an attractive entry point for those investors willing to focus on the long-term rather than short-term price movements. In an environment where inflation is around 4% and SA government bonds are yielding close to 9%, we believe the real yield of around 5% is an attractive investment opportunity. In our opinion, the yields on offer provide sufficient compensation for the risks associated with the asset class. In addition to this, government bonds provide portfolio protection against a strengthening rand. While the rand has weakened dramatically over the past few months, we believe it is now looking slightly oversold

Morningstar Investment Management South Africa Disclosure

The Morningstar Investment Management group comprises Morningstar Inc.’s registered entities worldwide, including South Africa. Morningstar Investment Management South Africa (Pty) Ltd is an authorised financial services provider (FSP 45679) regulated by the Financial Sector Conduct Authority and is the entity providing the advisory/discretionary management services.

At OWLS Software we offer 8000 insurance software features designed to automate any Insurers, UMAs or Brokers insurance admin.