Angela Jack, Business Unit Head: Financial Services Group at Aon South Africa

Company Directors and Officers (D&O) are facing unprecedented times.

Not only are they having to manage a whirlwind of change and disruption in their business models as factors such as technology, changing buyer behaviours, socio-demographic shifts, climate change and pandemics exert their influence, but they’re also being confronted by the global spread of a highly litigious culture.

Increased pricing, reduced reinsurance capacity and restrictions in the scope of cover have created significant challenges in the global Directors and Officers (D&O) liability market, and South Africa is no exception. A combination of inadequate ratings with larger almost ‘catastrophe-like’ settlements being seen in an overall deteriorating claims environment, has meant that insurers have been feeling the pressure at both ends of the business.

The inevitable consequence is a drive by insurers to price risk differently to allow for the increased frequency and size of their D&O related losses – losses not previously contemplated in their rating models. It’s one reason why we have seen a hike in pricing – by as much as 50% or more in some instances and lines – as well as restrictions in cover and even markets withdrawing from certain industry sectors as appetites wane.

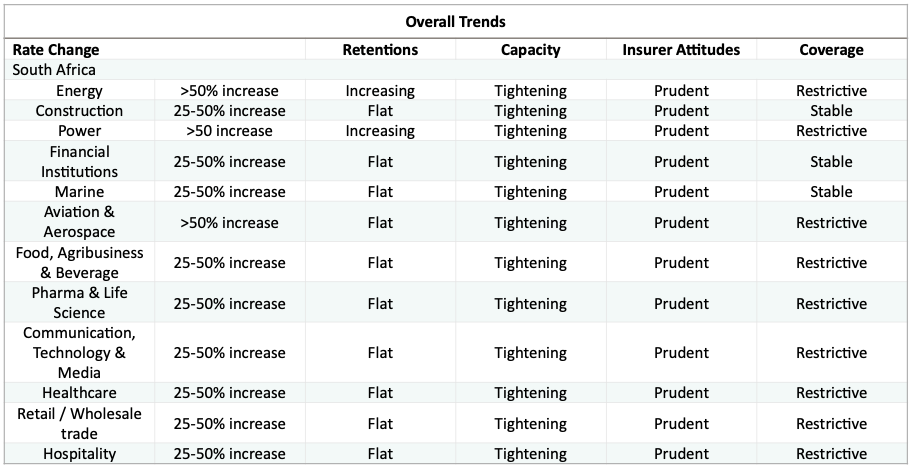

Emerging insurance pricing trends impacting businesses include:

- Listed companies are being impacted regardless of industry sector with increases of between 25% – 50% where the client is claim-free and in a sound financial position. Distressed risks can see upwards of 100% increases in premium, in addition to coverage restrictions. Increased pressure relative to cost and capacity are being experienced by companies with US-listed securities including American Depositary Receipts (ADRs).

- In the State-owned Enterprise (SOE) space, price has become the least significant of the variables, with being able to secure the capacity being the greatest challenge. Conduct provisions are being rewritten, with defence costs in respect of allegations of criminal or intentional actions only applicable on a reimbursement basis in the event of an acquittal or dismissal.

- There is stability in the SME and middle market segment, with 5% – 10% increases being the norm. There is the ability in this space to negotiate flat rates through sound risk management practices.

COVID-19 brings an additional burden into an already distressed class of insurance. Following a number of Coronavirus-related securities class action, the question of the applicability and availability of D&O liability cover for claims related to COVID-19 is top of mind. We anticipate more D&O claims against companies relating to failure of the fiduciary duty of care, inadequate or inaccurate representations about the impact of COVID-19 on the business and its stakeholders, insolvencies and allegations of anti-competitive behaviour. We have already seen increased underwriting scrutiny in the wake of COVID-19 and future pandemic risk, with insurers requiring detailed information relative to business continuity, impact and response plans.

South Africa has also not been exempt from the impact of Lloyd’s review of underperforming classes, which has resulted in limited capacity from syndicates and rate increases to build sustainable portfolios for the long term. Lloyd’s remains the most significant overseas market for South African risks, both in terms of complex primary placements and traditional excess layer support, with the restrictions creating a need to restructure insurance programmes and seek alternative markets. Traditional excess layer capacity with minimum rates are now being imposed. In some instances, this has led to situations where excess layers are coming in at a higher cost than the underlying policy.

Claims

In terms of claims, insolvency-related claims and regulatory enquiries feature strongly with a significant rise in the severity of defence cost claims. Inter-company and state-brought litigation have impacted on the scope of D&O cover being offered, with event specific exclusions being brought into the wordings.

The most significant claims impact from a severity perspective is the rise of audit failure and inadequate or incorrect financial reporting, with several full policy limit losses anticipated. Companies with multiple listings are especially exposed with the potential for multiple shareholder actions, with choice of jurisdiction becoming a matter of importance.

Top three D&O trends

- Pricing pressure is likely to increase.

- Alternate capacity needs to be sourced.

- Information provided to the insurance markets needs to be of an extremely high level with tripartite client, broker and insurer engagement essential to ensure any continuity of cover within existing structures.

With the current hard market considered to be more of an overdue correction, it is anticipated that rates will continue to increase, and capacity will reduce over the next six to 12 months with a stabilising period thereafter. Without a significant new influx in capacity in the next period, the new pricing levels would look to become the new norm.

Manage the Challenge with Preparation

The importance of good preparation is key, and the quality of market submissions will be essential going forward. That means making sure that submissions include everything that underwriters might require to understand and correctly price the business; including financials, business plan/strategy with areas of particular focus being expansion to new territories, M&A, and how the business is addressing issues around the environment, diversity and inclusion, and cyber. Engagement with insurers needs to be timeous and transparent with representation at C-Suite level essential for ensuring the continuity of complex multinational programmes.

To get D&O ready, Aon recommends a proactive approach with the following providing a useful guide:

- Start early – The renewal process will take considerably more time than in previous renewals and insureds must be in the best possible position to secure the coverage they need.

- Give insurers the best opportunity to get know the business – through insurer roadshows or by invitation to attend investor days. The broker and insurer/s are strategic partners and it is important there is a relationship built on trust and understanding. The broker working towards getting the best outcome for their client should make sure they are identifying insurers who share the same philosophy and approach to allow that relationship to flourish.

- Challenge the status quo – Insureds should work with their broker to identify potential issues that might arise based on the current panel of insurers. For example, how have their appetites changed? Will they be looking to reduce capacity? Buyers should also not be afraid to revisit areas like program structure.

- Insurer choice is key – Especially when thinking about a program leader, buyers will need to decide where they focus in this highly litigious and unstable environment, and how they balance pricing with an insurer’s capabilities. Aon´s Data & Analytics can help insureds make this decision based on objective market analysis on both underwriting and claims capabilities (available on a country and regional basis).

D&O plays an incredibly important role for companies looking to attract and retain the best management team in an environment where heightened and increased oversight is a fact of corporate life with new and emerging focus on areas around environment, reputation, sexual harassment, discrimination, and cybersecurity.

Every D&O buyer should expect – with their broker – to work much harder to get cover whilst minimising rate increases as best they can and holding on to acceptable limits. This is where the value of having an expert insurance broker by your side comes to the fore.

Aon´s leading data and analytics capabilities combined with our international network of leading D&O expertise, aims to shine a light on the big changes being seen in D&O by businesses around the world and to help insureds prepare and navigate the changing market and challenges that it throws up.

Overall D&O trends for South Africa